What’s the most poorly governed city in the United States? Is it San Francisco, Detroit, New York City, Minneapolis, or Seattle?

How about none of the above. At least if we care about empirical research.

In 2019, I shared a study that put Riverside, California, in last place.

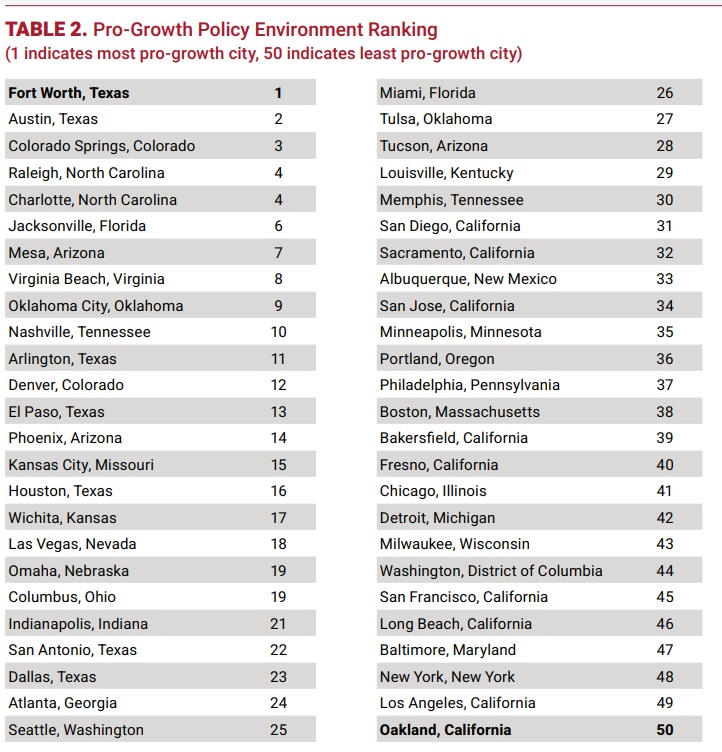

Last year, I shared a report that had Oakland, California, at the bottom.

I’m sure those must be places with terrible governance, but I’m surprised Chicago is not in last place.

It’s been in a downward spiral for years, and you can make a strong case that it has America’s worst mayor.

It also seems to be getting worse rather than better.

Here are some excerpts from a new editorial in the Wall Street Journal.

Chicago…hasn’t had a Republican mayor in nearly a century, making it a showcase for progressive governance. So how do Democrats explain its high crime, fiscal woes, and failing public schools? …The Chicago metro area’s unemployment rate, 6.2%, is the highest of any big city in the country…

Boeing and Citadel have fled. …The city budget has a $538 million hole, and there’s a $51 billion pension debt that siphons off municipal revenue. Chicago has a boat-mooring tax, a fountain-drink tax, a parking tax and an amusement tax, on top of a 10.25% combined state and local sales tax. Mr. Johnson has called for adding another $800 million in new levies. …Chicago schools are notoriously awful, and only 21% of 8th graders in 2022 were proficient in reading.

John Tillman makes similar points in a recent column for Fox News.

Every American should pay close attention to what’s happening in Chicago… Barely 12% of the city’s elementary school students are proficient in math, while only 16% are at that level in reading. The math numbers don’t budge by the time they reach high school. The reading numbers fall, to just 14% proficiency.

…It’s not for lack of taxpayer funding. Democrats have nearly doubled per-student funding in the last 12 years, yet educational outcomes have plummeted over the same time. …taxpayers are mostly propping up teachers unions… More and more Chicagoans no longer see a future here, with nine consecutive years of population decline. …Chicago has the second-highest sales tax in the country, along with the second-highest property taxes.

…Businesses are running from the Windy City, too. …Boeing, Caterpillar, Tyson Foods and dozens of others have all moved their headquarters out of the metropolitan area or downsized their footprint in recent years.

Many local governments have promised too many giveaways (both in the short run and long run) to government unions and those cities then impose high taxes and provide crummy services.

That combination is driving away taxpayers in the economy’s productive sector.

Chicago is an extreme example of this problem. My two cents is that the city is headed toward a fiscal crisis.

What worries me that some politicians in Washington will want to provide a bailout. The obvious answer is no, presumably preceded by some inappropriate words.

Kamala’s Proposed Increase in the Corporate Tax Rate: The Good News and Bad News.

As part of her tax-and-spend agenda, Kamala Harris says she wants to increase the federal corporate tax rate from 21 percent to 28 percent.

While it doesn’t seem possible, there is a tiny sliver of good news in her proposal. I’m happy that she isn’t proposing to push the rate to 35 percent, which is where it was before the Trump tax cuts.

Though I guess that should be in the not-as-bad-as-it-could-have-been category rather than being considered good news.

With that out of the way, let’s now look at the bad news, courtesy of Kyle Pomerleau of the American Enterprise Institute.

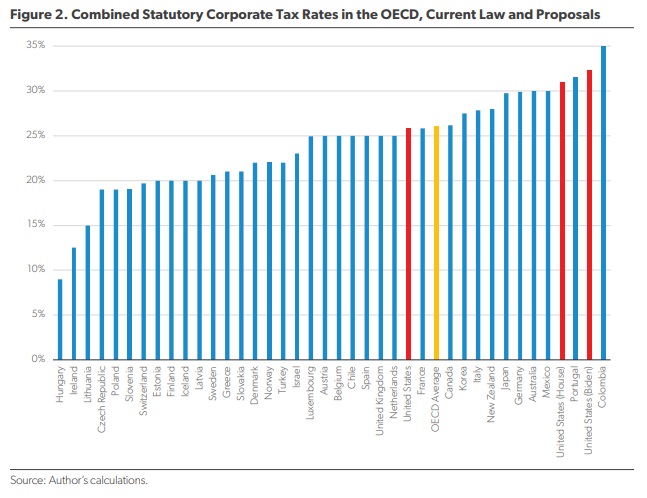

If Harris wins and her plan becomes law, the United States will have the developed world’s highest corporate tax rate.

