May 23, 2022 by Dan Mitchell @ International Liberty

Trump had some economically illiterate tweets about trade during his presidency, including the infamous one about being “Tariff Man.”

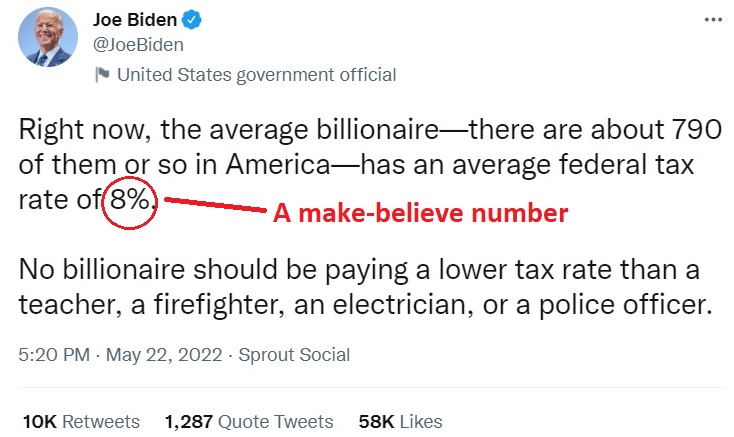

I think Joe Biden must be feeling envious that Trump got so much attention, so he has issued a tweet showing that he also suffers from economic illiteracy.

Or maybe Biden’s problem is dishonesty because his tweet is based on a make-believe number about the the average tax rate paid by billionaires.

For what it’s worth, this isn’t the first time that Biden has issued a tweet based on fake numbers.

In the previous instance, he deliberately confused the distinction between the financial concept of book income and and cash-flow concept of taxable income.

What accounts for his most recent error?

Reporting for the Wall Street Journal, Richard Rubin and Rachel Louise Ensign explain how the Biden Administration concocted this number.

What do the wealthy pay in federal taxes? On paper, the top marginal income-tax rate is 37% on ordinary income and 23.8% on capital gains. Government estimates put high-income filers’ average rates in the mid-20s. A new Biden administration analysis, however, pegs the average tax rate for the 400 wealthiest households at 8.2% from 2010 to 2018. …It’s far below traditional estimates from government number crunchers… Recent estimates of a broader group of rich people from the Congressional Budget Office, Treasury Department and the Joint Committee on Taxation fall between 23% and 26%.

So how does the Biden Administration get a number that is radically different than other sources?

By artificially inflating the income of rich people by asserting that changes in wealth should count as income.

White House…economists Greg Leiserson and Danny Yagan..include increases in unrealized capital gains. That is the change in the value of assets, including stocks, that haven’t been sold. …Conventional analyses and the current income-tax law don’t include unrealized gains.

At the risk of making a wonky point, “conventional analysis” and “income-tax law” don’t include unrealized capital gains as income because, well, changes in net worth are not income.

And the fact that some folks on the left want to tax people on unrealized capital gains doesn’t change that reality.

To understand why that would be wretched policy, let’s cite examples that apply to those of us who, sadly, are not billionaires.

- Imagine filing your taxes next year and having to pay more money to the IRS simply because Zillow estimated that your house rose in value.

- Imagine that you’re filling out your 1040 form next year and you have to pay more money to the IRS simply because your IRA or 401(k) rose in value.

Both of these examples sound absurd because they would be absurd. And if a policy is absurd and unfair for regular people, it’s also absurd and unfair for rich people.

Since I’m a fiscal wonk, I’ll close by making the point that the Biden Administration wants to take a bad tax (capital gains tax) and make it worse (by taxing paper gains in addition to actual gains).

The net result is that we would have a backdoor wealth tax – a approach that is so anti-growth that even most European governments have repealed those levies.

But since Joe Biden is motivated by class warfare (see here, here, here, and here), he apparently doesn’t care about the economic consequences.

P.S. Biden once claimed that it is “patriotic” to pay higher taxes, but he then played Benedict Arnold with his own tax return.

No comments:

Post a Comment