Search This Blog

De Omnibus Dubitandum - Lux Veritas

Friday, March 31, 2017

Quote of the Day!

Then there's "Heinlein's Razor" which has since been defined as variations on "Never attribute to malice that which can be adequately explained by stupidity, but don't rule out malice."

The second one is the one I prefer and - quite frankly - is far more historically correct. When you read about the personal lives of some of the most famous - or in the case of many - infamous leaders in politics, science, entertainment or business - you can't help but attribute their actions and motives to malice. And I would attribute greed as a form of malice. Greedy for money, fame, notoriety and respect - even if that respect is attained through illegitimate means.

Remember When: Hillary Clinton Reportedly Killed a State Department Investigation into a Pedophile Ring

In a report that has resurfaced this week (the original report is from 2013), NBC reported that there were allegations that while Hillary Clinton was Secretary of State, the quashed investigations into a prostitution and pedophile ring that was operating inside the department in order to avoid scandal and protect high-ranking employees and an ambassador.

“Serious allegations concerning the State Department,” the NBC anchor said. “According to internal State Department memos the agency might have called off or intervened into investigations into possibly illegal, inappropriate behavior within its ranks allegedly to protect jobs and avoid scandals.

“This concerns a time when Hillary Clinton was secretary of state.”......To Read More.....

Inspector Obama and the Red Panther

His bumbling, grasping, leaking aides are responsible for the Russian fiasco.

George Neumayr

March 30, 2017

The incompetence of the Obama administration was only exceeded by its arrogance, a toxic mix that led his aides to spy on the Trump campaign, leak to the press about a “multi-agency” investigation into bogus Trump-Russia ties, then whine about the unwelcome exposure Trump (and now Devin Nunes) drew to their antics.

The only known crimes in this unfolding fiasco are the ones they committed, namely, criminal leaks that they fed to reporters desperate to discredit Trump. It is impossible to overstate the audacity of the Obama aides’ partisan squealing in this matter. It is akin to a group of prisoners demanding that the warden be locked up.

To get a sense of the depth of their entitlement, just listen to former Pentagon official Evelyn Farkas bumptiously acknowledge the frantic criminal leaking of classified information in the waning days of the Obama administration:.........Farkas blurted this out as if Obama’s aides deserved medals of freedom for their criminal leaks...........What has come out of all this snooping? No evidence of collusion between Trump and Russia, as even Obama aides James Clapper and Mike Morrell have conceded. But it is yielding plenty of evidence of criminal collusion between the Obama administration and the media............To Read More....

Fossilized Tick Carrying Pathogens in Mammalian Blood Cells Discovered in 15-Million-Year-Old Amber

Ticks have been pathogen-carrying parasites for a very, very long time. A new discovery in a specimen of fossilized amber, roughly 15 million to 20 million years old, reveals a tick encased adjacent to mammalian blood cells infected with microbes resembling those in the order Piroplasmida. Today, related pathogens are known to cause Babesiosis and Texas cattle fever. The research was published in March in the Journal of Medical Entomology.

The finding “shows that ticks have been vectoring protozoan pathogens for millions of years and that humans and other animals infected today with piroplasmic diseases like human Babesiosis, which is considered an emerging disease, acquired the pathogens from ticks feeding on wild mammals, especially monkeys,” says George Poinar, Ph.D., author of the research paper and an entomologist at Oregon State University. “It also shows that these pathogens had millions of years to perfect their infectivity and transmissibility, which makes them so difficult to control today.” […] Read more of this post

Trump’s Dilemma

President Donald Trump's ability to make changes depends on whether his support rises or falls.

Editor’s note: This week, in light of the Republican withdrawal of a bill that would have repealed and replaced the Affordable Care Act (Obamacare), we are republishing George Friedman’s piece from Dec. 16, 2016 about the constraints on the power of Trump’s administration. In that piece, George talked about how weak the office of the U.S. president is in general and how weak Trump will be as a president in particular. This past week’s legislative setbacks for the Trump administration are foreseen by this Dec. 16 piece. In addition, its insights are not just relevant for explaining the significance of that defeat. The piece describes the broader challenge Trump will be facing throughout the course of his presidency.

