October 21, 2024 by Dan Mitchell @ International Liberty

In April of 2023, I wrote about the fact that there is more spending and more debt in the PIGS (Portugal, Italy, Greece, and Spain) compared to levels before the last European fiscal crisis.

In December of 2023, I wrote about the growing burden of spending and debt in all European nations.

Today is Part III in this series. We’re going to look at which European Union nations face the greatest fiscal challenges.

From an economic perspective, the best way of measuring fiscal challenges is simply looking at some mix of the current spending burden and the future spending burden (which is driven by a combination of demographics and program design). After all, spending is the problem, whether it is financed by taxes, borrowing, or money printing.

That being said, others generally focus on deficits and debt. So it is quite common to see analysis that is based on fiscal imbalances.

My role is to then dig into that type of data to find out what it actually means.

For instance, a Brussels-based think tank, Bruegel, has a new report looking at fiscal policy for European Union countries.

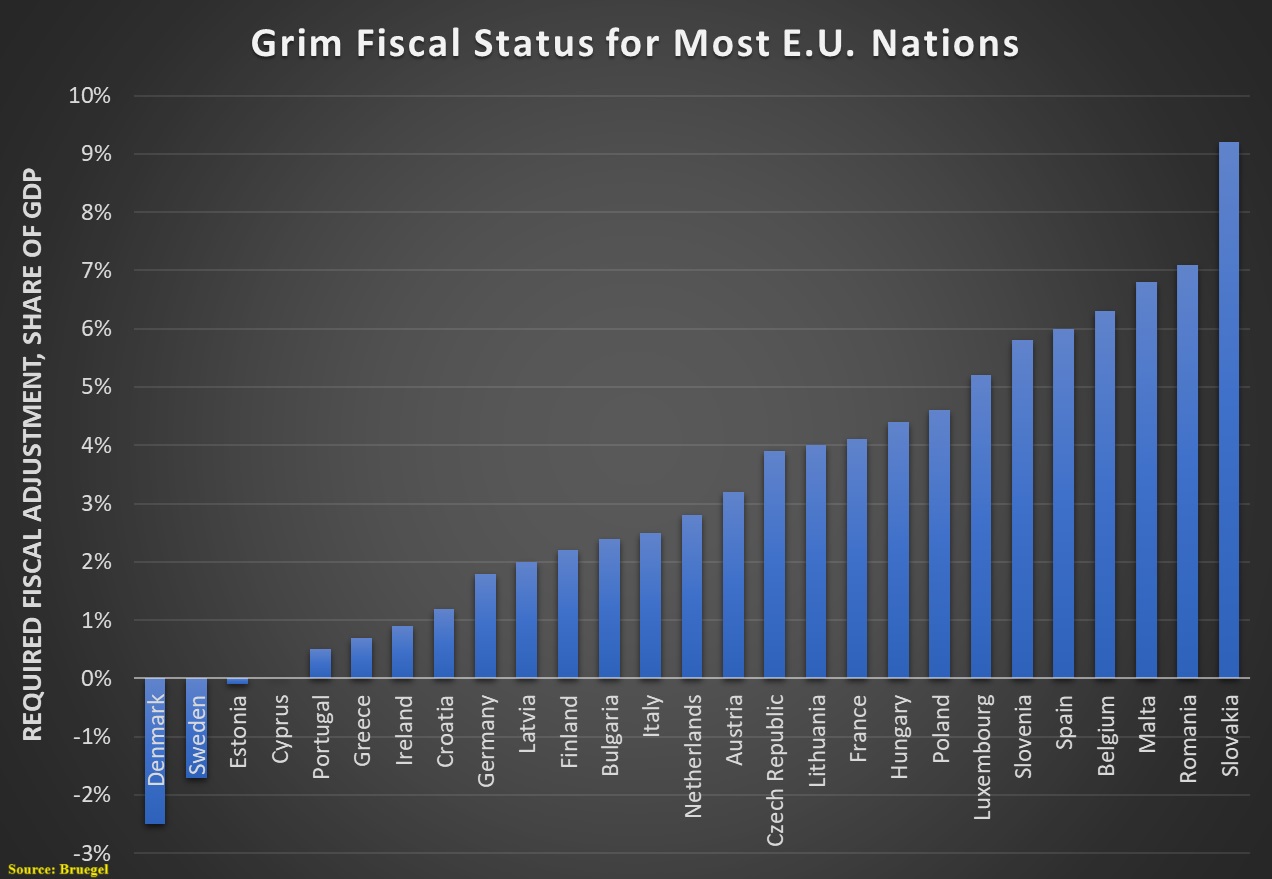

Here’s a chart I created, based in the last column from Table 2 in the report. It shows the amount of fiscal adjustment needed to comply with the European Union’s fiscal rules. At the risk of stating the obvious, it’s good to be on the left side and bad to be on the right side.

I would have preferred if the report focused on spending, but nonetheless it contains a lot of useful information.

Here’s my two cents on the big takeaways.

- Nations with fully or partially privatized Social Security systems (Denmark, Sweden, Estonia, Greece, and the Netherlands) tend to be in better shape.

- Nations with a track record of “populist” governments (Hungary, Poland, Slovenia, and Slovakia) tend to be in worse shape.

The common theme is that these two points involve spending. To elaborate, Social Security reform leads to a smaller spending burden, particularly in the long run, and populist politicians can’t resist squandering taxpayer money as they seek to buy votes.

In other words, the problem in the European Union is spending and the solution is spending restraint.

If you want more conventional analysis, here are some relevant excerpts from the Bruegel report.

Population ageing is putting pressure on the public debt-to-GDP ratios of European Union countries, both by raising net public expenditures and by lowering potential growth. To keep debt ratios under control and to comply with EU fiscal rules, EU countries will need to run sufficiently high structural primary balances – the difference between non-cyclical revenue and non-interest spending.

Because the EU’s fiscal rules require countries to anticipate and offset the fiscal costs of ageing during the adjustment period and in the 10 years beyond, the impact of ageing on overall fiscal indicators, such as the structural primary balance, will be felt mostly during the initial four-to-seven-year adjustment period that begins in 2025. …However, in countries in which fiscal ageing costs are rising…fiscal adjustment in the nonageing portion of the budget needs to continue…

Unless ageing cost can be brought under control, this would require the re-allocation of expenditure from non-ageing to ageing-related items, or further increases in taxation. This creates difficult adjustment choices for many EU countries. … there are major differences in EU countries’ adjustment requirements, driven by substantial differences in initial fiscal positions and in projected ageing costs. …by 2052, the sum of required unadjusted structural primary balances and the required adjustment in the non-ageing budget will amount to over 4 percent of GDP for six countries and above 3 percent of GDP for another five countries.

I’ll close by observing that the fiscal rules in the European Union are better than nothing, but they are misguided in that they seek to control deficits and debt.

The European Union should copy Switzerland and have fiscal rules that limit spending growth (as the German government recently recommended).

No comments:

Post a Comment