By Rich Kozlovich

What's a Seldon Crisis? For old science fiction readers, like me, that's an understood term. One of the truly great science fiction writers of all time was Issac Asimov, and his greatest contribution to that genre was the Foundation Series, which featured a character named Hari Seldon.

The character Hari Seldon was a mathematician who created what he called "psychohistory". Psychohistory was "an algorithmic science that allowed him to predict the future in probabilistic terms." He outlined the future going forward for hundreds, and even thousands of years, and even created a programmable hologram that would appear many years in the future explaining what they needed to know, or what needed to be done regarding a "crisis" he predicted, AKA, a Seldon Crisis.

There was only one problem. As quantum physicist Niels Bohr noted: "It is difficult to make predictions, especially about the future." I don't care how smart anyone may be, or how well read, or how much experience in life one has, you can't predict the future unerringly, especially for long periods of time.

As it turned out they were facing a crisis Hari hadn't predicted, and couldn't have predicted, so, when Harri's scheduled hologram appeared and he told them everything was going along wonderfully, so be happy, that created a real Seldon Crisis. Since he was wrong, that upset the apple cart, and that's where we are today, entirely too many economists and political leaders have been wrong, it's getting worse, and entirely too many people are willing to go along with that.

When it comes to economics I've concluded if you put the top 25 economists in the world in a room and asked them if they thought two and two really was four, and to explain why they believed what they believed, you'd get 25 different answers. That's clearly an oversimplification, but the concern about what come out of the minds and mouths of economists is valid.

Economics, as a field, is in many ways like statistics. Arcane! Economists can make up anything and make it sound like it's something, but so often all they're doing is justifying preconceived notions that are politically expedient. I've often stated in my articles my grandfather, who made his living as a coal miner and a farmer, was one of the world's great economists. He said if you spend more than you make, you'll go broke! That's foundational! That can't be overturned! Eventually that becomes reality!

There is one economist/investor I find more interesting, and understandable than so many others, John Mauldin. I receive a weekly economics update from him called, Thoughts From the Frontline, which is free so you may wish to subscribe. On Saturday he sent out this piece called the, Supercycle of Debt, (pdf here).

In this piece he discusses books that explain historical cycles, which I've believed in for years. I've found the patterns of life repeat over and over again. It seems everyone wants to be a real life Hari Seldon, me too, but while I see historical patterns repeating over and over again, and I think it's important to read these "cycle" books for their historical oversight and insights as to what's going on, I also think they're not predictively useful. I've defined them as historical tarot card reading. While they need to be read, and they outline concepts that are judgmentally useful, they're not road maps to the future.

The biggest take from this article

is the massive debt that's being accumulated by the world's governments

and individuals. He notes:

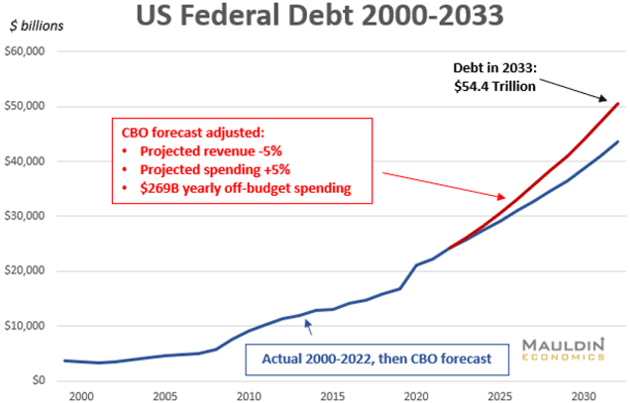

Just as an individual can go bankrupt no matter how rich she starts out, a financial system can collapse under the pressure of greed, politics, and profits no matter how well regulated it seems to be.............. But highly leveraged economies, particularly those in which continual rollover of short-term debt is sustained only by confidence in relatively illiquid underlying assets, seldom survive forever, particularly if leverage continues to grow unchecked.................Last week the Congressional Budget Office estimated the FY 2023 federal budget deficit was $1.7 trillion, about $300 billion more than the prior year. Spending actually fell slightly but tax revenue fell even more. This brought the gross national debt to $33+ trillion, of which debt held by the public was $26 trillion (a distinction without a real difference!). I have been saying for a long time we would have a $50 trillion debt by 2030. That now looks laughable naive.

This mess in the Republican House for Speaker, and the Israel/Hamas War, is going to change things dramatically in my view. Both of these crises are exposing more and more people for who and what they are, on both sides of the aisle, and that picture isn't a pretty one. I'm expecting to see a massive primary shakeup in 2024, for both party's.

We're going broke and unchecked immigration is killing the nation's homogeneity, which is putting America existentially at risk. That's just foundational, but someone has to say it, everyone needs to recognize it, and then act on it. Especially those in powerful positions. One thing is clear, the forces aligned against doing so are powerful and entrenched. To do so will mean completely upsetting the apple cart. That will require guts, perseverance, the willingness to be unliked and most importantly, the willingness to fight the good fight and do battle irrespective of the personal consequences.

Everyone's worried about BRICS, but at some point the debt load worldwide will be so great it just won't matter whose currency is being used since no currency will be worth the paper its printed on, and like Venezuela, the cost of printing the money will become too expensive. Which is why I think cryptocurrency will be forced on humanity, which I believe is a system for corruption beyond imagination. The Sam Bankman-Fried trial clearly exposes just how corrupt that system can become, and he's not alone out there.

The fact is the people in charge of the nation's money have no idea what they're doing. Massive debt, unrestrained borrowing, massive spending, inflation at a 40 year high, a banking crisis, frozen housing market, de-dollarization abroad, massive corruption, massive government activity that's blatantly criminal, international political and social instability, and cryptocurrency. Things aren't wonderful, and there's not one logical reason to be happy about it.

This our Seldon Crisis. And it's not fiction.

No comments:

Post a Comment