The New York Times is going overboard with disingenuous columns.

I also explained back in August how Steven Greenhouse butchered the data when he condemned the American economy.

And Paul Krugman is infamous for his creative writing.

But Mr. Leonhardt is on a roll. He has a new column promoting class warfare tax policy.

Here’s the supposed proof for Leonhardt’s claim, which is based on a new book from two professors at the University of California at Berkeley, Emmanuel Saez and Gabriel Zucman.Almost a decade ago, Warren Buffett made a claim that would become famous. He said that he paid a lower tax rate than his secretary, thanks to the many loopholes and deductions that benefit the wealthy. …“Is it the norm?” the fact-checking outfit Politifact asked. “No.” Time for an update: It’s the norm now. …the 400 wealthiest Americans last year paid a lower total tax rate — spanning federal, state and local taxes — than any other income group, according to newly released data. …That’s a sharp change from the 1950s and 1960s, when the wealthy paid vastly higher tax rates than the middle class or poor.

Here are the tax rates from 1950.

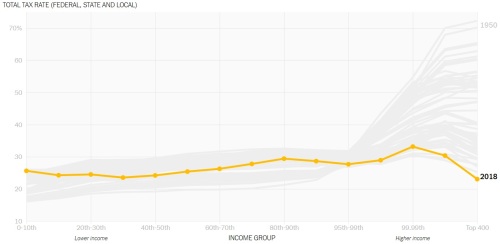

And here are the tax rates from last year, showing the combined effect of the Kennedy tax cut, the Reagan tax cuts, the Bush tax cuts, and the Trump tax cut (as well as the Nixon tax increase, the Clinton tax increase, and the Obama tax increase).

So is Leonhardt (channeling Saez and Zucman) correct?

Are these charts evidence of a horrid and unfair system?

Nope, not in the slightest.

But this data is evidence of dodgy analysis by Leonhardt and the people he cites.

First and foremost, the charts conveniently omit the fact that dividends and capital gains earned by high-income taxpayers also are subject to the corporate income tax.

Even the left-leaning Organization for Economic Cooperation and Development acknowledges that both layers of tax should be included when measuring the effective tax rate on households.

Indeed, this is why Warren Buffett was grossly wrong when claiming he paid a lower tax rate than his secretary.

But there’s also another big problem. There’s a huge difference between high tax rates and high tax revenues.

Simply stated, the rich didn’t pay a lot of tax when rates were extortionary because they can choose not to earn and declare much income.

Simply stated, the rich didn’t pay a lot of tax when rates were extortionary because they can choose not to earn and declare much income.Indeed, there were only eight taxpayers in 1960 who paid the top tax rates of 91 percent.

Today, by contrast, upper-income taxpayers are paying an overwhelming share of the tax burden.

It’s especially worth noting that tax collections from the rich skyrocketed when Reagan slashed the top tax rate in the 1980s.

Let’s close by pointing out that Saez and Zucman are promoting a very radical tax agenda.

Punitive income tax rates, higher corporate tax rates, and a confiscatory wealth tax.Saez and Zucman sketch out a modern progressive tax code. The overall tax rate on the richest 1 percent would roughly double, to about 60 percent. The tax increases would bring in about $750 billion a year, or 4 percent of G.D.P…. One crucial part of the agenda is a minimum global corporate tax of at least 25 percent. …Saez and Zucman also favor a wealth tax

Does anybody think copying France is a recipe for success?

P.S. I pointed out that Zucman and Saez make some untenable assumptions when trying to justify how a wealth tax won’t hurt the economy.

P.P.S. It’s also worth remembering that the income of rich taxpayers will be subject to the death tax as well, which means Leonhardt’s charts are doubly misleading.

No comments:

Post a Comment