Only Colombia’s rate would be higher, but I don’t count that country as being part of the developed world since it’s per-capita GDP is only about half the level of the poorest nations in Western Europe (the OECD added Colombia and Mexico as members primarily to counter accusations that it was a club of white-governed countries).

But regardless of how one categorizes Colombia, the big takeaway from Kyle’s chart is that the U.S. would have a higher corporate tax rate than every single European welfare state. Even France and Italy.

At the risk of understatement, that’s not a recipe for attracting jobs and investment.

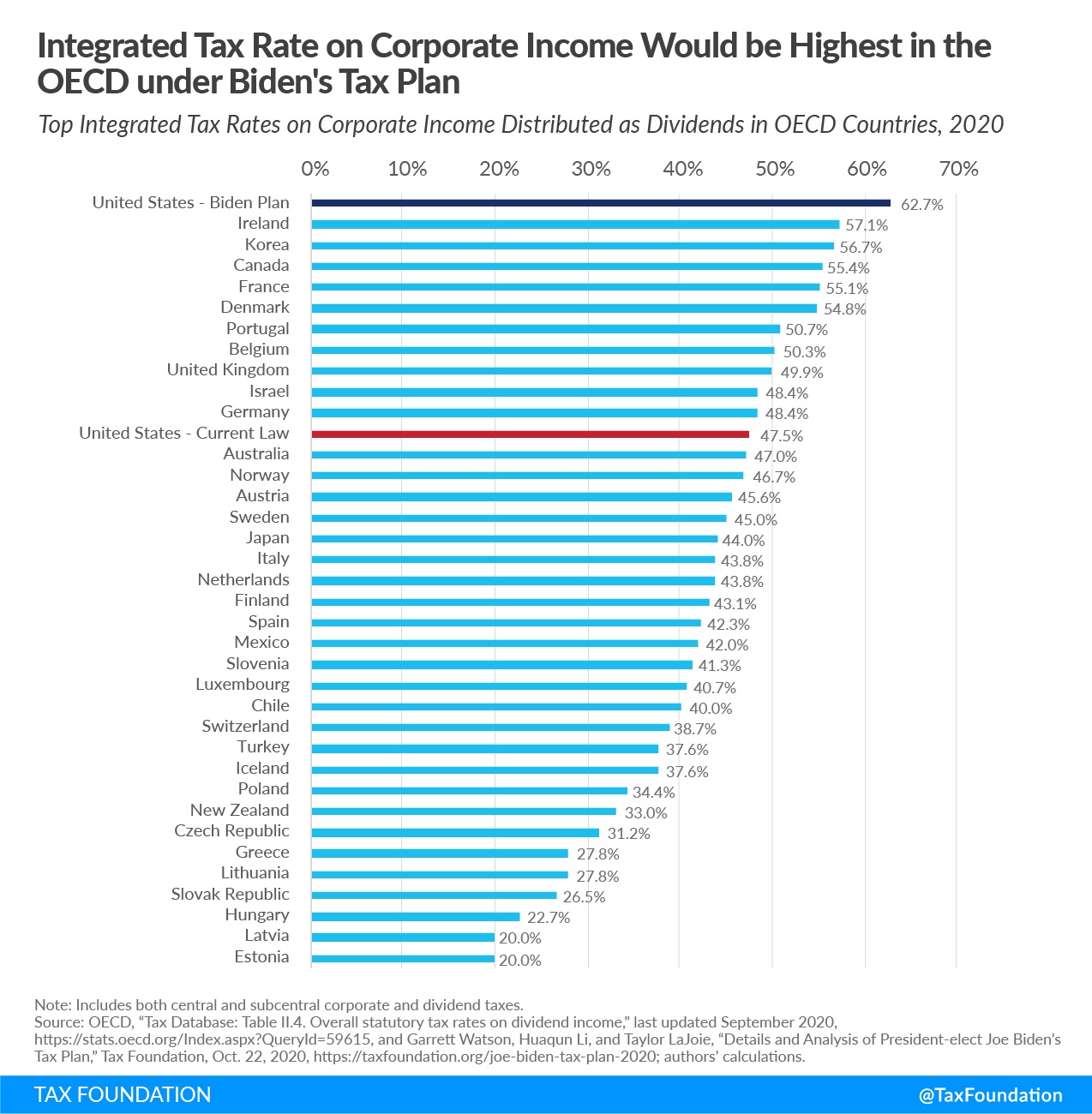

To make matters worse, the United States has a pervasive problem with double taxation.

A few years ago, when Biden was proposing the exact same policy, the Tax Foundation noted that the United States would have the highest tax on business income in the industrialized world (counting the corporate tax and the double tax on dividends).

And America also would be plagued by the highest capital gains tax.

And the highest personal income tax among developed countries.

Given what these policies would do to America’s competitiveness ranking, let’s keep our fingers crossed that she does not turn all of the Biden-Harris tax increases into Harris-Walz tax increases.

P.S. Click here for my explanation about why class-warfare taxation is a bad idea.

No comments:

Post a Comment