More than 13 years ago, when many European nations were rocked by fiscal crisis, I speculated about which nation would be the next to suffer a Greek-style meltdown.

I focused my analysis on Japan, Italy, Greece, Belgium, Spain, and Portugal. And I included the United States in my analysis because of the Bush-Obama spending binge.

The good news is that there has not been a repeat of Greece’s fiscal collapse.

The bad news is that it may just be a matter of time.

Why? Because scholarly research shows that the best and strongest predictor of a fiscal crisis is excessive budgetary expansion. And that’s happening in too many nations.

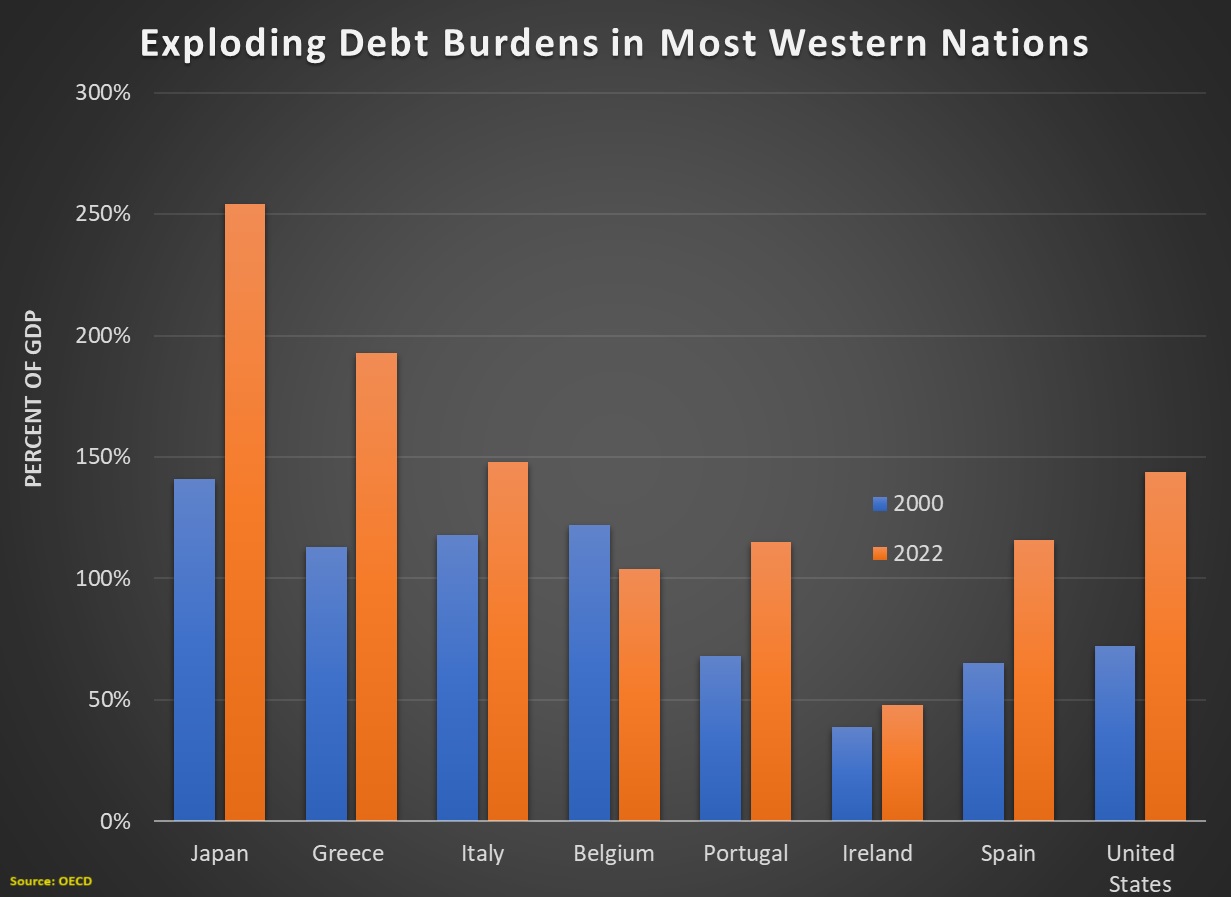

And more spending leads to more red ink. Here’s a chart, based on OECD data, showing government debt levels in 2000 and 2022. Six of the seven nations have moved in the wrong direction.

In the case of Japan, Greece, Spain, and the United States, the deterioration has been dramatic, with Portugal also moving significantly in the wrong direction.

