October 19, 2024 by Dan Mitchell @ International Liberty

What nation has the world’s best tax policy?

There are relatively straightforward ways of answering that question, such as looking at the places (Cayman Islands, Bermuda, Monaco, etc) with no income tax.

|

But what about picking the nation with the best pension system?

Nobody has ever tried to answer that question from a libertarian perspective. So when the Fraser Institute asked me to write a chapter for this year’s Economic Freedom of the World, I jumped at the opportunity to develop a methodology and then grade a sample of 20 nations.

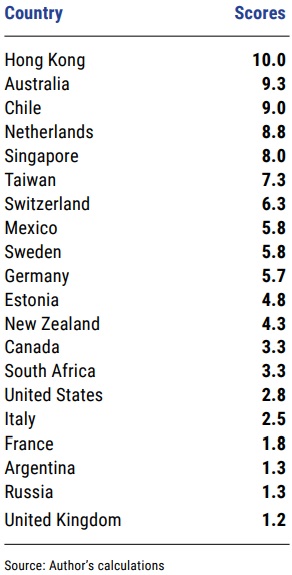

For readers who have faith in my analytical skills, I’ll lead with the headline results. As you can see, Hong Kong has the best system, followed by Australia and Chile.

None of those results are surprising, but how many people know that the Netherlands has a very good system? Or that Mexico has a decent approach?

Sadly, the United States is toward the bottom, though fortunately not in last place (interestingly, European nations generally score better than America).

So how did I put together this ranking? I open the chapter by explaining the problem and also what I wanted to accomplish.

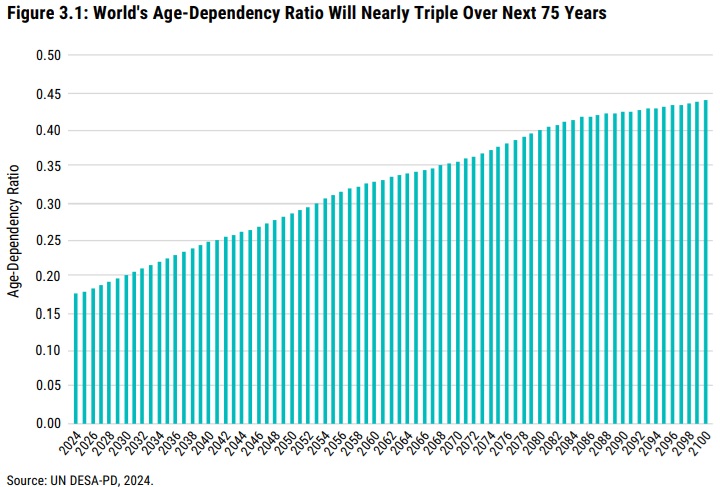

Because of aging populations and falling birth rates, public pensions are an increasingly important policy issue. Most governments have some type of tax-and-transfer system, with payments to the elderly being financed by levies on workers. Such systems are mathematically feasible when there are lots of young people and relatively few retirees. But increasing lifespans and falling birthrates have changed that equation. As a result, many nations will soon face significant fiscal imbalances. Simply stated, current rates will not generate nearly enough revenue in the future to finance promised benefits.

Countries that figure out the best way of navigating this challenge will enjoy better economic outcomes compared to nations that either make bad policy choices or “kick the can down the road” and allow problems to fester. This chapter will analyze Social Security/pension-related systems, consider the costs and benefits of various policy options, and conclude by investigating the challenges of incorporating pension systems into the index published in the Economic Freedom of the World.

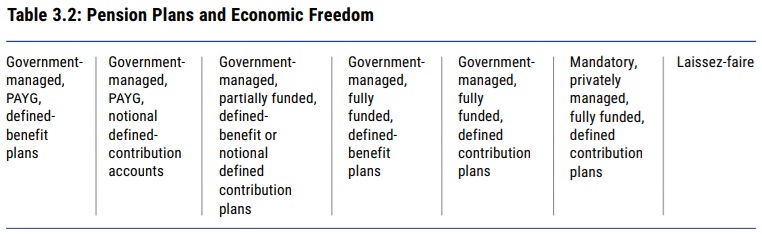

If you want a shortcut explanation of my methodology, here’s the pension spectrum I developed.

It shows different types of social Security systems, with the most statist approach on the left and the best approach is on the right, with various intermediate steps in the middle.

Here’s some of what I wrote about that methodology.

…a pure laissez-faire approach is the policy that maximizes economic freedom and thus would merit a perfect score. However, it seems that no nation is in this category. From a practical perspective, this means constructing a scoring system is an exercise in ranking options that range from second best to terrible. On this basis, the default option for the best score would then go to nations with retirement systems based on mandatory private savings. But there are many secondary questions that have to be answered. …A better score for nations that allow private management of investment rather than government control. …A better score for nations that choose defined contribution accounts rather than defined benefit accounts.

By the way, the chapter begins with an explanation of why we should care about pensions and Social Security. Since I’ve written on those issues many times, no need to belabor that point.

So I’ll simply share this chart showing the dramatic change in the age-dependency ratio between now and the end of the century.

The bottom line is that America’s Social Security – and systems in other nations that also are based on the pay-as-you-go approach – are doomed.

The nations that figure out how to navigate the shift to a better system will be in a much stronger position than the ones that try to prop up government-run systems.

No comments:

Post a Comment