The recipe for economic growth is not complicated. You can put it in very simple terms, as Adam Smith did a few hundred years ago.

Or you can develop and utilize data-heavy indexes like the ones published by the Fraser Institute and Heritage Foundation.

In either case, the result will be the same. If you want mass prosperity, there’s no substitute for limited government and free markets.

Given my interest in this topic, I was curious to read an article on boosting prosperity in the latest issue of the Economist.

But my curiosity turned to frustration because pro-market policies (the “Washington Consensus“) were viewed as an afterthought and the article instead focused on government planning (i.e., industrial policy).

By 2050 there will be a new crop of economic powers—if things go to plan. Narendra Modi, India’s prime minister, wants his country’s GDP per person to surpass the World Bank’s high-income threshold three years before then. Indonesia’s leaders reckon that they have until the mid-century mark…to catch up with rich countries.

…These…all have something in common: breathtaking ambition. …Very few countries have maintained such growth for five years, let alone for 30. Nor is there an obvious recipe for runaway growth. To boost prosperity, economists typically prescribe liberalising reforms of the sort that have been advanced…under the label of the “Washington consensus”.

…the three strategies employed by countries looking to get rich—leaping to high-tech manufacturing, exploiting the green transition and reinventing the entrepot—all represent gambles, and expensive ones at that. …a certain amount of state involvement in the process is inevitable, and that policymakers will have to pick some winners. Even so, governments are now intervening much more frequently.

Many have lost patience with the Washington consensus.

At the risk of understatement, the countries discussed in the article (India, Indonesia, Saudi Arabia, etc) will never become rich for the simple reason that they generally have bad economic policy.

And to the extent they waste taxpayer money trying to pick “winners,” their bad policies will become worse policies.

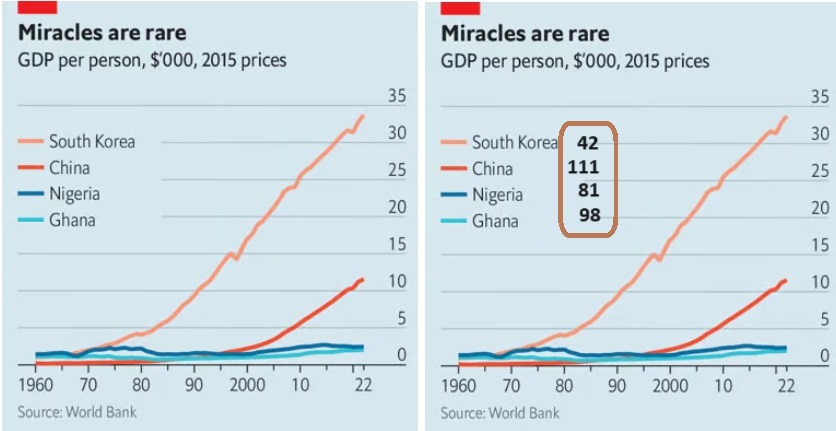

The article included a chart about rare growth miracles, but there were two big problems with the chart. First, there was no explanation of why South Korea grew faster than China, Nigeria, and Ghana. So I added the economic freedom rankings to show that South Korea has pro-market policies compared to the other nations.

My second concern is that I don’t view South Korea as a “growth miracle.”

Yes, it has done well compared to the other nations. And you could say it is a miracle compared to the disaster of North Korea.

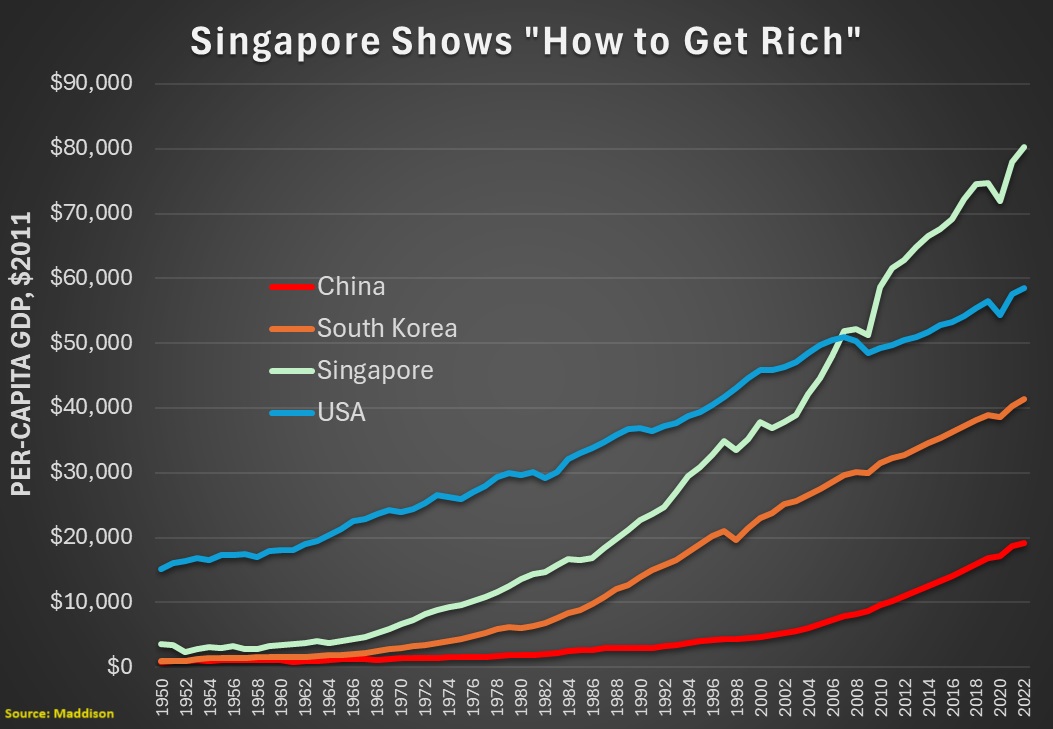

But the Economist should have used Singapore as their example of “how to get rich.” As you can from this chart, South Korea has enjoyed decent growth, but there’s very little chance it will ever catch the United States.

Singapore, by contrast, already has eclipsed the United States.

Singapore is the real “growth miracle.” And it is no coincidence that it also ranks #1 for economic freedom.

In other words, it is possible to avoid the “middle-income trap,” but it only happens rarely because politicians are not will willing to stand aside and let markets work.

No comments:

Post a Comment