One of the worst examples of Washington cronyism is the Export-Import Bank, which has provided subsidies for big companies that sell to foreign buyers.

Corrupt firms such as Boeing and General Electric argue that they need help from the Ex-Im Bank in order make those sales.

Is that true?

Interestingly, we had a real-world test earlier this decade when the Ex-Im Bank was temporarily shut down and then, after re-opening, was largely unable to provide subsidies to big corporations.

So what happened? Veronique de Rugy of Mercatus explains that exporters did just fine when the Ex-Im Bank was curtailed.

Back in 2015, there was widespread agreement in Congress that the Export-Import Bank — the U.S. government’s export credit agency — was nothing but a crony bank, mostly serving the greedy interests of Boeing and other large companies. As a result, Congress let the bank’s charter expire.

It was reauthorized a few months later but in a much-diminished form, operating at 15% capacity. …A thorny problem for those supporting Ex-Im’s revival is that we now have nearly a half-decade’s worth of data on what happened to U.S. exports, economic growth, jobs and beneficiaries while the institution was mostly dormant between 2015 and 2019. During that time, …its activities dropped from $21 billion in 2014 (the last year the bank functioned at full capacity) to $3.6 billion in 2018. …Back in 2014, 65% of the bank’s activities benefited 10 giant companies.

Boeing alone got 40% of Ex-Im’s largesse. On the foreign side, the bank’s clients belong to a who’s who list of large, wealthy, successful and often state-owned companies. …

Most of this profligacy ended between 2015 and 2018. During that time, the share of funding that benefited large firms dropped by 93%. …once Ex-Im stopped extending giant deals to giant companies, American taxpayers’ liability fell from $112 billion in 2014 to $72.5 billion in 2018. U.S. exports continued to grow without being impacted whatsoever by Ex-Im limitations, and many beneficiaries of the bank had their best year ever in 2018, demonstrating that none of these subsidies are necessary for their success.Sadly, the Ex-Im Bank is now back in business (and President Trump deserves a big chunk of the blame).

But its charter has to be renewed this year.

There’s no chance of killing the program, but there may be an opportunity to at least curtail its power and authority.

Negotiations on Capitol Hill have produced a compromise package between the top Democrat and top Republican on the House Financial Services Committee.

But not everyone is a fan. The Washington Examiner opined that the deal should be rejected.

House Financial Services Chairwoman Maxine Waters, D-Calif., has drafted a bill that would expand the Ex-Im Bank, rename it, free it from oversight, and charge it with a handful of irrelevant liberal mandates. The committee’s top Republican, Rep. Patrick McHenry, R-N.C., has unfortunately agreed to Waters’ bill. …Republicans should outright reject Waters’ proposal. It’s pitched as a compromise, but the Senate GOP has no reason to compromise. Either fix Waters’ bill or let the Ex-Im Bank’s charter expire in the fall. The “reforms” in Waters’ bill are weak tea. They don’t do anything to steer the Ex-Im Bank away from being welfare for America’s largest corporations.So did House Republicans kill the deal, which should have been an easy decision?

Not exactly. According to a Politico report, House Democrats stopped it.

But not because they’re opposed to corporate welfare. They rebelled because they want a deal that’s even worse.

House Financial Services Chairwoman Maxine Waters on Wednesday shelved a bipartisan Export-Import Bank bill that sparked a fierce backlash from her own caucus…

The delay raises questions about the fate of the beleaguered bank, which, without action by Congress, will see its operating charter lapse in September. …

the original compromise she drafted with McHenry ignited criticism from a wide swath of the Democrats on the committee… They objected to new restrictions that would be imposed on the bank and big manufacturers such as Boeing, that benefit from its loan guarantees… Rep. Denny Heck (D-Wash.)…had been raising concerns about sections of the bill that would impose new disclosure requirements on major manufacturers and restrict the agency from providing financial support for deals with Chinese state-owned enterprises. …

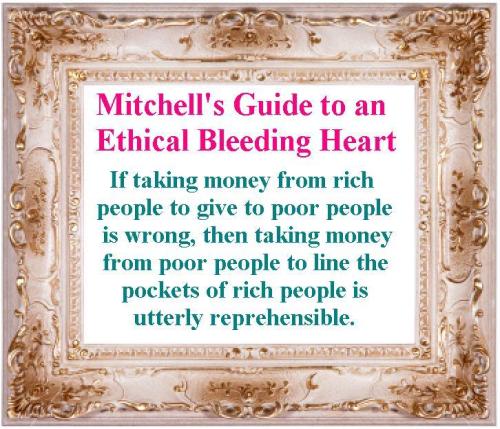

The restrictions turned out to be one of the biggest sticking points for Democrats. …The bank is only now returning to full operation after years of being hobbled by conservative Republican lawmakers who criticized the agency as engaging in “crony capitalism” and posing a risk to taxpayers.The moral of the story is that big government and big business shouldn’t be in bed together.

The federal government shouldn’t redistribute money, and it’s especially offensive to have programs that give handouts to rich and powerful companies.

And it’s not just the Ex-Im Bank.

- Look at the way the major pharmaceutical companies and big insurance companies got into bed with the White House to line their pockets via Obamacare.

- And examine how big financial firms pillaged taxpayers as part of the sleazy TARP bailout.

- How about the way big agri-businesses rip off consumers with the ethanol scam.

- Don’t forget H&R Block is trying to get the IRS to drive competitors out of the market.

- Big Sugar also gets a sweet deal by investing in politicians.

- Another example is the way major electronics firms enriched themselves by getting Washington to ban incandescent light bulbs.

- Needless to say, we can’t overlook Obama’s corrupt green-energy programs that fattened the wallets of well-connected donors.

- And General Motors became Government Motors thanks to politicians fleecing ordinary Americans.

P.P.S. I have no objection to companies getting profits, but I want them to earn money by serving consumers and not steal money by fleecing taxpayers.

No comments:

Post a Comment