If Joe Biden’s bungled economic policy is any indication, the GOP may wind up controlling Washington in the not-too-distant future.

If so, I hope Republicans rekindle their interest in the kind of genuine entitlement reform discussed in this interview.

But I’m not sure whether to be optimistic or pessimistic.

On the plus side, the GOP supported pro-growth entitlement reform during the Obama years.

On the minus side, the party largely punted on the issue once Trump took over.

To be sure, punting is the easy route from a “public choice” perspective. Politicians like offering freebies to voters and many voters like getting handouts.

However, that approach means America’s economy is weakened by an ever-growing burden of federal spending and eventually is plunged into fiscal crisis.

And that’s based on the programs that already exist. Joe Biden wants to expand the welfare state with even more entitlements!

The Wall Street Journal editorialized about the downside of making America more like Europe last October.

The result of…expanded entitlements is likely to be reduced incentives to work and invest, slower economic growth, lower living standards, and less fiscal space for essential public goods like national defense. That’s the lesson from Europe’s cradle-to-grave welfare states… Europe’s little-discussed secret is that its cradle-to-grave welfare states are financed by the middle class via value-added and payroll taxes. The combined employer-employee social security tax rate is 36% in Spain, 40% in Italy and 65% in France. Value-added taxes in most European economies are around 20%. There simply aren’t enough rich to finance their entitlements.

Amen. I’ve repeatedly warned that a European-sized welfare state would mean European-sized taxes on lower-income and middle-class Americans.

And what’s remarkable (and discouraging) is that some politicians in the U.S. want to expand entitlements even though many European governments now realize they made big mistakes and need to scale back.

The irony is that some European governments have tried to reform their tax and welfare systems to become more competitive. Germany and Sweden over two decades reformed their welfare and labor policies. …Other European governments are also pushing welfare-state reforms. French President Emmanuel Macron has passed pension reform and cut the corporate tax rate to 26.5% from 33% in 2017… Greece is pulling out of its debt trap with Prime Minister Kyriakos Mitsotakis’s tax, pension and regulatory reforms.

For what it’s worth, I’m happy about these reforms, but I fear many European nations are in the too-little-too-late category.

Why? Because the demographic outlook is deteriorating faster than reform is happening. In other words, most of them are probably destined to suffer Greek-style fiscal crises.

But if (or when) that happens, maybe American politicians will finally wake up and realize we need good reforms to prevent Social Security, Medicare, and Medicaid from causing a similar collapse on this side of the Atlantic Ocean..

Hopefully that epiphany will take place before it is too late for the United States.

P.S. For those who are interested in the history of fiscal policy, John Cogan of the Hoover Institution wrote about pre-20th-century entitlements earlier this year.

Here are excerpts from his column in the Wall Street Journal.

The history of U.S. entitlements is a 230-year record of continuous expansion… The first major entitlement, Revolutionary War disability benefits, was initially restricted to members of the Continental Army and Navy who were injured in battle and survivors of those killed in wartime. Eligibility was then expanded, first to state militia soldiers, then to veterans whose disabilities were unrelated to wartime service, and eventually to virtually all people who served during the war regardless of disability. Civil War disability pensions followed the same…process, except on a far grander scale. Pensions were initially confined to U.S servicemen who suffered wartime injuries and survivors of those killed in battle. Eventually they were extended to virtually all union Civil War veterans regardless of disability. …Congress followed the same liberalizing process with 20th-century entitlements.

If this excerpt doesn’t satisfy your curiosity, here’s Cogan discussing the topic for 46 minutes.

P.P.S. Not all entitlement reform is created equal.

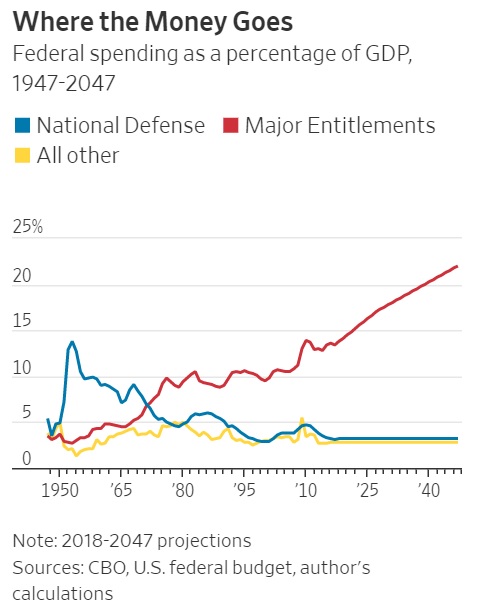

P.P.P.S. Here an informative chart if you want to know whether to blame defense spending or entitlement spending.

P.P.P.P.S. I always argue in favor of a Swiss-style spending cap, which presumably would force politicians to address America’s entitlement problem.

No comments:

Post a Comment