Five years ago, I defended the “Washington Consensus” of the 1980s and 1990s.

…the “Washington Consensus”…was a term that was used to describe the kind of policy advice in those days provided to (or imposed upon) the developing world by the IMF, World Bank, and U.S. Treasury. …the Washington Consensus was pro-market, but nonetheless a bit timid because it did not include a plank to limit the size of government. …it would be nice if there had been some focus on the size of government, but all of the advice on trade, regulation, monetary policy, and quality of governance was very sound.

Today, let’s revisit the issue.

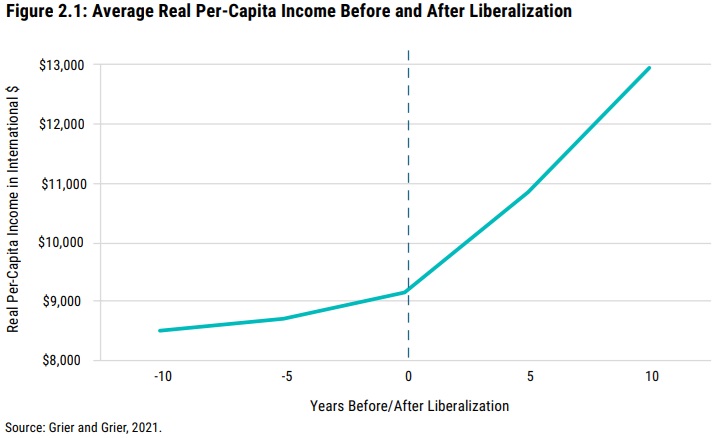

We’ll start with this chart prepared by Kevin Grier and Robin Grier, as part of their chapter in the newest edition of Economic Freedom of the World. It shows significantly faster growth following pro-market reforms.

In the chapter, which builds upon an academic study they wrote, the authors are looking at the potential for economic liberalization in Argentina.

They explain that pro-market reforms produce dividends.

Liberalization reforms, like lowering inflation, reducing deficits, reducing the state’s manipulation of exchange rates, and opening up to trade are often referred to as a package called the “Washington Consensus.” …as it turns out, there is actually quite a bit of evidence that Washington Consensus-style policy reform does consistently raise national incomes! …

Your intrepid authors…use the index published in the Fraser Institute’s Economic Freedom of the World (EFW) and code a reform when that index jumps by at least one standard deviation over a five-year period. …Grier and Grier find 49 cases of these generalized reforms occurring between 1975 and 2000. …on average, reform leaves a country around 10% richer after five years and 16% richer after 10 years. …Figure 2.1…shows that the average real per-capita income in the treated units rises gradually from about $8,500 to $9,000 before the treatment; after the treatment, income rises sharply, increasing to $13,000 after 10 years.

By the way, this improvement in prosperity is very beneficial to the poor.

One question often asked of us (frequently stated as a fact or accusation) is whether this increased average real income simply accrued to the rich. Callais and Young (2023) address this question using the Grier and Grier methodology (they study the same 49 cases as we do) but apply it to each decile in the income distribution in the treated countries instead of just the average. …

They find that jumps in economic freedom lead to significant income gains in all 10 deciles! Interestingly, the effects appear to be the largest at the bottom and the top of the distribution (the increases for the sixth, seventh, and eighth deciles are a bit smaller than the others).

In a column for Law & Liberty, James Herndon agrees that the Washington Consensus was a net plus.

Here are some excerpts from his article, which focuses on Latin America.

…the weight of new evidence calls for an overdue reconsideration of the Washington Consensus, one that helps us understand how much of the world converged on the path to less poverty and richer lives. …A reform agenda centered on privatization and deregulation should have attracted support from any ostensibly pro-business party, but the emphasis on free trade threatened too many vested interests. …

When countries liberalize trade, new (and often better) consumer goods arrive. But inflation numbers struggle to capture the benefits of greater diversity and quality, resulting in inflation-adjusted GDP numbers that do not reflect the actual change in living standards. Because the poor spend relatively more on goods and less on services, the benefits from open trade actually reduced inequality…

Flawed as GDP per capita may be, today the positive trends associated with the Consensus have grown hard to deny. Latin American GDP showed a -0.4% decline per year in the 1980s but has 1.2% annual increase since then. This turnaround occurred amid lower taxes, liberalized interest rates, more flexible exchange rates, and privatization.

Another victory for good policy.

I’ll close with an observation that may only be of interest to academic-leaning readers.

The guy who came up with “Washington Consensus” was not a libertarian or “neoliberal.” He didn’t want people like me to highlight his policies.

The New York Times obituary for John Williamson has some fascinating tidbits.

It started innocently enough: In the late 1980s, in the face of pressure on developing economies by the World Bank, International Monetary Fund and the U.S. Treasury to enact sweeping reform, Mr. Williamson organized a conference of Latin American policymakers to demonstrate what their countries were already doing to make their countries more competitive.

He drew up a list of 10 things that both Latin American governments and international economists would say constituted “best practices” — among them, keeping deficits under control, protecting property rights, investing in education and health care, reducing subsidies and making it easier for foreign direct investments to enter developing economies.

He called the list the Washington Consensus. …By the mid-1990s the Washington Consensus had come to refer to a broad portfolio of pro-market, deregulatory reforms imposed with often brutal efficiency by developed countries on emerging economies, including the “shock therapy” implemented in post-Soviet Russia. …the Washington Consensus became a term of derision, used by progressive scholars and activists to attack both neoliberals and free-market conservatives for undermining public welfare… Mr. Williamson, a critic of neoliberalism, particularly on tax policy and deregulation, was aghast.

The bottom line is that Williamson’s “Consensus” wound up being better than he wanted it to be, at least as it is now understood.

Hopefully he now knows not to be “aghast” about good tax policy and deregulation.

No comments:

Post a Comment