The greatest compliment you can give us is a recommendation to your friends and colleagues. Please feel free to share this piece with anyone you think would enjoy reading it.

|

Why Some Scientists Are Bad at Their Jobs

Scientists are humans, too. And, just like other humans you know, some of them aren't very good at their jobs. There are three main ways in which scientists can mess up.

First, some scientists feel as if they have something valuable to say on any topic under the sun. (Far too often, it's politics.) Like those suffering from the dreaded Nobel Disease, they act as if their true expertise in one subject gives them wide latitude to speak boldly on every subject. They are wrong.

Consider a poll of scientists who belong to the American Association for the Advancement of Science (AAAS). While countless studies have shown GMOs to be safe, only 88% of AAAS scientists agree. It should be 100%. The fact that it isn't means 12% of scientists haven't the foggiest clue what they're talking about regarding biotechnology. Similarly, only 68% of scientists think pesticides are safe (despite that both conventional and organic agriculture use pesticides), and only 65% of scientists favor more nuclear power (even though Generation IV nuclear reactors are meltdown-proof and the waste can be safely stored in Yucca Mountain)

Second, some scientists are ideologically committed to certain causes, regardless of the evidence.........

Third, some scientists are incapable of separating scientific fact from science policy........Read More.....

Turning Point

I received an e-mail from Turning Point USA featuring their Professor Watchlist.

The letter goes on to say, "It's no secret that college professors are using their roles to advance liberalism at every turn. College campuses are becoming places where students are expected to look different, but think the same. Through the Professor Watchlist, Turning Point USA is holding professors accountable for their bias, indoctrination, and outright ridiculous behavior in the classroom."

The list five new additions to that list:

- Dr. Ciccariello-Maher is a professor at Drexel University. Last week Ciccariello-Maher tweeted out about wanting to "vomit" because a uniformed military service member was given a first class plane ticket from another passenger. Click here to read the full story.

- Dr. Danielle Allen is a distinguished professor at Harvard University. Recently during one of her lectures, Miller compared the rise of President Trump to the rise of Adolph Hitler in Nazi Germany. Click here for more information.

- Eric Canin is an adjunct professor at California State University - Fullerton. Canin was recently accused of assaulting a college republican student and was subsequently suspended by the University. Click here to learn more.

- Dr. Nancy Scheper Hughes is a Professor of Medical Anthropology at the University of California - Berkeley. After the Orlando Night Club Massacre, Hughes blamed the National Rifle Association (NRA) for the act of domestic terrorism. Click here for more information.

- Chris Knap is a Professor of Communications at California State University - Long Beach. In one of his classes, Knap assigned a homework assignment which mocked Trump as sexist and homophobic. The assignment involved an employee named "Ronald Plump" that harassed women and used homophobic slurs. Click here for the full story.

.

Six Sobering Charts about America’s Grim Future from CBO’s New Report on the Long-Run Fiscal Outlook

But I can’t help myself. I feel like I’m watching a surreal version of Titanic where the captain and crew know in advance that the ship will hit the iceberg, yet they’re still allowing passengers to board and still planning the same route. And in this dystopian version of the movie, the tickets actually warn the passengers that tragedy will strike, but most of them don’t bother to read the fine print because they are distracted by the promise of fancy buffets and free drinks.

But I can’t help myself. I feel like I’m watching a surreal version of Titanic where the captain and crew know in advance that the ship will hit the iceberg, yet they’re still allowing passengers to board and still planning the same route. And in this dystopian version of the movie, the tickets actually warn the passengers that tragedy will strike, but most of them don’t bother to read the fine print because they are distracted by the promise of fancy buffets and free drinks.We now have the book version of this grim movie. It’s called The 2017 Long-Term Budget Outlook and it was just released today by the Congressional Budget Office.

If you’re a fiscal policy wonk, it’s an exciting publication. If you’re a normal human being, it’s a turgid collection of depressing data.

But maybe, just maybe, the data is so depressing that both the electorate and politicians will wake up and realize something needs to change.

I’ve selected six charts and images from the new CBO report, all of which highlight America’s grim fiscal future.

The first chart simply shows where we are right now and where we will be in 30 years if policy is left on autopilot. The most important takeaway is that the burden of government spending is going to increase significantly.