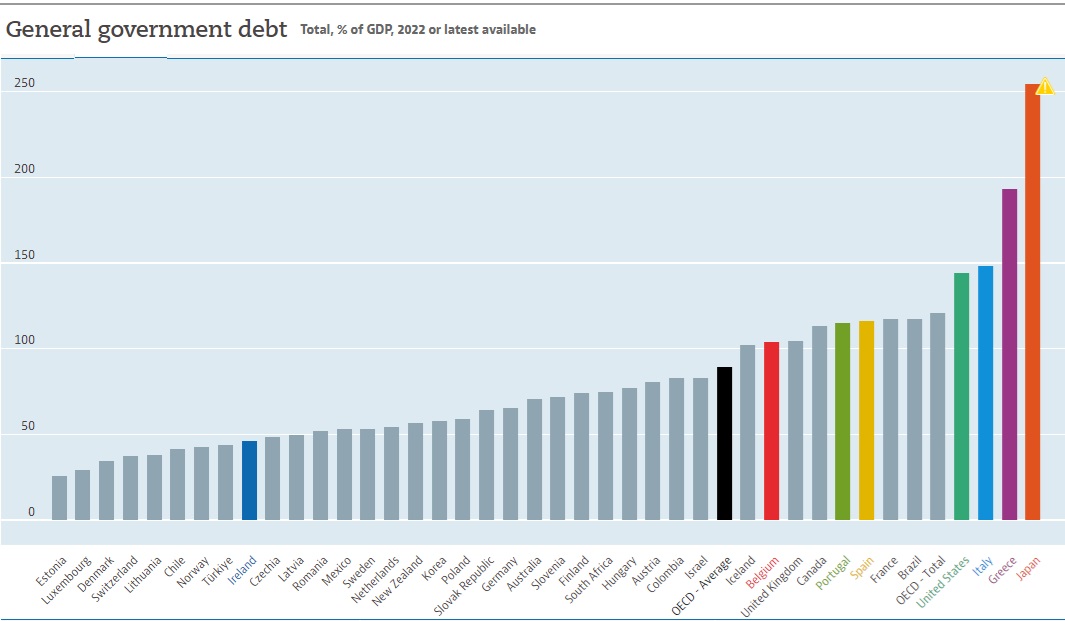

For those who want to see all OECD nations, here another chart.

Kudos to Estonia for keeping government under control. And the other Baltic nations also score well.

And Switzerland’s strong position is another reason to celebrate that nation’s spending cap.

I’m somewhat surprised, though, to see Denmark is such good shape.

But it’s not a shock to see that France is one of the worst of the worst.

Speaking of France, Desmond Lachman of the American Enterprise Institute includes that country in his very pessimistic assessment.

…instability raises risks of a French debt crisis. Other countries in Europe, most notably Italy, are also flashing warning signals at a particularly bad time for the global economy. Debt is putting an economic strain on Europe. Italy, the third-largest euro zone member country, finds itself on an unsustainable public debt path. To have France, the second-largest, also on such a path looks plainly dangerous for the euro’s future. …

Until recently, Italy was generally regarded as the euro’s weak link. Not only was its public debt to GDP ratio well above its level at the time of the 2010 euro zone debt crisis, there was also little prospect that it could get its debt ratio on a declining path. In addition to having an economy that grows at a snail’s pace, last year Italy ran a budget deficit of over 7% of GDP. That combination of low growth and a relatively high budget deficit must be expected to keep Italy’s public debt at a dangerously high level indefinitely. …

Greece’s debt problems shook world financial markets. We have to wonder how much more markets would be shaken if debt problems were to surface in Italy, which has an economy some ten times the size of Greece. This…is now also focusing the market’s attention on France’s precarious public finances. …Even in a benign political setting, experience with budget belt-tightening during the 2010 euro zone debt crisis suggests that France and Italy will have difficulty in restoring public debt sustainability.. All of this casts a dark cloud over the world economic recovery in the year ahead.

Richard Rahn has the best analysis for the simple reason that he points to a solution that would reverse the fiscal mess plaguing nations. Here’s some of what he recently wrote for the Washington Times.

As of May 1, each U.S. citizen’s federal government per capita debt was $102,984. This debt is rising rapidly, increasing 7.66% in the last year and an astounding increase of 2.38% in the last month. These figures do not include the unfunded liabilities of Social Security, Medicare, etc., which run into many added trillions of dollars.

Last month, I participated in conferences in several European cities dealing with the global debt crisis (most major economies have debt-to-gross domestic product ratios exceeding 100% and growing — which is not sustainable). Among knowledgeable people, the fact that we are at the edge of the debt cliff is widely accepted — which means there will be a large drop in living standards or, at best, very little improvement (shades of Argentina and Greece). The correct policy solution is to cut government spending so that the debt-to-GDP ratio is falling at a meaningful rate.

Amen. The United States needs a spending cap. Europe needs a spending cap. Developing nations need a spending cap.

Remember, spending is the problem and debt is a symptom of the problem.

P.S. Any country can fix its problem with spending restraint. Which is why I want to applaud Italy and Greece for small steps in the right direction.

P.P.S. Debt-financed spending is bad. But tax-financed spending is equally bad. And spending financed by money-printing may be the worst of all options.

No comments:

Post a Comment