July 18, 2024 by Dan Mitchell @ International Liberty

I’ve been writing about China this week (see here and here) because I’m teaching economics at Northeastern University in Shenyang.

But, regardless of my location, I probably would be writing about China this week anyhow because the country’s leadership has been having high-level meetings to address the problem of slowing growth.

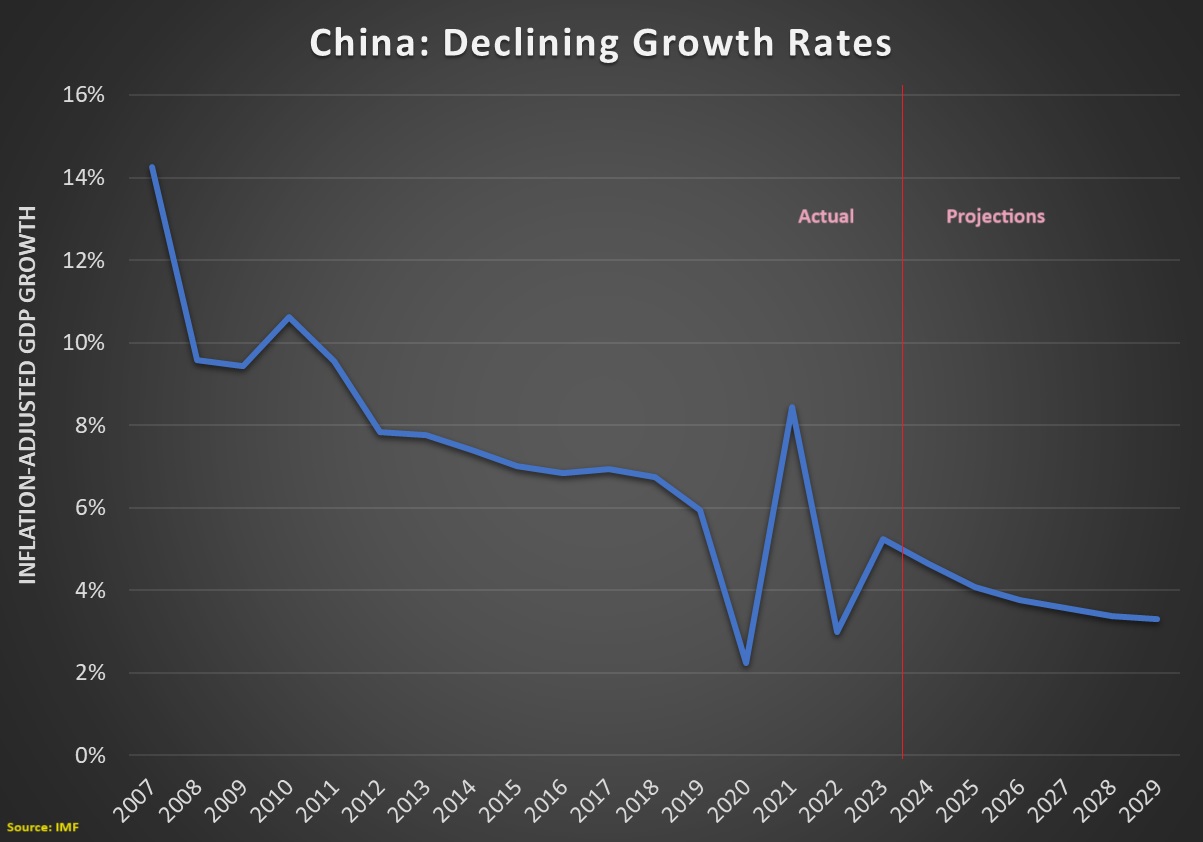

To give you a sense of what’s happening, here’s the IMF data showing actual and projected growth rates from 2007-2029.

Not a pretty picture.

To put this data in context, let’s consider some good news and bad news.

