June 15, 2024 by Dan Mitchell @ International Liberty

Economic freedom has been declining in the United States in recent decades. But it’s also been declining in Western Europe over the same period.

It’s almost as if politicians on both sides of the Atlantic are having a race to see who can do the most damage to prosperity.

Perhaps because they started with more statism, it appears that European politicians are winning. Which means that the European people are losing.

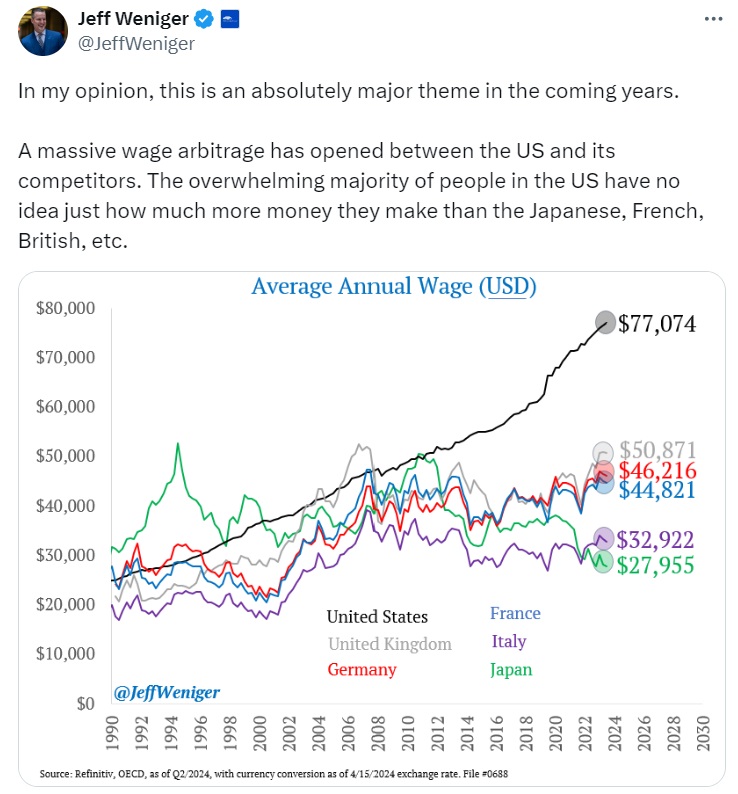

Two months ago, I wrote about the widening gulf between the United States and Europe and shared a chart about a growing wage gap between the U.S. and other major nations.

And that builds upon the two columns I wrote in 2023 (here and here) and the three columns I wrote in 2022 (here, here, and here), all of which show America out-performing Europe.

Today, let’s revisit the issue.

Here are some excerpts from a Washington Post column by Fareed Zakaria. Here’s his comparison of the U.S. and Europe.

In Europe, the talk is all about how Europe has been unable to keep up with the U.S. powerhouse. …In 2008, the United States and the euro-zone economies were roughly the same size. Today, the American economy is nearly twice the size of the euro zone. And it’s not just one measure. Average European income is now 27 percent lower than in the United States, and average wages are 37 percent lower. …The U.S. economy towers above Europe’s these days. The United States’ technology companies dominate the continent.

U.S. banks are far more profitable than European ones. U.S. energy production has created a boom in manufacturing which is luring many European companies to the United States. As one German CEO said to me. “America is an easier place to do business, has fewer regulations, and now has much lower energy costs. How do I rationally invest in Europe?” ……every year 300 billion euros is diverted to overseas markets to find superior investments, most of them in the United States.

I think it’s a gross overstatement for him to call the United States a powerhouse. After all, inflation-adjusted wages and household income numbers in America have been quite dismal.

But Zakaria is correct to say that Europe is in much worse shape.

Where he goes astray is in his proposed solution. He thinks more centralized power in Brussels (the headquarters of the European Union) is the key to faster growth.

The solution to Europe’s woes can be summarized in one line — a deeper, more united, more strategic Europe. But that solution means, inevitably, more power to the European Union.

This is completely backwards. Europe needs more federalism and jurisdictional competition, not more centralization and harmonization.

To be fair, there are plenty of good things about the European Union, particularly the goal of free trade among the member nations.

But the E.U. also is a major source of bad policy, such as carbon protectionism and tax harmonization.

The bottom line is that more power for Brussels means expanding the cost of supranational government in Europe while doing nothing to fix the primary problem of bad policy by national governments.

No comments:

Post a Comment