(Editor's Note: I've never been impressed with the Flat Tax/Fair Tax concept as it seems to me it would become as complicated and convoluted as the income tax system we have now. But I think this is worth looking at anyway. I still like the national sales tax. Let's not be delusional. There's no taxing system that can't be corrupted, and it will be corrupted. Stealing other people's money under a "legal" framework is too entirely tempting for politicians to resist. The big difference is, at least in my opinion, any corruption taking place with a national sales tax will be more easily detected. RK)

Fundamental tax reform is back on the agenda, with House Republicans promising a vote this year on a national sales tax, so I dug into C-Span’s archives so I could share a few of my thoughts from 2007 on the Fair Tax.

As you might suspect, the principles I believed in back in 2007 and the principles I still support in 2023.

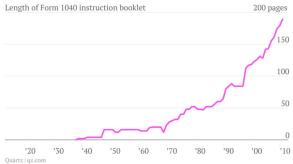

If anything, I have even greater disdain for the IRS and our awful tax system.

Politicians have combined the worst of two worlds, giving us a tax code that simultaneously is filled with class-warfare provisions that punish success while also containing thousands of special tax breaks that benefit the well-heeled friends of politicians.

As I said in the video, it would be nice to toss the current tax code in the trash and replace it with something that collects revenue is a less-damaging and less-corrupt fashion.

For what it’s worth, I’ve always preferred the flat tax over a national sales tax.

Not because one is theoretically better than the other, but because of two political reasons.

- As noted in the above clip, I’m very worried about giving untrustworthy politicians a new source of tax revenue without unambiguously and permanently getting rid of the income tax (so that we don’t repeat the European mistake of giving politicians a way of expanding government).

- I also worry that a Fair Tax is vulnerable to demagoguery since lawmakers will get hit with election-year ads stating they want a big 30 percent tax on everything people buy (while overlooking that our paychecks will be much bigger once income taxes and payroll taxes are abolished).

Indeed, many sympathizers openly admit that the Fair Tax has vulnerabilities.

And there’s plenty of less-friendly opposition. In an article for the Bulwark, Jim Swift pours cold water on the idea.

…nobody has ever taken the Fair Tax seriously. Not in the years after the Tea Party wave… Not in 2011, when Texas Gov. Rick Perry briefly campaigned in support of the Fair Tax, only to quietly walk back his support and switch to a flat tax proposal.Not in 2017, when the Republican-controlled Congress passed the Tax Cuts and Jobs Act. …Do moderate House Republicans really want to be forced to vote on the Fair Tax? …In light of all this, why promise a vote on such a loser? Going straight to the floor poses risks, given the slim GOP majority. It’s a lose-lose situation: Vote yes, and the House Republican Conference looks frivolous, to say nothing of the messaging gift they would give Democratic speechwriters in 2024 (“Republicans want to instate a 30-plus percent federal sales tax!”). Vote no, and invite primaries by far-right candidates who will accuse you of siding with Democrats when given a chance to abolish the IRS. …It’s possible that McCarthy agreed to a floor vote expecting moderates to break ranks and the bill to fail by a spectacular margin. That would drive a stake through the heart of the Fair Tax. …What’s likelier is that McCarthy knew this was a promise he could break. He never said anything about when he would bring the bill to the floor.

While I do worry about the political blowback against a Fair Tax, I hope Speaker McCarthy keeps his promise and there is a floor vote.

Not because I’m deluded about something good getting through the Senate or surviving a sure-veto from Biden.

But if tax reform becomes a big issue this year, that may set the stage for a bigger debate in 2024 and maybe one of my fantasies will come true and we’ll get something good in 2025.

P.S. Here’s another video from the archives, in which I discuss the flat tax and national sales tax./p>

P.P.S. Speaking of archives, here are my brief thoughts from 2011 about the various proposals for tax reform.

P.P.P.S. And click here, here, here, or here if you want to peruse my arguments for the flat tax.

No comments:

Post a Comment