September 25, 2024 by Dan Mitchell @ International Liberty

In 2018, I shared a study that gave people a way to predict when a country would suffer a fiscal crisis. I liked the findings because the authors concluded that spending restraint was the best way of staying out of trouble. Now there’s a new study by Mark Warshawsky and Giorgi Bokhua of the American Enterprise Institute.

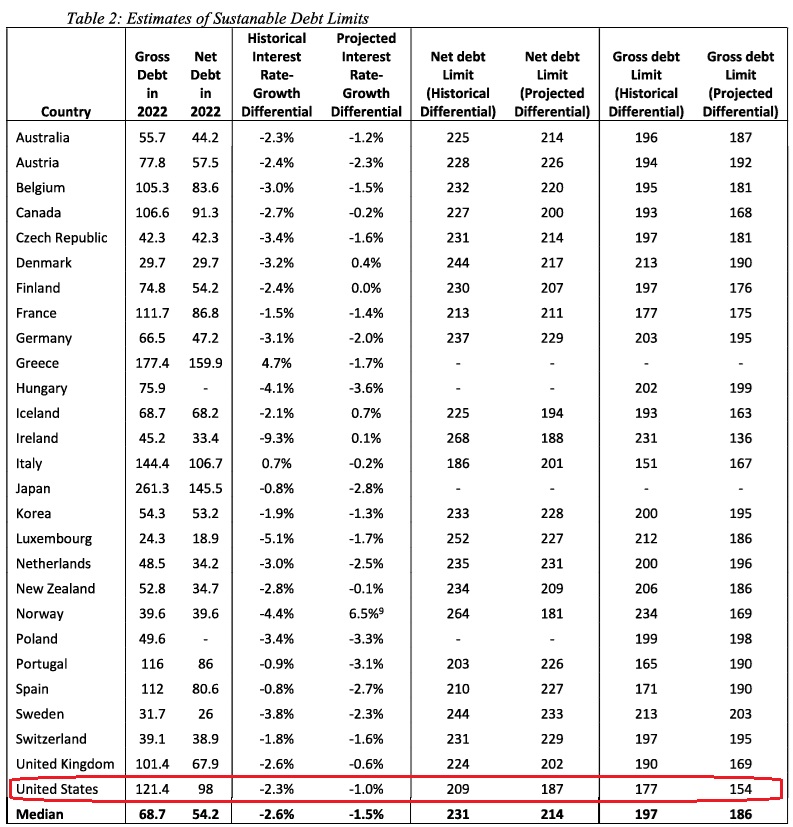

Here’s the part that will grab everyone’s attention. It’s a chart showing estimates of the amount of debt developed nations can incur before they hit a tipping point and are vulnerable to a fiscal crisis (for American readers, the United States is highlighted in red).

Here’s some of the authors’ analysis.

Sadly, the United States is among the countries that are running out of “fiscal space.”

Prudent policymakers and worried market participants…want to know…when in the future will the federal government face an economic limit to its issuance of debt. This would be manifest in substantial incrreases in interest rates on is debt, difficulties in marketing bonds, and existing bondholders experiencing losses through runaway inflation or financial restrictions. …Knowing actual figures of net and gross debt in 2022, allows us to gauge how far countries are away from their sustainable debt limits. When looking at net debt, figures indication that most countries have a relatively flexible fiscal space… Gross debt limits give more concerning picture. For example, the United States, Italy, and France have tight sustainable debt limits and modest remaining fiscal space using both historical and projected differentials, while the United Kingdom and Canada have limited fiscal spaces when using projected differentials. …these countries appear to have limited flexibility to accumulate additional debt, particularly if an economic or financial crisis or war were to occur.

Here’s some of the U.S.-specific analysis.

…our model gives a sustainable gross debt limit of 154 percent using OECD interest rate and economic growth projections. Combining long-term projections of net debt…from the CBO…, that sustainable debt limit will be reached in 2034.

Ten years does not give America a lot of time.

The bad news is that both Trump and Harris are big spenders, so the day of reckoning in the study (gross debt reaching 154 percent of GDP) will probably happen before 2034.

The good news is that I expect the United States has more leeway than the study suggests, in part because the dollar is the world’s reserve currency.

But it will be very bad news, whether we have a fiscal crisis in 2030, 2034, or 2049. I still expect that a few European nations will have a crisis before one happens in the United States. Probably starting with Italy. If that’s the case, let’s cross our fingers that American politicians finally sober up and enact much-needed entitlement reform.

P.S. Always remember that red ink is the symptom. The underlying disease is too much spending.

No comments:

Post a Comment