There isn’t much good news coming from Washington, DC, especially since Biden was able to push through a (fortunately watered-down) package of more spending and higher taxes.

But there have been some very positive developments at the state level over the past couple of years.

I’ve already written several times about how school choice has been spreading, led by big reforms in states such as Arizona and West Virginia.

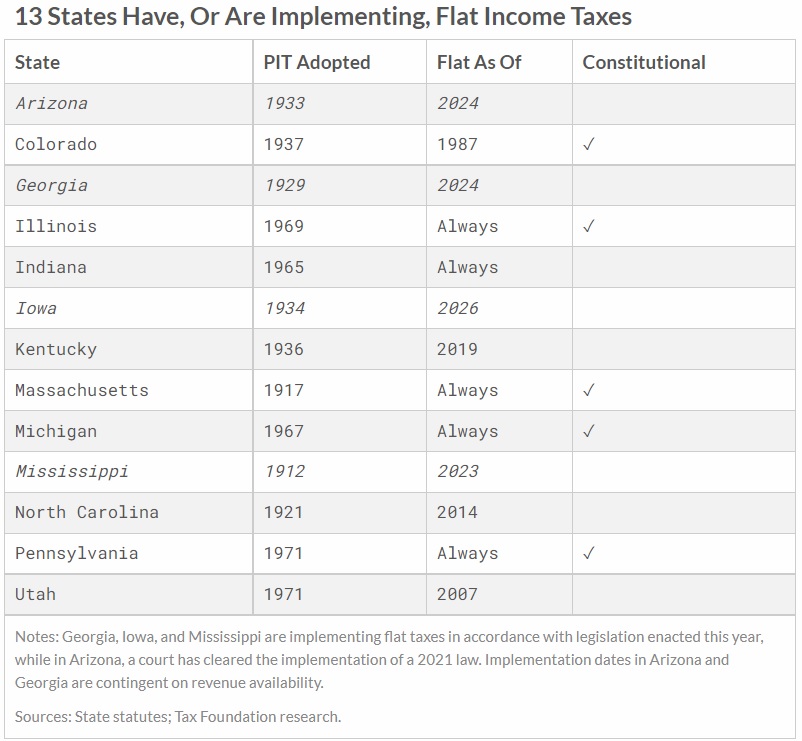

The other big development is that states are lowering tax rates and replacing discriminatory “progressive” tax systems with simpler and fairer flat taxes that are more friendly to growth.

In a column for Forbes, Patrick Gleason of Americans for Tax Reforms discusses the latest developments in state tax policy – most notably Idaho’s shift to a flat tax.

…The second half of the year is resulting in further income tax relief and strengthening the recent trend of states moving from graduated to flat income taxes. Most recently, Idaho legislators returned to the state capital in Boise on the first day of September for a special session called by Governor Brad Little (R) for the purpose of making Idaho the newest flat tax state. …Governor Little’s proposal, which state legislators passed on September 1, moves Idaho to a flat 5.8% personal income tax. Idaho currently has a progressive income tax code with a top rate of 6%, which kicks in at less than $8,000 in annual income. …HB 1, which Little will soon sign into law, will also cut Idaho’s corporate tax rate from 6% to 5.8%.

North Dakota also is contemplating tax reform.

…in North Dakota, Governor Doug Burgum (R) unveiled a new tax proposal that would also move North Dakota to a flat tax. North Dakota currently has a two-tier income tax with rates of 2.04% and 2.9%. Governor Burgum’s proposal would move to a flat 1.5% income tax.

From a big-picture perspective, the last couple of years have been great news for taxpayers in certain states.

here are currently nine states with a flat income tax, 18 when counting the nine no-income-tax states that charge a flat 0%. Four states (Arizona, Iowa, Georgia, and Mississippi) codified laws in 2021 and 2022 that will phase in flat taxes in the coming years. When Governors Little and Burgum enact their tax proposals as is expected, Idaho and North Dakota will become the the fifth and sixth states in past two years alone to adopt a flat tax, bringing the total number of flat or zero tax states to 24.

I’ll conclude by observing that I put together a 5-column method in 2018 for ranking state tax system.

At the beginning, 18 states were in the two good columns (no income tax or flat tax).

Today, we’re approaching 25 states and a few other states have moved in the right direction (reducing so-called progressive tax systems).

The bottom line is that it is costly to escape bad policy in Washington, but at least we have more options if we want to find good policy at the state level.

No comments:

Post a Comment