By Rich Kozlovich

I receive a lot of information from a lot of sources and, truth be told, I get overwhelmed far more than I like. I've been purging my e-mail notices and my draft files, but I'm trying to do it in such a way the information isn't lost by either incorporating the pieces in one of my own commentaries, or listing them as I'm doing below with Dan Mitchell's articles.

For some years I've been publishing articles by Dan Mitchell, and he's absolutely prolific, he's a libertarian, and as a result, as much as I admire his work, I wonder at times what planet libertarians are from, as a result, I find I'm in total disagreement with some of the things he espouses, and don't publish those.

His articles are complicated to duplicate, and permission to publish his work came with caveats, which I follow. So, while I've published a lot of his articles, for whatever reason, I've failed to publish these listed below. Any gaps in chronology are because those are the ones I published. I've decided to go more the way of links versus full publication from now on.

There's a lot of good stuff here, I especially like the Bernie Sanders piece, which is presented in full, and why I didn't publish that one I will never know. Bernie is a gift that keeps on giving.

So, take you time, peruse what's here and ..... enjoy!

More Evidence of State Tax Progress, February 21, 2023 by Dan Mitchell - It usually is not fun writing about public policy, given my libertarian sentiments. After all, politicians have a natural tendency to expand their powers and diminish our liberties. So where there is occasional good news, I like to relish the moment. For instance, I’ve been getting immense enjoyment from the progress on school choice over the past couple of years. Particularly the enactment of state-wide choice programs in West Virginia, Arizona, Iowa, and Utah. Another area were we’ve seen big progress is state tax rates. I’ve also written about that topic, showing earlier this month how average top personal income tax rates have declined in recent years. Today, let’s let a couple of maps tell the same story. Here’s the Tax Foundation’s new map showing top personal tax rates for 2023. At the risk of stating the obvious, it’s best to be grey. But if you’re not grey, it’s good to be a lighter color and bad to be a darker color..........

Lessons from the Texas Budget, February 20, 2023 by Dan Mitchell - I shared some data last month from the National Association of State Budget Officers to show that Texas lawmakers have been more fiscally responsible than California lawmakers over the past couple of years. California politicians were more profligate in 2021 when politicians in Washington were sending lots of money to states because of the pandemic. And California politicians also increased spending faster in 2022 when conditions (sort of) returned to normal. These results are not a surprise given California’s reputation for profligacy. What may be a surprise, however, is that (relative) frugality in Texas has only existed for a handful of years. Here are some excerpts from a report written for the Texas Public Policy Foundation by Vance Ginn and Daniel Sánchez-Piñol............

The IMF’s Dirigiste Tax Agenda, Part II, February 19, 2023 by Dan Mitchell - Yesterday’s column reviewed a new report from the International Monetary Fund and criticized that bureaucracy for celebrating how the world’s most-powerful governments are going to take more money from the private sector thanks to a corporate tax cartel. But that’s not the worst part of the IMF document. The report also asserts that low-income countries (LICs) can grow faster if they increase their fiscal burdens. This is not April Fool’s Day. I’m not joking. The bureaucrats at the IMF apparently want readers to believe that higher taxes and more spending are a route to prosperity. Let’s look at some excerpts from the report, which was authored by Ruud de Mooij, Alexander Klemm, and Christophe Waerzeggers...........

Should America Copy Estonia’s Pro-Growth Flat Tax?, February 17, 2023 by Dan Mitchell - he Baltic nation of Estonia is an improbable success. After breaking free from the horror of Soviet communism, leaders adopted pro-market reforms.

- Including a low-rate flat tax for households.

- Including a pro-growth tax system for companies.

- Including widespread economic deregulation.

- Including periodic episodes of spending restraint.

Is Estonia a laissez-faire paradise? No. But it ranks #8 in the world for economic liberty. And having decent policy means poverty has plummeted and it has been quickly closing the gap with European nations that did not suffer from decades of communist enslavement................

- Social Security’s long-run deficit is now $56 trillion rather than $24.9 trillion as was the case back in 2008.

- Social Security payroll taxes now apply to income up to $162K rather than $102K as was the case back in 2008.

Some politicians want to get rid of the limit (the “wage base cap”) on the amount of taxes workers must pay. Instead of applying the 12.4 percent Social Security payroll tax on the first $162,000 of income, they want to impose the tax on all income. In some cases, they want this big increase in marginal tax rates in order to prop up the Social Security system while in other cases they actually want to expand the program. In either case, the economic consequences would be very bad.............

The Most Uplifting Chart (so far) of 2023, February 2, 2023 by Dan Mitchell - I wrote in both 2021 and 2022 about states enacting lower tax rates. And that includes several states (Iowa, Idaho, Arizona) adopting flat taxes. Today, let’s quantify these developments. Our friends at the Tax Foundation just published a chart showing how top tax rates at the state level have declined since 2010.*......