Interestingly, even CBO openly acknowledges that rising levels of red ink are caused solely by the fact that spending is projected to increase faster than revenue.

And it’s also worth noting that revenues are going up, even without any additional tax increases.

The bottom part of this chart shows that revenues from the income tax will climb by about 2 percent of GDP. In other words, more than 100 percent of our long-run fiscal mess is due to higher levels of government spending. So it’s absurd to think the solution should involve higher taxes.

This next image digs into the details. We can see that the spending burden is rising because of Social Security and the health entitlements. By the way, the top middle column on “other noninterest spending” shows one thing that is real, which is that defense spending has fallen as a share of GDP since the mid-1960s, and one thing that may not be real, which is that politicians somehow will limit domestic discretionary spending over the next three decades.

This bottom left part of the image also gives the details on built-in growth in revenues from the income tax, further underscoring that we don’t have a problem of inadequate revenue.

Here’s a chart that shows that our main problem is Medicare, Medicaid, and Obamacare.

Last but not least, here’s a graphic that shows the amount of fiscal policy changes that would be needed to either reduce or stabilize government debt.

I think that’s the wrong goal, and that instead the focus should be on reducing or stabilizing

the burden of government spending, but I’m sharing this chart because it shows that spending would have to be lowered by 3.1 percent of GDP to put the nation on a good fiscal path.

the burden of government spending, but I’m sharing this chart because it shows that spending would have to be lowered by 3.1 percent of GDP to put the nation on a good fiscal path.Some folks think that might be impossible, but I’ll simply point out that the five-year de facto spending freeze that we achieved from 2009-2014 actually reduced the burden of government spending by a greater amount.

In other words, the payoff from genuine spending restraint is enormous.

The bottom line is very simple.

We need to invoke my Golden Rule so that government grows slower than the private sector. In the long run, that will require genuine entitlement reform.

Or we can let America become Greece.

The False Compassion Of Liberalism

Last week on CNN I debated a liberal commentator who complained that the problem with President Donald Trump's budget blueprint is that it lacks "compassion" for the poor, for children and for the disabled.

This woman went on to ask me how I could defend a budget that would cut Meals on Wheels, after-school programs and special-education funding, because without the federal dollars, these vital services would go away.

This ideology — that government action is a sign of compassion — is upside-down and contrary to the Christian notion of charity.

We all, as individuals, can and should act compassionately and charitably. We can volunteer our time, energy and dollars to help the underprivileged. We can feed the hungry, house the homeless. Most of us feel a moral and ethical responsibility to do so — to "do unto others."

And we do fulfill that obligation more than the citizens of almost any other nation. International statistics show that Americans are the most charitable people in the world and the most likely to engage in volunteerism.

Whenever there is an international crisis — an earthquake, a flood, a war — Americans provide more assistance than the people of any other nation.

But government, by its nature, is not compassionate. It can't be. It is nothing other than a force. Government can only spend a dollar to help someone when it forcibly takes a dollar from someone else.

At its core, government welfare is predicated on a false compassion. This isn't to say that government should never take collective action to help people. But these actions are based on compulsion, not compassion.

If every so-called "patriotic millionaire" would simply donate half of their wealth to serving others we could solve so many of the social problems in this country without a penny of new debt or taxes.

My friend Arthur Brooks, the president of American Enterprise Institute, has noted in his fabulous book "Who Really Cares: The Surprising Truth About Compassionate Conservatism" that conservatives donate more than the self-proclaimed compassionate liberals.

The liberal creed seems to be: "We care so much about poor people, climate change, income inequality and protecting the environment (or whatever the cause of the day) that there is no limit to how much money should be taken out of other people's wallets to solve these problems."

Let's take Meals on Wheels. Is this a valuable program to get a nutritious lunch or dinner to infirmed senior citizens? Of course, yes.

Do we need the government to fund it? Of course not. I have participated in Meals on Wheels and other such programs, making sandwiches or delivering hot lunches. And many tens of thousands of others donate their time and money every day for this worthy cause.

Why is there any need for government here? The program works fine on its own. Turning this sort of charitable task over to government only makes people act less charitably on their own. It leads to an "I gave at the office" mentality, which leads to less generosity.

