I’ve written many times about the harmful consequences of the federal death tax. Simply stated, it is both immoral and foolish for the IRS to grab as much as 40 percent of someone’s assets simply because they die.

That drains private capital from the economy and is a de facto heavy tax on those who save and invest (triple or quadruple taxation!).

That’s the bad news.

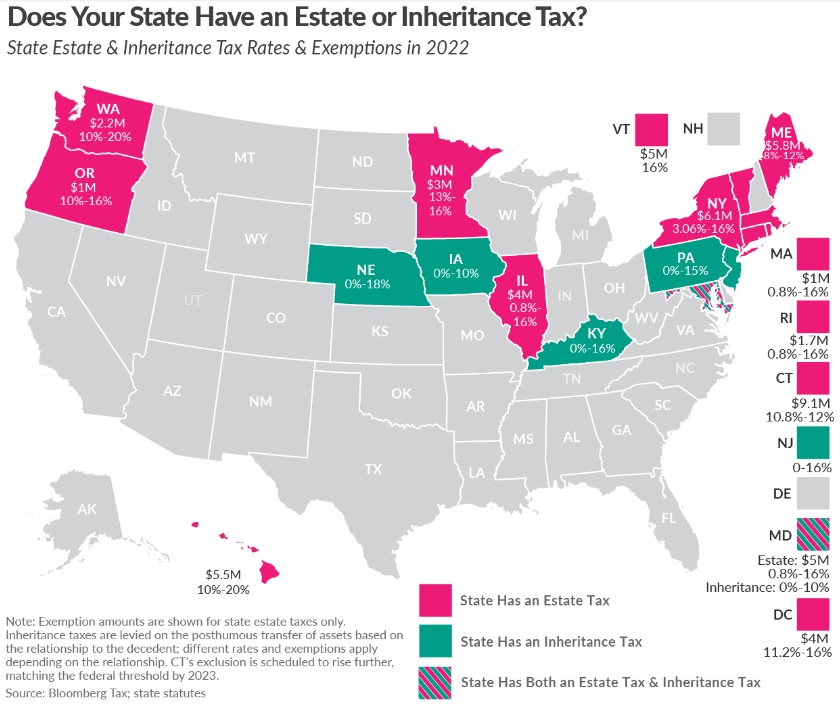

The worse news is that some states augment the damage with their own death taxes. Here’s a map from the Tax Foundation showing which states shoot themselves in the foot.

For those curious, the estate tax is imposed on the dead person’s assets and an inheritance tax is imposed on the the people who inherit the dead person’s assets.

In both cases, it’s bad news.

How bad?

There’s some new research from a couple of scholars examining this topic. Enrico Moretti of Berkeley and Daniel J. Wilson of the San Francisco Federal Reserve have a study published by the American Economic Journal that quantifies the impact of state death taxes on location choices.

In this paper, we contribute to the literature on the effect of state taxes on the locational choices of wealthy individuals by studying how estate taxes affect the state of residence of the American ultra-rich and the implications for tax policy. …Specifically, we estimate the effects of state-level estate taxes on the geographical location of the Forbes 400 richest Americans between 1981 and 2017. We then use the estimated tax mobility elasticity to quantify the revenue costs and benefits for each state of having an estate tax. We find that billionaires’ geographical location is highly sensitive to state estate taxes. Billionaires tend to leave states with an estate tax, especially as they get old. …On average, estate tax states lose 2.35 Forbes 400 individuals relative to non–estate tax states. …—21.4 percent of individuals who originally were in an estate tax state had moved to a non–estate tax state, while only 1.2 percent of individuals who originally were in a non–estate tax state had moved to an estate tax state. The difference is significantly more pronounced for individuals 65 or older… Overall, we conclude that billionaires’ geographical location is highly sensitive to state estate taxes. …We estimate that tax-induced mobility resulted in 23.6 fewer Forbes 400 billionaires and $80.7 billion less in Forbes 400 wealth exposed to state estate taxes.

What makes the study especially persuasive is that state death taxes suddenly no longer could be offset against federal death taxes because of a policy change in 2001.

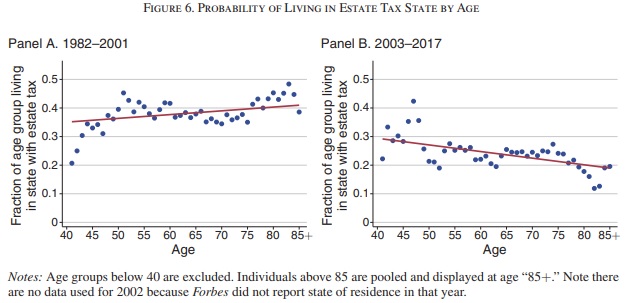

That meant post-2001 data should look different. And that’s exactly what the authors found, as illustrated in Figure 6 of the study.

Here are some final excerpts from the conclusion.

The 2001 federal tax reform introduced stark cross-state variation in estate tax liabilities for wealthy taxpayers. Our findings indicate that the ultra-wealthy are keenly sensitive to this variation. Specifically, we find that billionaires responded strongly to geographical differences in estate taxes by increasingly moving to states without estate taxes, especially as they grew older. Our estimated elasticity implies that $80.7 billion of 2001 Forbes 400 wealth escaped estate taxation in the subsequent years due to billionaires moving away from estate tax states.

By the way, the study said that most states still wind up collecting net revenue because of death taxes.

In other words, the death tax revenue from remaining rich people is generally greater than the foregone income tax revenue because of those who left.

But I wonder if those findings would be true if the authors had been able to measure the secondary effects such as lost sales tax revenue, lost property tax revenues, and (perhaps most important) lost income tax revenue from people who did business with escaping rich people.

But, regardless of the findings, it is always immoral and wrong for politicians to impose taxes simply because someone dies.

P.S. In Australia, people changed when they died because of the death tax.

P.P.S. In France, people changed who they were because of the death tax.

P.P.P.S. In Ireland, people pretended to change their sexual orientation because of the death tax.

No comments:

Post a Comment