Bernie Sanders Humor February 1, 2023 by Dan Mitchell

I’m going to start today’s column by admitting that I lied. That might be expected since much of my work takes place in the sleazy environment of Washington, DC.

But my lie was innocent. Back in 2020, when he was defeated by Joe Biden for the Democratic presidential nomination, I wrote what I thought would be a “Farewell-and-Good-Riddance Edition of Bernie Sanders Humor.”

I figured there would no longer be a need to mock Crazy Bernie (or is he Evil Bernie?).

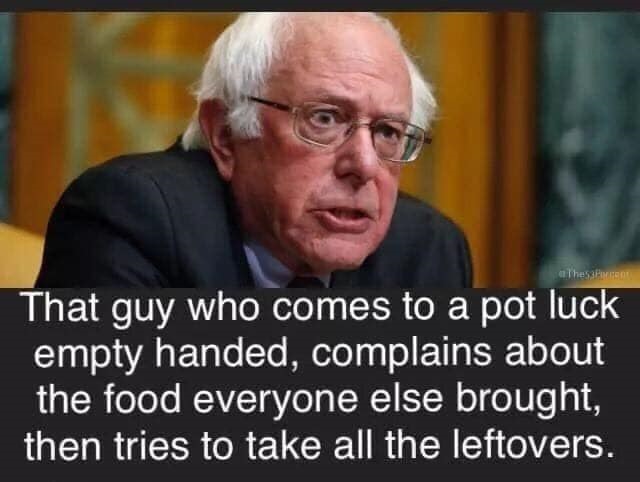

But then I saw this tweet, highlighting how gullible idiots are being charged as much as $95 to attend Bernie’s lecture about the supposed evils of capitalism. And it included this amusing meme.

I don’t know if Bernie’s the one reaping the profits from this scam. But since he owns three homes and is part of the top-1 percent, I wouldn’t be surprised (sort of like this cartoon).

And since we’re kicking around Bernie one more time (or is this truly the last time?), here are a few other items.

Mao probably killed more people than anybody else in world history, so he’s definitely evil, whereas we can laugh our you-know-whats-off about Bernie.

(By the way, if we’re measuring evil by the percentage of the population that was butchered, than the communist dictator of Cambodia was worse than Mao.)

For our third item, the Babylon Bee put together an entirely plausible Bernie Sanders anti-poverty plan.

I am once again asking for your support in eradicating systemic poverty from the face of the earth. America can do it, but we won’t because America is immoral and Elon Musk has all the money. Horrible! I have a simple ten-step plan that is foolproof — and I should know because I’ve been to the Soviet Union and it’s a paradise over there, let me tell you!

The article lists 10 reasons, but 2-6 were the best in my opinion.

2. Tax rich people until they’re poor: If everyone is poor then no one will be.

3. Give everyone money until they become middle class: We cannot rest until Tom Hanks and John Doe are shopping at the same grocery store. Then maybe I can get an autograph.

4. Drop Elon Musk off the Empire State Building: This is how we win, America!

5. Print more money: Unexpected expenses can be paid for with a giant savings account everyone can access. The beauty of it is that if it’s overdrawn we can just print more money! Why haven’t we done this yet.

6. Offload our health care to Cuba: Sailing to Cuba for treatment will also build muscle, making you healthier overall! Is there anything Cuba can’t do?

This next one is basically a different version of a meme I shared in 2019.

As usual, I save the best for last. Here we have Bernie showing the socialist philosophy at a pot-luck dinner.

All take and no give. Sort of the mealtime version of this classic cartoon.

I’ll close by noting we mock Crazy Bernie for his overt hurry-up socialism. Well, the incremental version isn’t much better since you eventually wind up in the same bad place.

Assessing North Carolina’s Fiscal Policy, January 30, 2023 by Dan Mitchell - When I first started citing the Tax Foundation’s State Business Tax Climate Index back in 2013, North Carolina was one of the 10 worst states. In a remarkable turnaround, North Carolina is now one of the 10 best states. The big improvement is partly because the state joined the flat tax club. But there were other tax cuts as well, along with some much-needed spending restraint. Sounds like great news, but you won’t be surprised to learn that not everyone is happy about what’s happened in the Tarheel State. In a column for the Raleigh News & Observer, Ned Barnett opined yesterday against tax cuts – both the ones that already have occurred and the new ones that the state legislature is considering.........

- Get rid of the capital gains tax

- Get rid of the double tax on dividends

- Get rid of the death tax

Does America Have an Under-Taxation Problem?, January 26, 2023 by Dan Mitchell - When leftists (or misguided rightists) tell me that Americans are under-taxed and that the government has lots of red ink because of insufficient revenue, I sometimes will direct them to the Office of Management and Budget’s Historical Tables in hopes of changing their minds. I’ll specifically ask them to look at the data in Table 1-3 so they can see what’s happened to federal tax revenue over time. As you can see from this chart, nominal tax revenues have skyrocketed.........

