August 24, 2024 by Dan Mitchell @ International Freedom

I’ve written many times about America having a problem of a government that is too big and growing too fast.

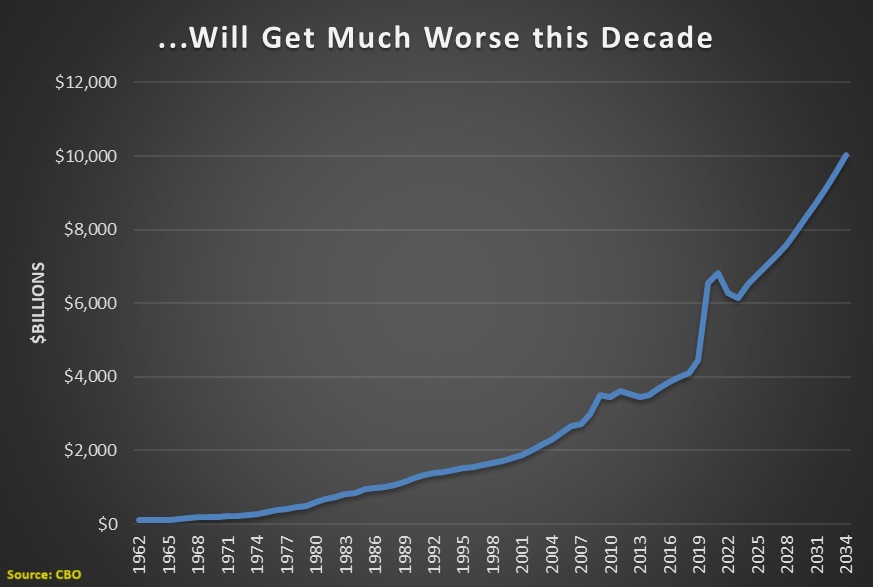

And I’ve warned that this will lead to some combination of the following dire consequences.

- Big tax increases.

- Big debt increases.

- Reckless money printing.

I mostly focus on the dangers of bad policy in the long run. But there’s also a very practical short-run consideration, which is the future of the Trump tax cuts. To elaborate, many provisions of the Trump tax cuts expire at the end of 2025, mostly the provisions that lowered taxes for individuals. Next year, there will be a big battle over whether those tax cuts will be extended or made permanent.

The problem is that big spending increases (under Trump and Biden) have made the fiscal outlook so dire that politicians may want to let the tax cuts expire so they can grab more money.

Christopher Jacobs wrote about this issue for The Federalist.

Broadly speaking, supply-siders focus on increasing economic growth by optimizing tax rates. Put another way, rather than following the left’s obsession with the right way to divvy up the economic pie — which presupposes a zero-sum game in which some must lose for others to win — they focus on expanding the size of the pie, such that everyone…obtain a bigger slice.

…Donald Trump’s 2017 tax package generally followed this blueprint, resulting in significant economic growth and rising incomes… The problem with this philosophy comes not with what supply-siders are saying but with what they aren’t. By focusing solely on the revenue side of the equation as the way to generate economic growth, they give politicians a reason to ignore the other side of the ledger and maintain destructive levels of government spending.

…with unified party control next year, Republicans could permanently extend the 2017 Trump tax relief — if they cut spending to do so. …Yet some Republican lawmakers are already backpedaling on the idea of repealing all of Biden’s green pork… Therein lies the problem with the supply-side argument: It absolves Republican lawmakers from exerting any fiscal restraint on the government spending that has left Americans with a mountain of deficits and debt.

My two cents is that I like supply-side economics and dislike supply-side economics. It all depends on different supply-siders. If someone wants to cut taxes, but favors bigger government, that person is actually for higher taxes in the long run. That’s the kind of supply-side economics I reject. But a Reagan-style agenda of lower tax rates combined with spending restraint is all that’s needed to send “a thrill up my leg.”

P.S. A similar fight occurred in 2012, when many of the Bush tax cuts expired (called the “fiscal cliff“).

No comments:

Post a Comment