It also subjects these programs to federal rules and regulations that could cripple them. Why must the federal government be funding after-school programs, or any school programs, for that matter?

One of my favorite stories of American history dates back to the 19th century when Col. Davy Crockett, who fought at the Alamo, served in Congress. In a famous incident, Congress wanted to appropriate $100,000 to the widow of a distinguished naval officer.

Crockett took to the House floor and delivered his famous speech, relevant as ever: "We have the right, as individuals, to give away as much of our own money as we please in charity; but as members of Congress we have no right to so appropriate a dollar of the public money. ... I am the poorest man on this floor. I cannot vote for this bill, but I will give one week's pay to the object, and if every member of Congress will do the same, it will amount to more than the bill asks."

Crockett was the only member of Congress who donated personally to the widow, while the members of Congress who pretended to be so caring and compassionate closed their wallets.

It all goes to show that liberal do-gooders were as hypocritical then as they are today.

SOURCE

The Civil War is Here

A civil war has begun.

This civil war is very different than the last one. There are no cannons or cavalry charges. The left doesn’t want to secede. It wants to rule. Political conflicts become civil wars when one side refuses to accept the existing authority. The left has rejected all forms of authority that it doesn’t control.

The left has rejected the outcome of the last two presidential elections won by Republicans. It has rejected the judicial authority of the Supreme Court when it decisions don’t accord with its agenda. It rejects the legislative authority of Congress when it is not dominated by the left.

It rejected the Constitution so long ago that it hardly bears mentioning. .......To Read More....

ObamaCare Was Designed to Explode — Dems Want Single-Payer

There were two big winners when the House failed to take up the President Donald Trump-backed bill to repeal and replace ObamaCare: Barack Obama, who saw ObamaCare stand; and Dr. Ben Carson, who was smart enough to pick Housing and Urban Development over Health and Human Services.

Thursday, March 30, 2017

Scientific Integrity is.............

Scientific Integrity is an Oxymoron: J Scott Armstrong - Fewer Than 1 Percent Of Papers in Scientific Journals Follow Scientific Method

Fewer than 1 percent of papers published in scientific journals follow the scientific method, according to research by Wharton School professor and forecasting expert J. Scott Armstrong. Professor Armstrong, who co-founded the peer-reviewed Journal of Forecasting in 1982 and the International Journal of Forecasting in 1985, made the claim in a presentation about what he considers to be “alarmism” from forecasters over man-made climate change. “We also go through journals and rate how well they conform to the scientific method. I used to think that maybe 10 percent of papers in my field … were maybe useful.

Now it looks like maybe, one tenth of one percent follow the scientific method” said Armstrong in his presentation, which can be watched in full below. “People just don’t do it.”.......To Read More....

Donald Trump Declares ‘New Age Of American Energy’

Donald Trump signs executive order rolling back Obama's climate policies

British Prime Minister Theresa May signs a letter invoking Article 50, which will formally start the process for the United Kingdom's exit from the European Union.

China has claimed big gains in energy efficiency for 2016 despite coal and steel production that covered cities in smog during the second half of the year. Official figures from the National Bureau of Statistics (NBS) have offered a murky mix of partial data, unexplained results and apparent discrepancies in accounting for the country's energy use in a year of lower economic growth. The numbers pose a puzzling question with several implications for China's economy and the environment. How could the country have made such an advance in energy efficiency at a time when power consumption climbed by such a large amount and GDP grew by 6.7 percent, the slowest pace in 26 years? Other energy figures from the NBS may only add to the mystery. --Michael Lelyveld,

On Tuesday, President Trump signed an executive order that promoted American energy security by rolling back several overreaching Obama-era regulations that are central to the Paris climate pact. The president’s order addressed some of the most economically damaging regulations behind the Paris accords. This executive order sent Washington’s regulatory agencies back to the drawing board to help make American energy as clean as we can, as fast as we can, without raising costs on American families. The order has taken the legs out from under the Paris climate agreement that President Obama signed in his last year in office. It’s time for the United States to pull out of the Paris climate agreement entirely. --John Barrasso, The Washington Times, 29 March 2017

