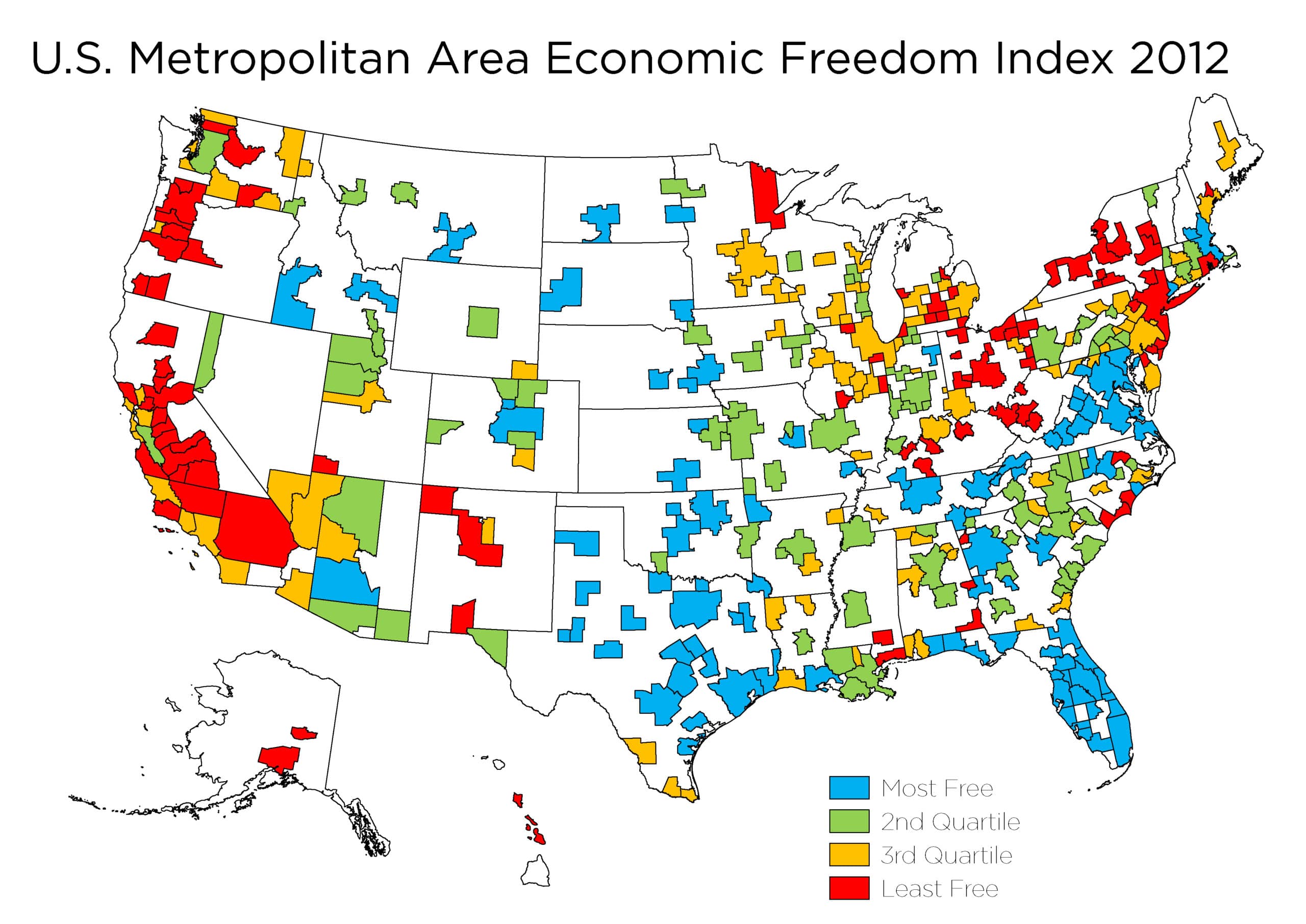

It’s not easy to identify America’s worst-governed city. You can make a case for jurisdictions such as San Francisco, Detroit, New York City, Minneapolis, or Seattle.

For what it’s worth, there is statistical research from last decade showing places like New York and Los Angeles are among the worst of the worst, but I wonder if Chicago actually deserves top billing

There are many reasons to criticize the Windy City. Crime is rampant, taxes are excessive, and schools are terrible.

And, to make matters worse, Chicago is in America’s worst-governed state (at least based on my poll, which is not scientific but is probably accurate).

I already wrote once about bad public policy in Chicago. Today’s column is going to show that things are getting even worse.

I’ve written about how taxpayers are fleeing poorly governed states. Well, they’re also fleeing poorly governed cities. And the AP reports that Chicago is a popular place for companies…to leave.

The Chicago area saw an exodus of corporate headquarters in 2022, including investment firm Citadel, which moved to Miami along with its billionaire founder, Ken Griffin; Caterpillar, which relocated from north suburban Deerfield to Irving, Texas; and aerospace giant Boeing, which moved to Arlington, Virginia, after more than 20 years in the West Loop. The most recent high-profile departure was announced in November, when Lake Forest-based auto parts manufacturer Tenneco said it was shifting its headquarters to Michigan. …vacancy rates in the central business district rose to 19.6%, while the Chicago metro ticked up to 21.8%… Meanwhile, Citadel principals and employees generated billions of dollars in tax revenue for the city and state over the past decade, according to the firm, money that has also headed south.

And why are businesses escaping?

As Adam Schuster explained last October in National Review, the city’s economic management is getting worse.

Can anything be done to save the financial future of one of America’s largest and best cities? …Let’s go through the numbers. The business community is right that a property-tax increase is unnecessary considering the $3.5 billion in pandemic-related federal aid. ..The property-tax hike could be prevented by using just 2.5 percent of Chicago’s $1.9 billion in American Rescue Plan funding. But instead of using the aid to prevent tax hikes that would impede Chicago’s economic recovery, the city has proposed to use those billions to create new programs. The mayor’s proposed budget increases spending by roughly $1.2 billion… Unfortunately, that spending is propped up by one-time federal aid that expires by 2024 — meaning many programs will have to be…financed with significant tax hikes within just two years. And about those pensions: Pension costs will consume more than $2.3 billion of the city’s budget, or 21.4 percent of its own source revenue, excluding state and federal grants. That’s more than a $967 million increase in pension spending since Lightfoot became mayor and $461 million more than last year alone.

In other words, the city is trying to raise taxes today while also making decisions (especially regarding unfunded pensions) that will almost surely mean additional tax increases in the future.

No wonder people and business are fleeing the state and the city.

P.S. To make matters worse, Chicago still has major problems with corruption.

P.P.S. My long-run fear is that politicians in DC will provide bailouts for profligate cities and states.

No comments:

Post a Comment