I wrote a couple of days ago about the possibility of confiscatory taxes in France and whether that would lead to an exodus of upper-income taxpayer.

Since that’s happened before, it’s very realistic to think it will happen again.

Now let’s cross the English Channel and investigate how the Labour Party also is pushing for policies that will cause an exodus of successful people.

Only instead of higher tax burdens on all rich people, the new Labour government is targeting “non-doms,” which is the shorthand term for non-domiciled residents (high-net-worth people who lived elsewhere and decided to move to the United Kingdom).

Under current law, non-doms don’t pay tax on income that is earned in other countries so long as the money isn’t remitted to the United Kingdom.

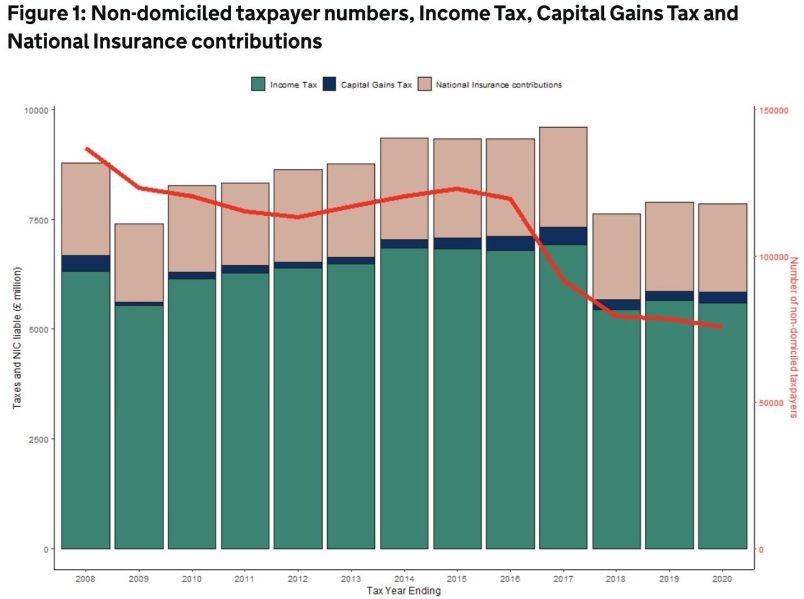

This policy has been very successful in attracting rich people from all over the world. And one of the most important things to understand – as shown by this chart – is that government collects a lot of money because of non-doms.

The chart comes from a 2022 article in CapX by Callum Price. Here are some excerpts.

Non-domiciled status is not some new tax wheeze. It has been around some 200 years, since it was used to protect colonial investments in in the days of the British Empire. It essentially means someone doesn’t have to pay tax on earnings they make outside the UK, unless those earnings are remitted to the UK…

Effectively, non-dom status just prevents someone being taxed twice, once by the country in which they are domiciled and again the country they reside in… By letting wealthy people move here without having to pay double taxes on their earnings from another country, Britain becomes a more attractive destination for high-net-worth individuals. That in turns brings some significant benefits. …

F rstly, for the Treasury… And given that non-dom status invariably applies to rich international business people, those tax receipts are significant. …we want to attract the best and brightest from around the world and the non-dom arrangements are a part of making Britain an attractive place for talent from around the world to come and bring their expertise, and spend their money, on these shores.

In April of this year, Mattie Brignal wrote an article for the Telegraph about the likely impact of a big tax hike on non-doms.

Wealthy foreigners are being told to “get out while they still can” after Labour announced plans to toughen up a Tory crackdown on non-doms. …high-end tax and wealth advisers warned the raid will be “devastating” for rich foreigners, forcing them to flee abroad and take their wealth with them. …Jon Elphick, international tax adviser at Mark Davies & Associates, said…“This will be a dealmaker for moving abroad, especially ultra-high net worth clients who would be paying a lot of tax.

There’s now a big risk they relocate.” …The Office for Budget Responsibility, the official forecaster, expects 10pc to 20pc of non-doms to leave the UK because of the tax raid, but in reality that figure could be even higher. …Mr Elphick added: “One Israeli client last week said they had had enough of how the tax system had changed and as a result will move, probably to Monaco, Switzerland or Dubai.

Notice, by the way, that the Conservative Party (Tories) also were bad on the issue. They became big spenders and sooner or later that leads to bad tax policy.

But let’s not digress. What matters if that politicians are threatening a big tax increase on people who bring a lot of wealth to the United Kingdom.

Defenders of the new Labour plan claim that non-doms are bluffing and that most of them will stay and pay more tax.

So let’s look at a July 19 article in Reuters by Sinead Cruise. As you can see from these passages, it seems like some of the golden geese are indeed flying away.

For ultra-wealthy entrepreneur Bassim Haidar, living in London has become an expensive indulgence he can no longer justify. While new British Prime Minister Keir Starmer settles into No. 10 Downing St, Haidar is searching for homes in Greece and Monaco, because a proposed inheritance tax revamp will make Britain a ‘no go’ zone for the rich, he says. …

Haidar says the proposed changes could harm the economy if international business owners choose to quit Britain, or avoid moving here, undermining its reputation… Investment firms, wealth managers and private bankers who provide financial services to around 70,000 UK-based individuals with ‘non-dom’ status are on high alert for when the historic tax overhaul might begin. …Britain is likely to lose nearly one in six of its U.S. dollar millionaires by 2028, according to the UBS Global Wealth Report for 2024 published earlier this month. …

David Lesperance, managing director of tax adviser Lesperance & Associates, told Reuters the government should not underestimate the ease and pace at which wealthy families could quit the UK, and how countries like Dubai and Singapore were striving to attract them. …”Wealth does not stay still anymore. It doesn’t have to. The golden geese have wings and they will fly,” he said.

I’ll close with three points.

First, this tax will have substantial Laffer Curve effects because rich people have significant ability to change their behavior (including their residence). It may still raise revenue, but the amount of revenue will be modest compared to the loss for the British economy.

Second, we have evidence to support my concerns. A tax raid on non-doms in the 2000s caused many of them to flee and the government may have suffered a net revenue loss.

Third, some people make a compelling argument that it’s not fair to exempt non-doms from tax on the income they earn in other countries when regular citizens are subject to such extraterritorial taxes. But the way to make things equal is by getting rid of worldwide taxation for everyone (the U.S doesn’t have a non-dom policy, but we also should get rid of worldwide taxation).

P.S. Greece and Italy have policies to attract well-to-do foreigners, so they’ll likely benefit from the U.K.’s mistake. As will Monaco, Switzerland, and other sensible jurisdictions.

No comments:

Post a Comment