July 2, 2024 by Dan Mitchell @ International Liberty

I wrote yesterday about a strange quirk in the Dutch tax system. That country (which is quite sensible on issues such as personal retirement accounts and school choice) has a very odd way of double taxing income that is saved and invested.

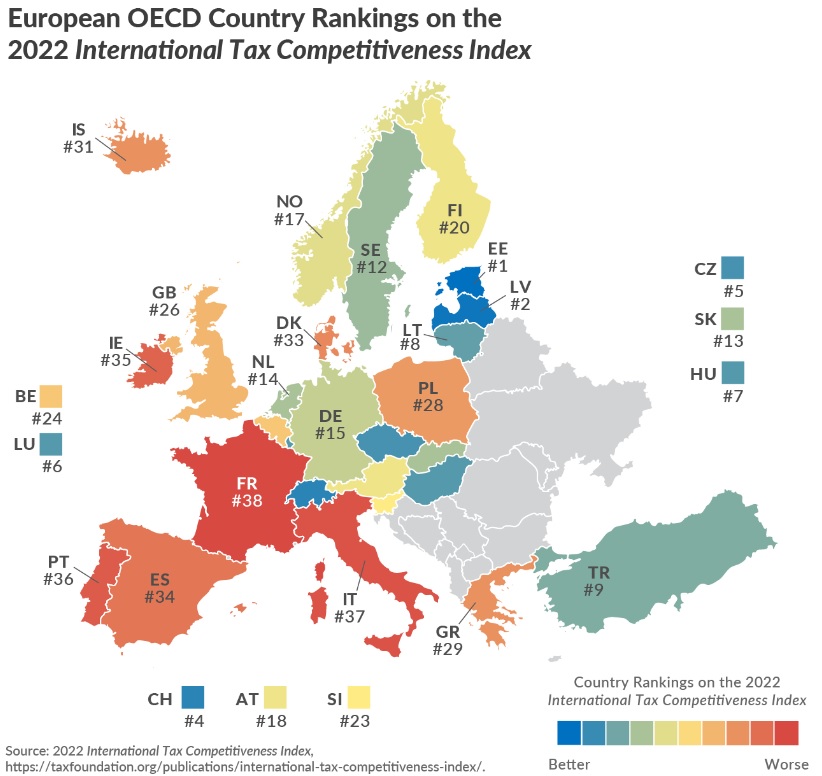

Today, we’re going to leave the Netherlands, travel through Belgium, and visit the country that arguably has the developed world’s worst tax system. Yes, I’m referring to France (though I’m open to the argument that Italy might rank even lower). Though, as I’ve warned before, never underestimate the ability of French politicians to take a bad situation and make it even worse. And that may be about to happen. Alan Katz reports for Bloomberg that the French left wants a 90 percent tax rate on successful taxpayers.

I’m not joking. Here are some excerpts.

France’s leftist alliance would raise the top marginal income tax rate to 90% if it were to take over the government following legislative elections that run through July 7. …the plan was previously in the program of his far-left France Unbowed party. In a budget amendment proposed in 2019, the top rate would apply on taxable income over €411,683 ($440,213). The income tax rate in France currently tops out at 45% on income over €177,106. …

The last time a government tried…a top income tax rate anywhere close to the level proposed by Coquerel…a 75% rate…paid by companies on salaries of more than €1 million. The tax…expired at the end of 2014. …the leftist alliance unveiled its plans…a vast increase in taxation and public spending…and reverse Macron’s pension reform.

So what’s the likelihood of these awful ideas being translated into policy? Based on the first round of the French legislative elections (which took place on Sunday), the likelihood of something bad has increased. That’s because President Macron’s party (which favors the status quo) suffered a a major setback while the hard left and populist right gained ground.

The populist right won the most votes, but that hardly matters since they are not fans of limited government. Indeed, the Economist has an article explaining that the two groups have disturbingly similar plans to expand the fiscal burden of government.

Both blocs’ agendas are “dangerous for the economy”, according to Patrick Martin, the head of MEDEF, a business federation. …On the hard right, Marine Le Pen’s total yearly net spending promises when she ran for president in 2022 amounted to…the equivalent of about 3.5% of GDP. …promises to strike down Mr Macron’s pension reform, which raised the legal minimum retirement age from 62 years to 64… The RN also wants to restore the wealth tax…

The left-wing alliance, dominated by Unsubmissive France, the party of…a one-time Trotskyist, has even more ambitious tax-and-spending plans. …striking down Mr Macron’s pension reform, reintroducing the wealth tax, bringing in an “exit tax” for those leaving the country, scrapping France’s 30% flat tax on financial income, increasing inheritance tax and imposing a tax on “super profits”, whatever they mean by those.

We won’t know the composition of the legislature until the second and final round of the election, which will happen on July 7. But it’s clear that the two statist blocs will control the vast majority of seats.

|

However, this doesn’t mean bad policy is a foregone conclusion. My fingers are crossed that they spend so much time fighting each other over issues such as crime and immigration that they forget that they are united in favor of higher taxes and more spending.

The bottom line is that the French public sector already is excessive. Making it an even bigger burden will accelerate the country’s almost-sure-to-happen economic crisis.

P.S. French politics are so absurd that I was only half-joking in 2012 and 2017 when I wrote that voters should pick the socialist over the socialist (and I similarly noted that the socialist beat the socialist in 2022).

P.P.S. In fairness to the current president, at least he has been semi-rational about pension reform (though his policy on wine leaves something to be desired).

P.P.P.S. If the top tax rate on households gets anywhere close to 90 percent and the wealth tax is restored, the combined burden will exceed 100 percent for some taxpayers. A (not-so) grand French tradition.

No comments:

Post a Comment