The Green Party lost every seat it held in a regional German legislature after a crushing election defeat Sunday. Greens did not receive the 5 percent of votes required to have a representative in the regional assembly of Saarland. The Greens still control 63 of the 630 seats in Germany’s national legislative body, but this may change during the September elections. Greens received three of the state legislature’s 51 seats in the 2009 election after receiving 5.9 percent of the vote. Voters may have punished left-leaning parties because Germany’s power grid almost collapsed in January due to poorly-performing wind turbines and solar panels. Unusually cloudy weather combined with atypical wind speeds set the stage for massive blackouts. --Andrew Follett, The Daily Caller, 27 March 2017

Press Release: Buckeye Institute

| ||||

| ||||

|

A Big Benefit of Real Tax Reform Is Ending the Bias for Debt over Equity

There are many powerful arguments for junking the internal revenue code and replacing it with a simple and fair flat tax.

- It is good to have lower tax rates in order to encourage more productive behavior.

- It is good to get rid of double taxation in order to enable saving and investment.

- It is good the end distorting preferences in order to reduce economically irrational decisions.

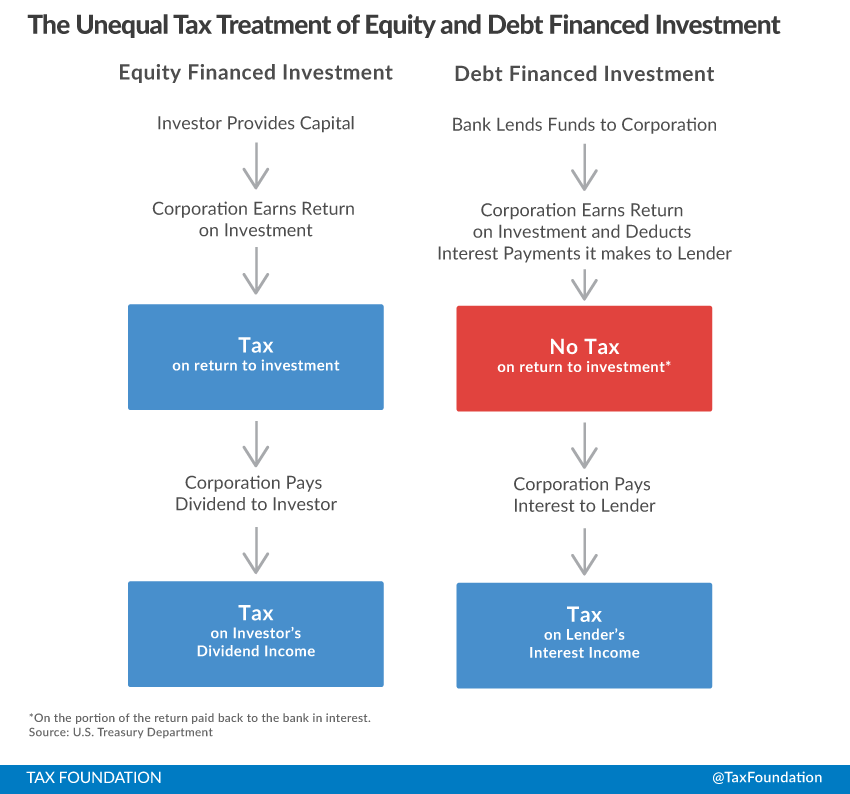

Under current law, there is double taxation of corporate income. This means that companies must pay a tax on income, but that the income is then taxed a second time when distributed to the owners of the company (i.e., shareholders).

Under current law, there is double taxation of corporate income. This means that companies must pay a tax on income, but that the income is then taxed a second time when distributed to the owners of the company (i.e., shareholders).This means that the effective tax rate is a combination of the corporate income tax rate and the tax rate imposed on dividends. And this higher tax rate is an example of why double taxation discourages capital formation and thus leads to lower wages.

But this double taxation of dividends also creates a distortion because there isn’t double taxation of corporate income that is distributed to bondholders. This means companies have a significant tax-driven incentive to rely on debt, which is risky for them and the overall economy.

Curtis Dubay has a very straightforward explanation of the problem.