Long-Run Policy Lessons from the Coronavirus Pandemic, Part II, January 20, 2023 by Dan Mitchell - In mid-2021, I wrote about long-run policy lessons from the coronavirus pandemic. That column focused on insights from my five-part series (see here, here, here, here, and here) about the failure of big government. More specifically, the CDC and FDA did a terrible job domestically and the WHO did a terrible job internationally.............

Macron’s Pension Reform Is Necessary (but Inadequate), January 19, 2023 by Dan Mitchell -It is an understatement to declare that fiscal policy in France is terrible.

- The highest burden of government spending in Europe.

- The third-highest level of pension spending in the OECD.

- One of the biggest long-run fiscal gaps in OECD countries.

- The fourth-highest tax burden on workers in the OECD.

- The sixth-highest top tax rate among developed nations.

In recent years, France has had terrible presidents such as Nicolas Sarkozy and Francois Hollande..........

Statism, Captured in Five Images, January 14, 2023 by Dan Mitchell - After five columns mocking statism in 2021 (here, here, here, here, and here), I only produced one in 2022. So let’s get an early start for 2023. This cartoon is a helpful reminder that government has done many wonderful things throughout history.

The Solution to Maine’s Fiscal Problems – and a Lesson for the Entire Nation, January 12, 2023 by Dan Mitchell - When I write about fiscal policy, there are two ever-present themes.

- Bad tax policy reduces growth and competitiveness, driving away jobs, people, and investment.

- Bad spending policy occurs when budgets grow faster than the economy’s productive sector.

And both of these themes can be found in a comprehensive new report issued by the Maine Policy Institute..........

Control the Burden of Government Spending, January 4, 2023 by Dan Mitchell - As part of my annual “Hopes and Fears” column, a rejuvenated interest in spending restraint was at the top of my list. This clip from a recent interview summarizes the economic issues...........

- Tax-financed spending is bad for prosperity.

- Debt-financed spending is bad for prosperity.

- Monetary-financed spending is bad for prosperity.

And if you understand those three things, then you realize that the real problem is spending...........

Understanding Biden and Red Ink, December 29, 2022 by Dan Mitchell - I don’t worry much about budget deficits. Simply stated, it is far more important to focus on the overall burden of government spending. To be sure, it is not a good idea to have too much debt-financed spending. But it’s also not a good idea to have too much tax-financed spending. Or too much spending financed by printing money.Other people, however, do fixate on budget deficits. And I get drawn into those debates. For instance, I wrote back in July that Biden was spouting nonsense when he claimed credit for a lower 2022 deficit. But some people may have been skeptical since I cited numbers from Brian Riedl and he works at the right-of-Center Manhattan Institute............

America’s Most Depressing Chart, December 28, 2022 by Dan Mitchell - I periodically use a “most depressing” theme when writing about charts or tweets with grim data. I’ve done that with regional data and also looked at depressing data from specific countries. Today, we’re going to look at some “most depressing” information about the United States. Here’s a tweet from Yale Professor Alice Evans about labor force participation for working-age men in developed nations..............

China, Poland, and Divergence, December 27, 2022 by Dan Mitchell - I created the Anti-Convergence Club so I could have concrete examples of how more economic liberty translates into higher living standards. In effect, it’s the data-driven version of my Never-Answered Question. Yesterday, I provided another example of anti-convergence by comparing Australia, Switzerland, and the United Kingdom. Today, let’s look at Poland and China. This tweet from Professor Noah Smith shows that Poland was richer than China 30 years ago and – contrary to convergence theory – has become even richer over time.................

Convergence and Divergence for the United Kingdom, December 26, 2022 by Dan Mitchell - I’m a big believer in looking at long-run trends, particularly whether countries are experiencing convergence of divergence with regards to per-capita economic output. Poor nations normally should grow faster than rich nations, so we can learn a lot when we see exceptions to this rule based on several decades of data.

- Why does/did South Korea out-perform North Korea?

- Why does/did Chile out-perform Venezuela?

- Why does/did the United States out-perform Western Europe?

- Why does/did West Germany out-perform East Germany?

- Why does/did Hong Kong out-perform Cuba?

- Why does/did Taiwan out-perform China?

I think the answer to these questions is obvious, for what it’s worth. Today, let’s consider another example. Mike Bird of the U.K.-based Economist tweeted about how the United Kingdom is diverging from Australia...............

The Tradeoff Between Government Dependency and Self-Sufficiency, December 21, 2022 by Dan Mitchell

|

- A nation’s economic output is determined in part by the number of people gainfully employed.

- The share of working-age people with jobs may be more important than the unemployment rate.

- Worker compensation is determined by productivity and productivity is driven by investment.

- Government redistribution programs can make joblessness more attractive than employment.........To Read More....

No comments:

Post a Comment