I worry about big tax increases because of America’s grim long-run fiscal outlook.

The video clip is less than two minutes (taken from this longer discussion with Fergus Hodgson), but I can summarize my key point in just one very important sentence

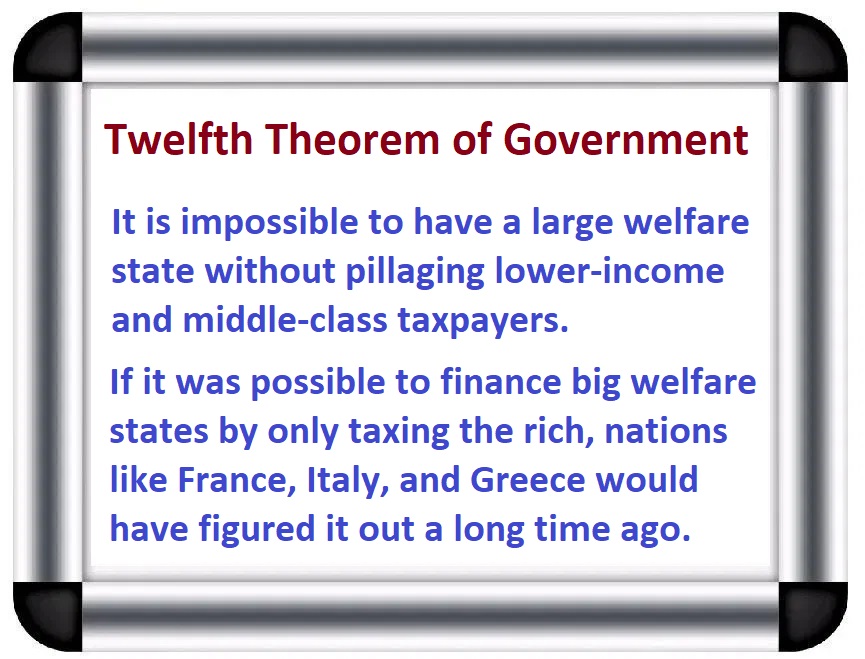

Anybody who opposes entitlement reform is unavoidably in favor of big tax increases on lower-income and middle-class Americans.

There are three reasons for this bold (and bolded) statement.

- The burden of spending in the United States is going to dramatically expand in coming decades because of demographic change combined with poorly designed entitlement programs.

- There presumably is a limit to how much of this future spending burden can be financed by borrowing from the private sector (or with printing money by the Federal Reserve).

- Many politicians claim that future spending on entitlements (as well spending on new entitlements!) can be financed with class-warfare taxes, but there are not enough rich people.

My left-leaning friends almost surely would agree with the first two points. But some of them (particularly the ones who don’t understand budget numbers) might argue with the third point.