In debt financing, a business raises money by issuing debt, usually by selling a bond. In equity financing, a business raises funds by selling a share in the business through the sale of stock. The tax system provides a relative advantage to financing capital expenditures through debt because under current tax law, businesses can deduct their interest payments on the debt instruments, but dividend payments to shareholders are not deductible. Thus, equity is disadvantaged because it is double taxed while debt correctly faces only a single layer of taxation.By the way, when public finance people write that something is “not deductible” or non-deductible, that simply means it subject to the tax (much as the non-deductibility of imports under the BAT is simply another way of saying there will be a tax levied on all imports).

But I’m digressing. Let’s get back to the analysis. Curtis then explains why it doesn’t make sense to create an incentive for debt.

The double tax on equity makes debt a relatively more attractive way for businesses to finance themselves, all else equal. As a result, businesses will take on more debt than they otherwise might. …This is a serious problem because carrying significant amounts of debt can make businesses less stable during periods when profitability declines. Interest payments on debt are a fixed cost that businesses must pay regardless of their performance. This can be onerous and endanger a business’s solvency when profits fall.He points out that the sensible way of putting debt and equity on a level playing field is by getting rid of the double tax on dividends, not by imposing a second layer of tax on interest.

…it does not make sense to equalize their tax treatment by eliminating interest deductibility for businesses. Doing so would further suppress economic growth, job creation, and wage increases. Instead, Congress should end the double taxation of income earned through equity financing in tax reform by eliminating taxes on saving and investment, including capital gains and dividends.Incidentally, what Curtis wrote isn’t some sort of controversial right-wing theory. It’s well understood by every public finance economist.

The International Monetary Fund, for instance, is generally on the left on fiscal issues (and that’s an understatement). Yet in a study published by the IMF, Ruud A. de Mooij outlines the dangers of tax-induced debt.

Most tax systems today contain a “debt bias,” offering a tax advantage for corporations to finance their investments by debt. …One cannot compellingly argue for giving tax preferences to debt based on legal, administrative, or economic considerations. The evidence shows, rather, that debt bias creates significant inequities, complexities, and economic distortions. For instance, it has led to inefficiently high debt-to-equity ratios in corporations. It discriminates against innovative growth firms, impeding stronger economic growth. … recent developments suggest that its costs to public welfare are larger—possibly much larger—than previously thought. …The economic crisis has also made clear the harmful economic effects of excessive levels of debt… These insights make it more urgent to tackle debt bias by means of tax policy reform.What’s the solution?

Well, just as Curtis Dubay explained, there are two options.

What can be done to mitigate debt bias in the tax code? In a nutshell, it will require either reducing the tax deductibility of interest or introducing similar deductions for equity returns.And the author of the IMF study agree with Curtis that the way to create neutrality between equity and debt is by using the latter approach.

Abolishing interest deductibility would indeed eliminate debt bias, but it would also introduce new distortions into investment, and implementing it would be very difficult. …The second option, introducing a deduction for corporate equity, has better prospects. …such an allowance would bring other important economic benefits, such as increased investment, higher wages, and higher economic growth.And Mooij even acknowledges that there’s a Laffer Curve argument for getting rid of the double tax on dividends.

The main obstacle is probably its cost to public revenues, estimated at around 0.5 percent of GDP for an average developed country. …In the long term, the budgetary cost is expected to be significantly smaller, since the favorable economic effects of the policy change would broaden the overall tax base. And in fact, a number of countries have successfully introduced variants of the allowance for corporate equity, suggesting that it is not only conceptually desirable but also practically feasible.Another study from the International Monetary Fund, authored by Mooij and Shafik Hebous, highlights the damage caused by luring companies into taking on excessive debt.

Excessive corporate debt levels are a serious macroeconomic stability concern. For instance, high debt can increase the probability of a firm’s bankruptcy in case of an adverse shock… Given this concern about excessive corporate debt, it is hard to understand why almost all tax systems around the world encourage the use of corporate debt over equity. Indeed, most corporate income tax (CIT) systems allow interest expenses, but not returns to equity, to be deducted in calculating corporate tax liability. This asymmetry stimulates corporations to use debt over equity to finance investment.We get the same explanation of how to address the inequity in the tax treatment of debt and equity.

