When I think of the world’s most mistreated taxpayers, a few options come to mind.

- Cam Newton, the quarterback who faced a marginal tax rate of nearly 200 percent on his Super Bowl bonus.

- The 8,000 French households who had to surrender more than 100 percent of their income in 2012.

- The unfortunate Spanish laborer who faced a tax rate of almost 70 percent even though he only earned about €1,000 per month.

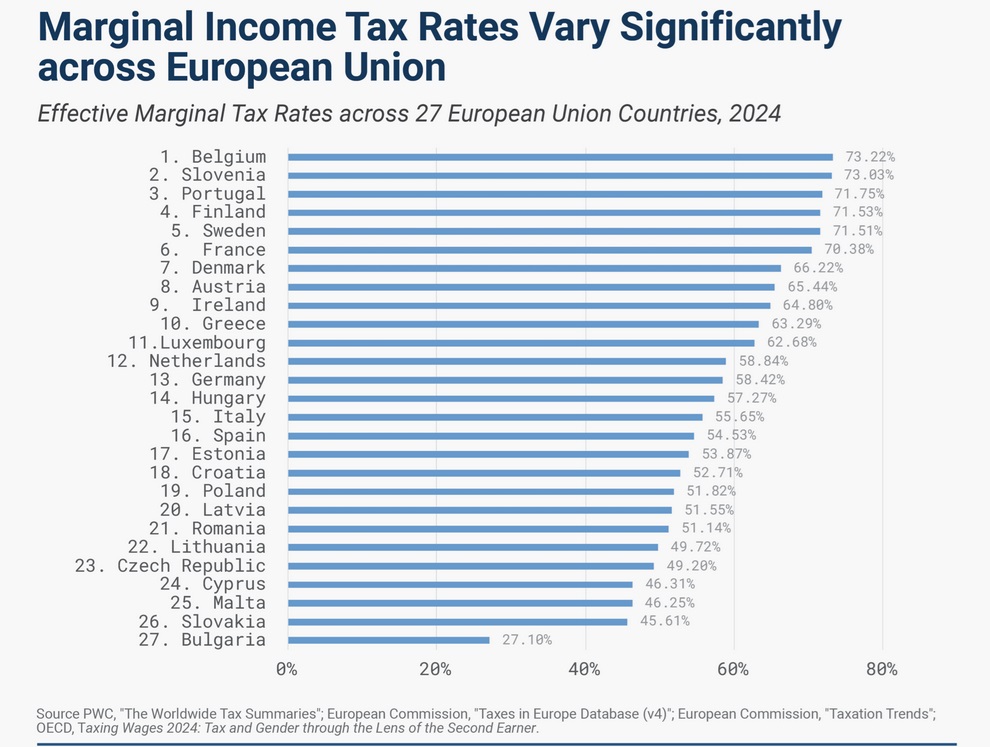

For today’s column, I want to shift the focus from individuals to countries because the Tax Foundation just released a new report on top tax rates in the European Union.

If you don’t have time to read the entire column, the main takeaway is that investors, entrepreneurs, business owners, and other successful taxpayers should avoid Belgium.

Heck, they should also avoid Slovenia, Portugal Finland, and every other European nation. Other than Bulgaria.

The Tax Foundation report points out that successful taxpayers do take steps to avoid the nations with the greediest governments.

Here are some excerpts from the report.

The issue of the mobility and sensitivity of top earners has been extensively studied in the literature. For example, Akcigit et al. (2016) analyze the effect of top income taxes on the international migration of inventors. The authors use a panel of international inventor data from U.S. and European patent offices and track their international location patterns since the 1970s all the way up to the mid-2010s.

The authors find a negative correlation between higher tax rates and the proportion of high-quality foreign investors located in a country as well as the proportion of high-quality domestic inventors who remain in their country. …Mathilde Muñoz addresses how income taxes affect the migration decisions of rich taxpayers in Europe. …Muñoz’s results reveal that the location decisions of high-income taxpayers are indeed significantly influenced by income tax rates. …if the net tax rate increases by 1 percent, the evidence in this study suggests that 0.1 to 0.3 percent of high earners will react by relocating or adjusting their taxable income, and in the case of foreign taxpayers, the figure rises to 1 percent.

And for wonky readers, here is a brief explanation of the methodology.

To estimate the tax burden of upper-income taxpayers, income tax rates will be combined with Social Security contributions as well as consumption taxes. This approach is slightly different from the papers cited in our literature review, but we consider it to be an important step toward providing an overview of the full tax burden borne by higher-income individuals.

In other words, the Tax Foundation correctly is looking at the wedge that all taxes create between pre-tax income and post-tax consumption.

Which is the data that is needed to understand the degree to which the overall tax system is discouraging productive behavior (and encouraging other behaviors, such as migration, tax avoidance, and tax evasion).

P.S. The three previous columns in this series can be found here, here, and here.

P.P.S. In 2016, I gave one of the reasons why Belgium has a terrible tax system (though there is an important exception).

No comments:

Post a Comment