About two weeks ago, I shared a new study that warned about potential fiscal crises in developed nations. The study specifically warned about “sustainable debt limits” in the United States, Italy, France, the United Kingdom, and Canada.

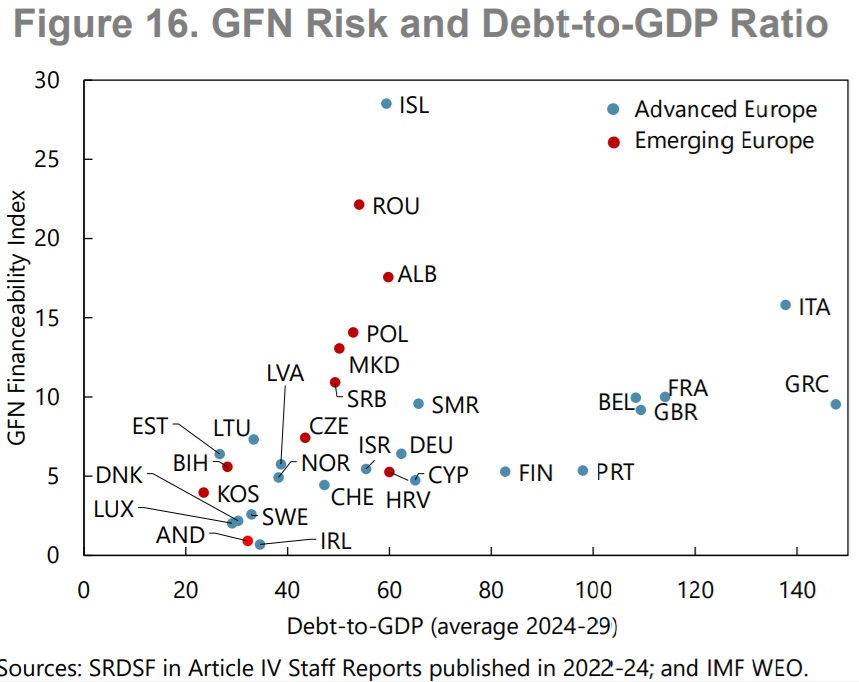

Using a different methodology, let’s now look at a chart that suggests which European nations might be most likely to face a fiscal crisis.

The horizontal axis measures the existing debt burden, so it’s not good to be on the right side of the chart. And it’s also not good to be toward the top of the chart since that’s a sign of systemic vulnerability according to the “GFN Financeability Index.”

Looking at individual nations, Italy (ITA) and Greece (GRC) have the highest debt levels, followed by France (FRA), the United Kingdom (GBR), and Belgium (BEL), while Iceland (ISL), Romania (ROU), and Albania (ALB) are perceived to have vulnerability.

The above chart comes from a new report from the International Monetary Fund.

Here are some of its conclusions.

The challenging outlook for public debt and financing in most European countries calls for decisive economic policies that reinforce fiscal sustainability while preserving long-term growth. The probability of debt not stabilizing five years out has increased in most euro area and emerging European countries, mainly driven by higher primary deficits. In the medium term, the main risks are insufficient primary balance adjustment to stabilize debt and lower-than-expected growth.

Sustained growth is expected to become a main driver for debt reduction in most countries, while risks to growth are tilted to the downside. Moreover, financing needs are expected to remain above pre-pandemic averages due to elevated public debt levels in most European economies.

......as market conditions normalize, sovereign bond holders will shift away from central banks, and domestic and global financial market factors will be reflected more in the risk premia, likely increasing the interest costs for more vulnerable countries.

Carefully-designed medium-term consolidation is key to address debt sustainability risks while supporting growth. Some countries need to phase out untargeted fiscal support more quickly, prioritize spending, and improve its efficiency, while others may need additional revenue-enhancing measures. Growth-enhancing reforms will be especially critical in high-debt countries. In EU countries…

The need for fiscal reforms across Europe is even more pressing as spending pressures are expected to increase significantly and reforms can take time to yield results. Some spending pressures, like defense and climate, are more immediate, while others, like pension and health, are expected to rise over time.

There’s some interesting data in the study, but I’m disappointed (though not surprised) that the IMF report does not explain that European nations are in trouble because government is too big and that it is growing too fast (a problem compounded by demographic change)..

I’m also disappointed (though not surprised) that the IMF’s conclusion (excerpted above) is mostly boilerplate language.

What’s needed in European nations is spending restraint. The IMF report should have strongly urged that countries copy Switzerland’s very successful spending cap.

But instead the IMF report promotes “additional revenue-enhancing measures.” So typical, so wrong.

P.S. Ironically, IMF economists have repeatedly found that spending caps are the only fiscal rule with a good track record (see here, here, and here). Too bad the political hacks in charge of the IMF are unfamiliar with this research. Or, more likely, they simply don’t care since their main goal is keeping their lucrative and tax-free jobs. And that means not pushing good policies, since that will upset the politicians in places such as Washington, Berlin, London, and Paris (i.e., the ones who ultimately decide who is in charge of the IMF).

No comments:

Post a Comment