Effectively, there are two ways in which debt bias can be neutralized: either by treating equity more similar as debt by adding an allowance for corporate equity (ACE); or by treating debt more similar for taxation as equity by denying interest deductibility for corporations.And we get the same solution. Stop double taxing dividends.

ACE systems have been quite widely advocated by economists and implemented in some countries, such as Belgium, Cyprus, Italy, Switzerland, and Turkey. Evaluations generally suggest that these systems have been effective in reducing debt bias… Yet, many countries are still reluctant to introduce an ACE due to the expected revenue loss.By the way, the distortionary damage becomes greater when tax rates are onerous.

A recent academic study addresses the added damage of extra debt that occurs when tax rates are high.

For a country like the United States with a relatively high corporate income tax rate (a statutory federal rate of 35%), theory argues that firms in this country should have significant leverage. …The objective of our study is to estimate how much such variation in tax structure arising from global operations explains the variation in capital structure that we observe among US publicly traded multinational firms. …We employ the BEA’s multinational firm data and augment it with international tax data… Using our calculated weighted average tax rate, we include otherwise identified explanatory variables for capital structure and estimate in a multivariate regression setting how much our blended tax rate measure improves our understanding of why capital structure varies across firms and, to a lesser extent, across time. …Economically, this coefficient corresponds to a 7.1% higher book leverage ratio for a firm with a 35% average tax rate over the sample period compared to an otherwise identical firm with a 25% average tax rate. These results demonstrate that, contrary to some of the earlier literature finding that tax effects were negligible, firms that persistently confront high tax rates have significantly more debt, both economically and statistically, than otherwise equivalent firms who persistently face lower corporate income tax rates. …Irrespective of whether we examine leverage ratios based on book values or market values, whether we include cash or not, or if we alternatively examine interest coverage, we find that multinational firms confronting lower tax rates use less debt. The results are not only statistically significant, but the coefficient magnitudes suggest that these effects are first orderThere’s some academic jargon in the above excerpt, so I’ll also include this summary of the paper from the Tax Foundation.

A new paper published in the Journal of Financial Economics finds that countries with high tax rates on corporate income also have higher corporate leverage ratios. …Using survey data of multinational corporations from the Bureau of Economic Analysis (BEA), the authors…find that businesses that report their income in high tax jurisdictions have corporate leverage ratios that are substantially higher than those in low tax jurisdictions. More precisely, they find that a business facing an average tax rate of 35% has a leverage ratio that is 7.1% higher than a similar firm facing an average tax rate of 25%.By the way, here are the results from another IMF study by Mooij about how the debt bias is connected to high tax rates.

We find that, typically, a one percentage point higher tax rate increases the debt-asset ratio by between 0.17 and 0.28. Responses are increasing over time, which suggests that debt bias distortions have become more important.The bottom line is that the U.S. corporate tax rate is far too high. And when you combine that punitive rate with a distortionary preference for debt over equity, the net result is that we have companies burdened by too much debt, which puts them (and the overall economy) in danger when there’s a downturn.

So the obvious solution (beyond simply lowering the corporate rate, which should be a given) is to get rid of the double tax on dividends.

The good news is that Republicans want to move in that direction.

The good news is that Republicans want to move in that direction.The not-so-good news is that they are not using the ideal approach. As I noted last year, the “Better Way Plan” proposed by House Republicans is sub-optimal on this issue.

Under current law, companies can deduct the interest they pay and recipients of interest income must pay tax on those funds. This actually is correct treatment, particularly when compared to dividends, which are not deductible to companies (meaning they pay tax on those funds) while also being taxable for recipients. The House GOP plan gets rid of the deduction for interest paid. Combined with the 50 percent exclusion for individual capital income, that basically means the income is getting taxed 1-1/2 times. But that rule would apply equally for shareholders and bondholders, so that pro-debt bias in the tax code would be eliminated.For what it’s worth, I suggest this approach was acceptable, not only because the debt bias was eliminated, but also because of the other reforms in the plan.

…the revenue generated by disallowing any deduction for interest would be used for pro-growth reforms such as a lower corporate tax rate.Though I can’t say the same thing about the border-adjustability provision, which is a poison pill for tax reform.

P.S. While the preference for debt is quite harmful, I nonetheless still think the worst distortion in the tax code is the healthcare exclusion.