More specifically, I’ve written a five-part series about governments and their “War Against Cash.”

|

- In Part I, I explained that politicians and bureaucrats want to get rid of cash so that governments could increase taxes.

- In Part II, I warned that abolition of cash would enable a further shift to irresponsible and inflationary monetary policy.

- In Part III, I showed why proponents are dishonest when they claim that a cashless society will somehow reduce criminal activity.

- In Part IV, I debunked the arguments made by Kenneth Rogoff, a Harvard professor and leading advocate for cash prohibition.

- In Part V, I pointed out how the Canadian government abused its power to restrict access to money for political opponents.

Let’s build upon those arguments by reviewing some additional material.

In a column yesterday for the Wall Street Journal, Sean Fieler warns that abolishing cash will empower government.

Neel Kashkari, president of the Minneapolis Federal Reserve, questioned why Americans would support a CBDC. “If they want to monitor every one of your transactions . . . you can do that with a central bank digital currency,” Mr. Kashkari said at a conference last year. “I get why China would be interested.

|

Why would the American people be for that?” …For Democrats, the party of big government, the appeal is obvious. A CBDC would allow the federal government to spend more money, manage outcomes… It’s naive to think that a government that is currently combing through individual financial information will stop doing so when it has the formidable power of a CBDC. …Policy makers in Washington have a choice between preserving a bloated federal government or putting America back on a path to limited government. By uniting to stop a CBDC, Republicans can take the side of the American people.

Well stated, though I have learned through painful experience not to rely on Republicans to protect freedom.

Writing last year for the Foundation for Economic Education, Brad Polumbo also warns against digital currency.

…many governments have floated the idea of a “central bank digital currency,”…and new reporting suggests the Biden Administration may soon press forward with efforts to create a so-called “digital dollar.” …At first glance, government getting in on the crypto craze might sound fun, novel, or harmless. But it’s actually cause for serious alarm. …it would offer governments new, unprecedented ways to control citizens. To call the idea rife for abuse is an extreme understatement. After all, a central bank digital currency would allow the government to track your every purchase. It could also be easily used to restrict purchases. For example, imagine a future government deciding that gasoline must be rationed in order to address climate change. Your “digital dollars” could be made to stop working at the gas pump once you’ve purchased a certain amount of gasoline in a week. …If any of this sounds extreme, fantastical, or otherwise far-fetched… well, just look at China.

Last but not least, here are some excerpts from Elaine Ou’s 2016 column for Bloomberg.

…in a cashless society every transaction must pass through a financial gatekeeper. …This means that politically unpopular organizations could easily be deprived of economic access. Past attempts to curb money laundering have already inadvertently cut off financial services for legitimate individuals, businesses, and charities. The removal of paper currency would undoubtedly leave similar collateral damage. The crime-fighting case against cash is overstated. …if we’re going to cite unlawful transactions as a rationale for banning cash, it only makes sense to ban banks and accounting firms first. The one benefit of replacing cash with claims on cash is that a claim can be discounted, canceled or seized. That doesn’t sound terribly beneficial to most people, but this attribute is attractive to a growing contingent that wants to send interest rates into negative territory. …Physical currency gets in the way of negative-interest-rate policy because people who don’t want to accrue negative interest can simply store their cash in a safe. By confining the national currency to regulated account holdings, the government can impose a tax on savings in the name of monetary policy.

The last sentence in that excerpt should be etched in stone. Replacing cash with a digital currency gives governments the ability to engage in “financial repression.”

|

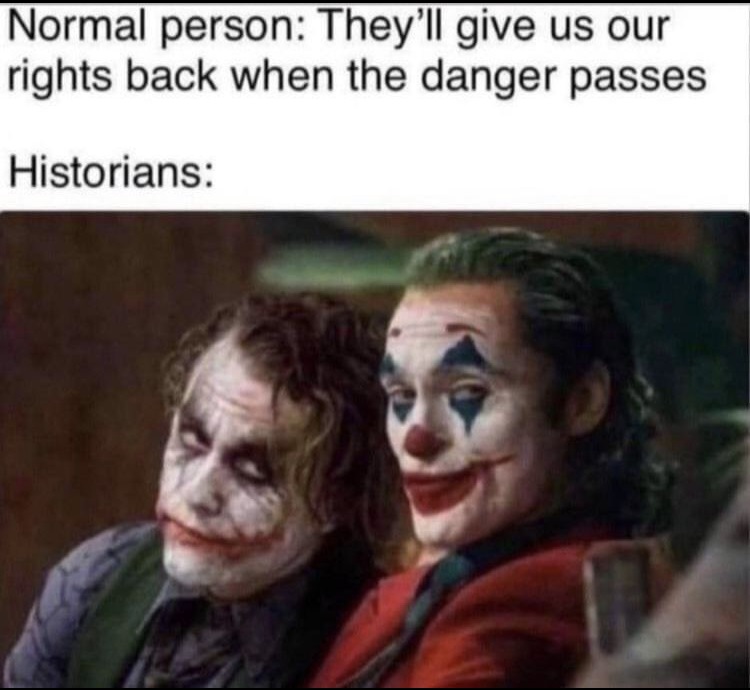

Is it possible that politicians and central bankers to get hold of this power and not abuse it?

Yes, that’s theoretically possible, but it’s very unlikely.

All too often, the history of government is to grab and abuse power during times of crisis.

And the ultimate insult to injury is that governments almost always instigate crises in the first place.

P.S. If you want a sneak preview at how governments would abuse power, it is very instructive to take a quick look at how India hurt ordinary people as part of that government’s war against cash.

No comments:

Post a Comment