I have repeatedly defended the national sales tax for the simple reason that it has the same desirable attributes as a flat tax.

- The tax rate is low.

- There is no double taxation.

- There are no loopholes.

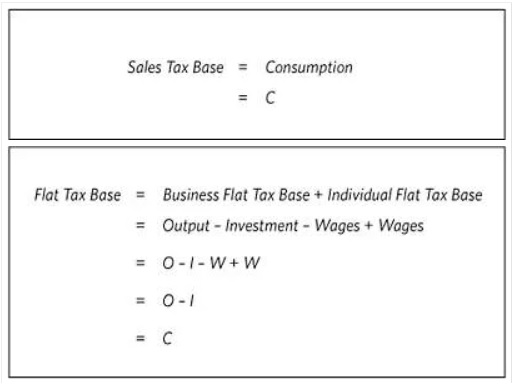

Indeed, the flat tax and a national sales tax (such as the Fair Tax) are basically different sides of the same coin.

The only big difference is the collection point. A flat tax takes a piece of your income as you earn it while a national sales tax grabs a piece of your income as you spend it.

Using the jargon of public-finance economists, both the flat tax and national sales tax are “consumption base” systems.

But that does not mean a tax that is collected at the cash register. Instead, it simply means a system where there is no double taxation of saving and investment (i.e., a system where all saving and investment receives IRA/401(k)-type protection).

But just because two tax plans are economically similar does not mean that they have the same political appeal.

Over the past few decades, I’ve explained to many politicians the best arguments for both the flat tax and national sales tax. I’ve also warned them about the most likely attacks and how to respond.

Suffice to say that it’s much easier to sell the flat tax and defend it from demagoguery (usually revolving around class warfare or itemized deductions).

Which is why some pro-tax reform folks are trying to discourage House Republicans from supporting the Fair Tax.

Here are excerpts from a Wall Street Journal editorial.

House Republicans may be…set to vote on a national sales tax that won’t become law but will give Democrats a potent campaign issue. The plan is called the Fair Tax and its premise is simple: Replace every existing federal tax with a new national tax on sales. …the true rate would be about 30%. The Fair Tax rate would be on top of state sales taxes. …It would also eliminate the Internal Revenue Service, but…replace it with a new Sales Tax Bureau and Excise Tax Bureau. …The Fair Tax is based on the reasonable theory that levies on consumption distort the economy less than our current taxes on work and investment. Killing the income tax also sounds good until you realize that a future Congress could restore it if the Constitution’s 16th Amendment isn’t repealed. …The point is that a consumption tax might make sense if Congress were writing the tax code from scratch. But it isn’t, and we could end up with both a national income and sales tax, the later of which could evolve over time into a value-added tax. …the Fair Tax has hurt GOP candidates before. When tea party Republicans ran on the idea in 2010, Democratic groups ran ads that blasted the sales tax… Few voters listen to a second sentence after they hear about a 30% tax on everything they buy.

Opining for National Review, Ramesh Ponnuru is even more critical.

Any House Republican who backs this bill can accurately be accused of voting for the following things: raising the price of everything by a huge amount at a time when inflation is already high; shifting more of the tax burden to the middle class; instituting a large new wealth tax on senior citizens; increasing federal spending by a massive amount; increasing the deficit; and creating large black markets. …FairTax supporters have answers for most of these charges. They are not…persuasive answers. But even if they were right, Republicans who vote for the bill would be taking on a formidable amount of defensive work. Those in competitive seats, especially, should know what they are getting themselves into.

Last but not least, Grover Norquist of Americans for Tax Reform argues against the Fair Tax in an article for the Atlantic.

The bill proposes to abolish the Internal Revenue Service and eliminate the federal income tax. So far, so good. Unfortunately, the bill would replace the income tax with a 30 percent national sales tax on all goods and services and establish a giant new entitlement program. …Under the bill’s plan, all households would receive a monthly check from the federal government regardless of earned income. …In all but name, in fact, the Fair Tax’s “prebate” system would establish a universal basic income, one of the left’s favorite policies. …Fair Tax proponents make two good points. They understand the need to end the double taxation of savings and investment in the present system, and they want to depoliticize the IRS workforce… None of this has stopped Democrats from seizing the opportunity to claim that Republicans now want to raise taxes on the poor and middle class. …the Fair Tax Act has a long record of proving politically toxic.

P.S. While I recognize that a national sales tax has political vulnerabilities, I actually think its biggest problem is the risk that politicians would not actually get rid of the income tax. Or, maybe they would get rid of the income tax, but then reinstate that awful levy after a few years. This is why, in this video, I explain that a national sales tax only should be considered after the 16th Amendment is repealed and replaced with something that unambiguously prohibits the income tax from ever again plaguing the nation.

No comments:

Post a Comment