- The good news is that China has enjoyed some dramatic growth since liberalizing its economy starting about 40 years ago.

- The bad news is that a lot more growth is needed for China to catch up to nations in North America and Western Europe.

Let’s review some reports and analyses of China’s current outlook.

We’ll start with some passages from Simone McCarthy’s article for CNN.

…top officials from China’s ruling Communist Party are gathering in Beijing this week to signal the direction forward for the world’s second largest economy as it faces major economic challenges and friction with the West. Stakes are high for the meeting, which takes place every five years and is known as China’s third plenum. …China is grappling with a property sector crisis, high local government debt and…flagging investor confidence… Economic problems on the back of years of stringent pandemic controls have triggered mounting social frustration, as well as questions about the direction of the country… About 200 members of the party’s Central Committee leadership body as well as 170 alternate committee members are gathering in Beijing to approve a document laying out a plan on “deepening reform” and advancing “Chinese-style modernization,” according to state media. …Observers will be watching for fiscal reforms, especially around taxation and government spending… Many also say the government should take steps to…expand social safety nets in a country grappling with high medical costs and a rapidly aging population.

For what it’s worth, it’s ludicrous to think an expanded safety net will boost China’s economic performance.

But let’s set that issue aside and look at another article.

Here are some excerpts from a report in the Economist.

Ever since China’s housing slump began in the middle of 2021, economists have worried that the world’s second-biggest economy might follow in the footsteps of Japan, which suffered a lost two decades… China’s retail sales…grew by only 2% in nominal terms in June, compared with a year earlier. Vehicle sales shrank by more than 6%. The slump in property rumbles on. …Could policy signals from the third plenum come to the rescue? Although the meeting, which takes place only twice a decade, is supposed to be about long-term reform not short-term stimulus, the distinction between the two is not absolute. …some structural reforms could make China’s cyclical problems worse. Local governments, for example, need new sources of revenue to replace dwindling proceeds from selling land. One answer is an annual tax on the value of property. But introducing such a tax now would seem perverse in the midst of a property slump. Another proposal discussed in recent months is expanding China’s consumption tax, which falls mainly on luxuries, like jewellery and cars, and sinful goods, like booze and cigars. Again, expanding the consumption tax would only further depress weak retail sales.

Just like more social welfare spending would be a bad idea, higher taxes also would be misguided.

But analyzing policy is not the purpose of today’s column.

Instead, we want to understand the extent to which China needs economic rejuvenation.

Regarding that question, Desmond Lachman of the American Enterprise Institute has the most pessimistic perspective.

Chinese economic growth has slowed…the Chinese economy is in deep trouble and that its economic growth model is now well past its sell-by date. Unless the Chinese government introduces major structural economic reforms…, China could experience a Japanese-style lost economic decade. …The root cause of China’s present economic problems is the highly unbalanced economic model that it has pursued over the past 30 years. Not only did China excessively rely on investment in general and on housing investment in particular to drive economic growth. It also became overly dependent on exports… There is now the clearest of evidence that China’s housing and credit market bubble has burst. House prices have now been declining for the past year, an estimated 65 million housing units are unoccupied, a host of large property developers, including Evergrande, have defaulted on their loans, and many housing projects have been abandoned. …All of this puts the Chinese government in an unenviable position to deal with the bursting of the country’s epic housing and credit market bubble. It knows that flooding the market with increased liquidity and resorting to fiscal pump priming will only add to the country’s long-term debt problem.

The takeaway from these three articles is that there are reasons to be concerned about China’s economic policy and economic outlook. Chinese policy makers realize that changes are needed and most external observers have the same perspective.

However, based on what’s being mentioned in the articles (an IMF-style mix of higher spending and higher taxes), I am not overly optimistic that concerns will lead to better public policy.

Tomorrow’s column will focus on the agenda that China needs to restore rapid growth and converge with the world’s rich nation.

No comments:

Post a Comment