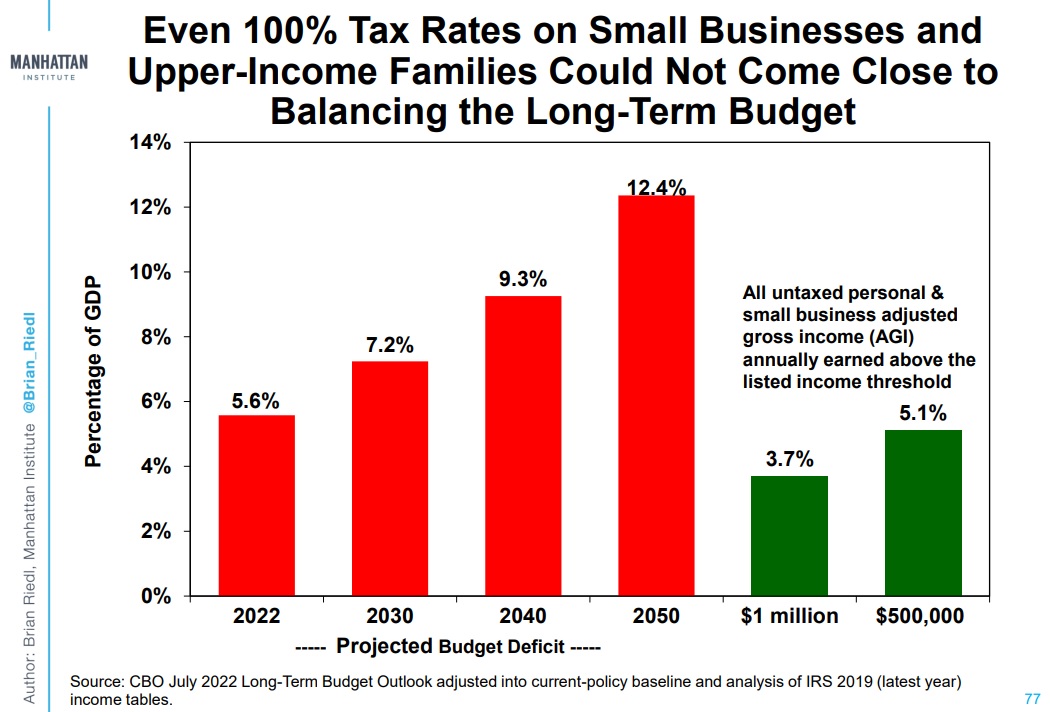

To confirm the accuracy of the argument, let’s look at this chart from Brian Riedl’s famous Chartbook.

As you can see, even confiscatory 100-percent taxes on the rich (which obviously would cripple the economy) would not be nearly enough to eliminate America’s medium-term fiscal gap.

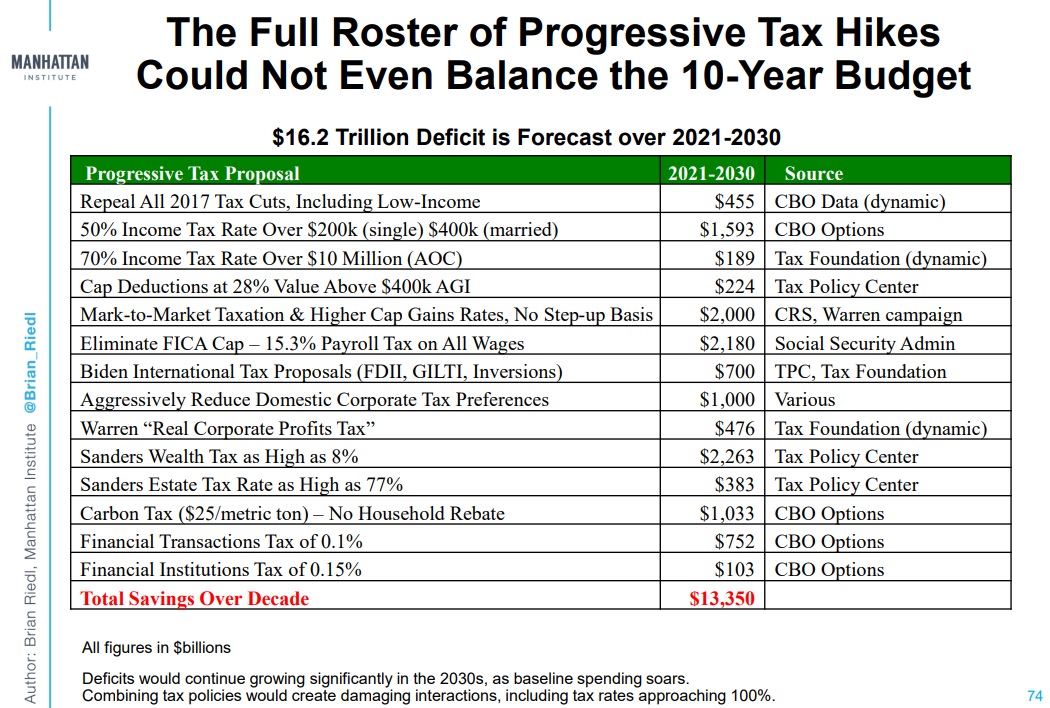

Heck, even if we look at just the next 10 years and include every possible tax hike, it’s obvious that a class-warfare agenda (which also would have negative economic effects) would not be enough to finance all the spending that is currently in the pipeline.

Here’s another Riedl chart (which even includes some proposals that would hit the middle class).

I’ll conclude with two further observations.

- First, there are plenty of honest leftists (the ones who understand budget numbers,

- including Paul Krugman) who openly admit that big tax increases will be needed if the burden of government spending is allowed to increase.

- Second, there are plenty of disingenuous (or perhaps naive) folks on the right who oppose entitlement reform while not admitting that their approach means massive tax increases on lower-income and middle-class taxpayers.

Needless to say, genuine entitlement reform would be far preferable to any type of tax increase.

P.S. In the absence of entitlement reform, politicians will first choose class warfare taxes, of course, but that simply will be a precursor to higher taxes on the rest of us.

P.P.S. The bottom line is that you can’t have European-sized government without European-style taxes. Including a money-siphoning value-added tax.

No comments:

Post a Comment