August 8, 2024 by Dan Mitchell @ International Liberty

Writing about Mitt Romney’s selection of Paul Ryan in 2012, I opined that, “…it probably means nothing. I don’t think there’s been an election in my lifetime that was impacted by the second person on a presidential ticket.”

I feel the same way about Tim Walz, who is Kamala Harris’ pick for Vice President.

But since several readers have asked me my opinion on the Minnesota governor, I’ll give my two cents.

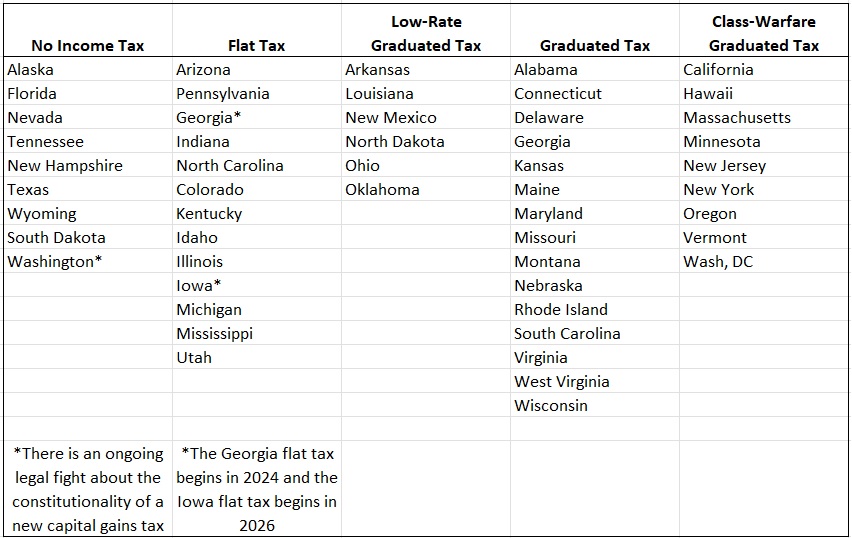

The first thing to understand is that Minnesota has bad tax policy. It is one of only nine states receiving the lowest-possible grade in my tax ranking.

And if there was a an even-worse category, Minnesota might be eligible, particularly since Gov. Walz pushed through more class-warfare tax policy last year.

No wonder he received a failing grade from Chris Edwards’ Fiscal Policy Report Card on America’s Governors (one of only eight governors to “earn” an F).

Other experts also have not been impressed. Jared Walczak of the Tax Foundation has an assessment of Governor Walz’s tax policy. Here are some highlights, though lowlights may be a better description.

Most states have cut taxes at least once since 2021… Twenty-eight states have cut individual income tax rates, fifteen states have cut corporate income tax rates… Under Gov. Tim Walz (DFL), Minnesota has been an outlier, one of the few states to raise taxes in recent years… Under Walz, Minnesota became the only state to impose a surtax on the long-term capital gain income and other net investment income of high earners (all other states tax long-term capital gains at ordinary income tax rates or even preferential rates).

Walz also signed legislation partially phasing out the benefit of standard and itemized deductions for high earners… Minnesota has doubled down on its status as a high-tax state even as most states have moved in a different direction. That may go some way toward explaining the state’s lackluster economic performance of late: in the past year, employment only grew by 0.7 percent in Minnesota, ranking 42nd nationwide. Net outmigration to other states is 6th highest for households with $200,000 or more in income, and 8th highest in terms of net outflow of income from all households.

Meanwhile, the Wall Street Journal has a disapproving editorial on Walz’s tax policies.

Private industries have lost jobs, including finance, information, professional and business services, retail, manufacturing and leisure and hospitality. …Manufacturing employment has declined by 7,500 over the past 12 months, while professional and business services have shed 22,700 jobs. This is especially notable since Mr. Walz last spring signed a giant tax increase, including a 1% surcharge on investment income over $1 million. …Minnesota’s top rate is 9.85% not counting his one-percentage point surcharge—which sends the rich or retired out of state. Households with roughly $5 billion in adjusted gross income left Minnesota between 2019 and 2022, according to the most recent IRS data. Minnesota in 2022 ranked eighth in income loss among states as a share of overall AGI… Top destinations for Minnesota refugees include zero-income tax Florida, Texas and South Dakota. South Dakota’s rate of job growth has been more than four times higher than Minnesota’s since Mr. Walz took the helm.

All of this analysis is confirmed by data on migration and changes in taxable income.

Simply stated, Walz is driving productive people (and their money!) out of the state.

Which brings me to the second thing that readers should understand.

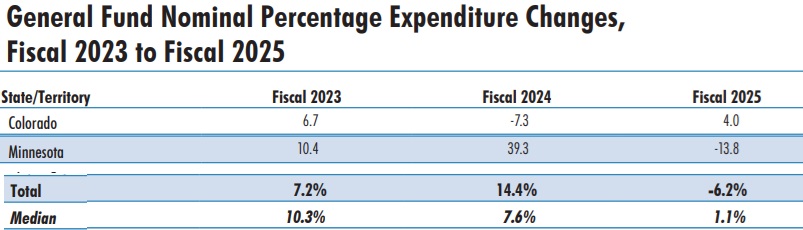

Walz is a big spender. Here’s some data from the National Association of State Budget Officers’ most-recent State Expenditure Report.

The burden of government spending has been expanding by average of nearly 12 percent annually in Minnesota. I also included Colorado, which has a liberal governor. But it also has a spending cap, so the budgetary burden has only climbed by an average of about 1.2 percent annually.

The bottom line is that Walz has a terrible track record, but so does Harris, so they are a good match.

No comments:

Post a Comment