I’m a big fan of tax competition. I cheer when jobs, investment, and people (or even booze) move from high-tax jurisdictions to low-tax jurisdictions.

This increases the rewards for good policy and also increases the punishment for bad policy.

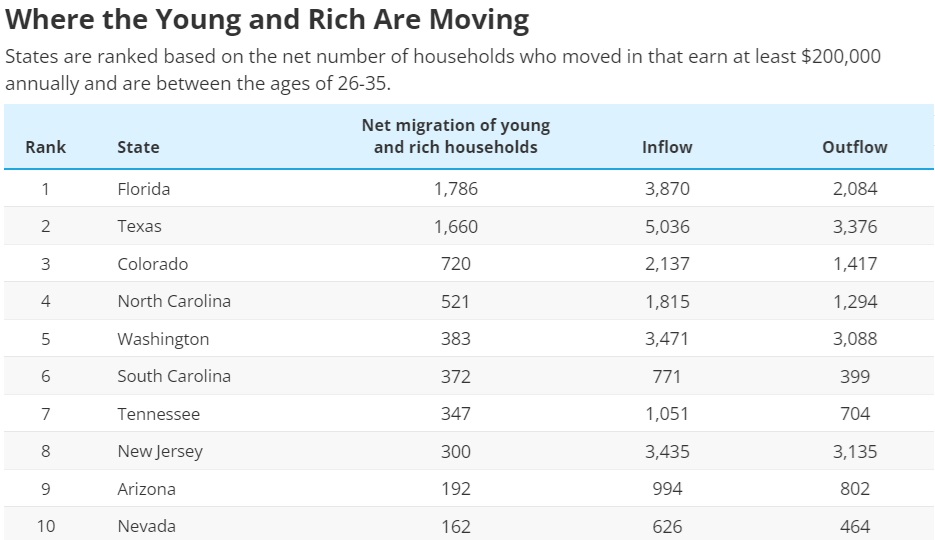

Given my interest in the topic, I obviously can’t resist sharing this chart, which shows the states benefiting from an influx of successful young people.

I want to emphasize two things about this data.

First, you’ll notice that eight of these states either have no income tax (Florida, Texas, Washington, Tennessee, and Nevada) or a flat tax (Colorado, North Carolina, and Arizona).

Second, it goes without saying (but I’ll say it anyhow) that states should be anxious to attract successful young people. These are households that are unlikely to be mooching off the government. Instead, they’ll be the geese laying the golden eggs.

So it makes no sense to impose policies that cause them to fly away.

Speaking of which, the above chart comes from a report by smartasset.com. Here’s an excerpt summarizing some highlights and also identifying the states that are driving away successful young people.

Many affluent young people often relocate for better jobs, lifestyle upgrades and tax advantages… With this in mind, SmartAsset used IRS data to rank states by the net inflow of young and rich households – those earning at least $200,000 per year and aged 26 to 35. …

Florida and Texas attract more than double the young and rich households as any other state. …Half of states attracting the most young and rich households don’t charge state income tax. …

California lost over 3,000 young and rich households. …Illinois lost second-most studywide with an emigration of 1,323 households. The outflow was worth approximately $5.1 billion in taxes. Massachusetts lost a net of 1,102, and New York ranked fourth-lowest with a net loss of 345 households.

For what it’s worth, it might also make sense to show the data after adjusting for state population. That presumably would boost the ranking of states such as Colorado and Nevada and hurt the ranking of places such as Massachusetts (a state that almost surely will suffer more out-migration).

But however you slice the date, the results will always be the same. As noted in my five-part series (here, here, here, here, and here), people of all ages are escaping blue states.

P.S. I’m assuming that New Jersey is a top-10 state merely because of young people escaping New York (unless, of course, some of them got lost trying to find the good Jersey).

P.P.S. The state of Washington arguably is in danger of getting kicked out of the no-income-tax club since politicians have imposed a capital gains tax notwithstanding disapproval by voters.

No comments:

Post a Comment