I’m not a fan of the International Monetary Fund, mostly because of the bureaucracy’s support for bailouts and higher taxes. Those are terrible policies for the global economy.

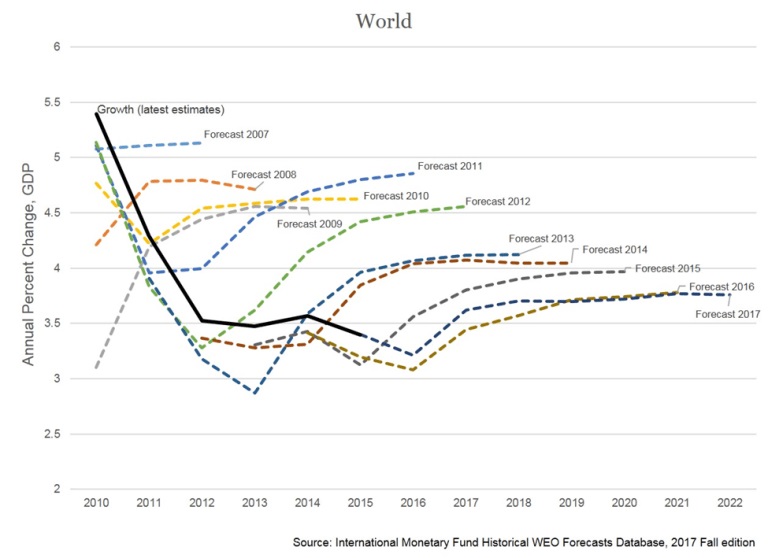

If you want to add insult to injury, the IMF’s forecasting ability also leaves much to be desired.

It is often wrong when predicting the global economy. And it is often wrong when predicting national economies.

But since economists in general are lousy forecasters, that’s a shortcoming of the profession rather than an IMF-specific complaint.

I’m opining on the IMF because it just had its big annual meeting in Washington and some observations are warranted.

Let’s look at some excerpts from Alan Rappeport’s story in the New York Times. We will start with the part that is least relevant, namely the bureaucracy’s predictions for future inflation and future growth.

New economic forecasts released by the fund on Tuesday showed that the global fight against soaring prices has largely been won… The year-over-year global inflation rate is poised to decline to 3.5 percent by the end of next year from 5.3 percent this year. That is down from its peak of 9.4 percent in 2022… The I.M.F. upgraded its projection for output in the United States this year to 2.8 percent from an earlier estimate of 2.6 percent… Output in the euro area remains sluggish this year at 0.8 percent, but the I.M.F. estimates that growth will pick up in 2025. …Other large countries are struggling, posing risks to the global economy. Growth in China and India is poised to decline this year and next.

If you want to know why the IMF’s predictions should be ignored, go back to 2020 and 2021 to see whether the IMF correctly warned about bad monetary policy leading to big price spike in 2022.

Now let’s look at the portions of the article where the IMF is right.

…a presidential election in the United States that could result in a major shift toward protectionism and tariffs if former President Donald J. Trump is elected. “…downside risks are rising and now dominate the outlook,” Pierre-Olivier Gourinchas, the I.M.F.’s chief economist, wrote in the report. …The repercussions of protectionist industrial policies and rising trade tensions are also a risk, which the I.M.F. said could hurt growth and disrupt supply chains. “Shifts toward undesirable trade and industrial policies can significantly lower output relative to our base line forecast,” Mr. Gourinchas said. …The Biden administration has maintained most of the Chinese tariffs that were enacted during the Trump administration and recently decided to increase tariffs on imports of many Chinese green energy products.

The IMF is right about the negative consequences of Trump-Biden protectionism.

And I’m glad the bureaucrats also are warning about the risks of industrial policy (i.e., politicians trying to pick winners and losers).

Now that I’ve looked at an area where the IMF is usually wrong (forecasts) and sometimes right (trade), let’s close by looking at fiscal policy, an issue where the bureaucracy is reliably wrong.

But I won’t be citing any passages from Rappeport’s NYT article. That’s because there was no coverage of fiscal policy. So I went to the IMF’s website to look at the new World Economic Outlook.

In that document, there is some discussion of fiscal policy, but it is entirely focused on the symptom of debt rather than the underlying problem of excessive spending.

And if you look at the IMF’s just-released Fiscal Monitor, you will also find a myopic fixation about debt…but also a reflexive support for higher taxes.

Key elements of fiscal adjustment vary across countries. Advanced economies should…increase revenues through indirect taxes where taxation is low, and remove inefficient tax incentives. Emerging market and developing economies have greater potential to increase tax revenues by upgrading tax systems; broadening tax bases, including by reducing informality; and enhancing revenue administration capacity.

To be fair, the Fiscal Monitor also includes language about “entitlement reforms” and “expenditure controls,” but past experience has shown that IMF fiscal interventions lead to permanent tax increases and fake (or rapidly evaporating) spending restraint.

The bottom line is that tax increases enable more spending while simultaneously dampening growth. All of which explains why higher taxes inevitably produce more red ink.

I imagine the economists working at the IMF understand that higher taxes will backfire, but the political appointees who run the IMF care about pleasing politicians rather than promoting good policy.

No comments:

Post a Comment