December 9, 2024 by Dan Mitchell @ International Liberty

Fifteen years ago, I explained that the bailout of Greece (by the IMF-EC-ECB “troika“) was a mistake because the net effect was a much bigger tax burden and no reduction in the spending burden.

And I did the same thing five years ago and found the same (predictable) result.

In other words, politicians responded to a crisis of over-spending by raising taxes.

Let’s see if anything has changed.

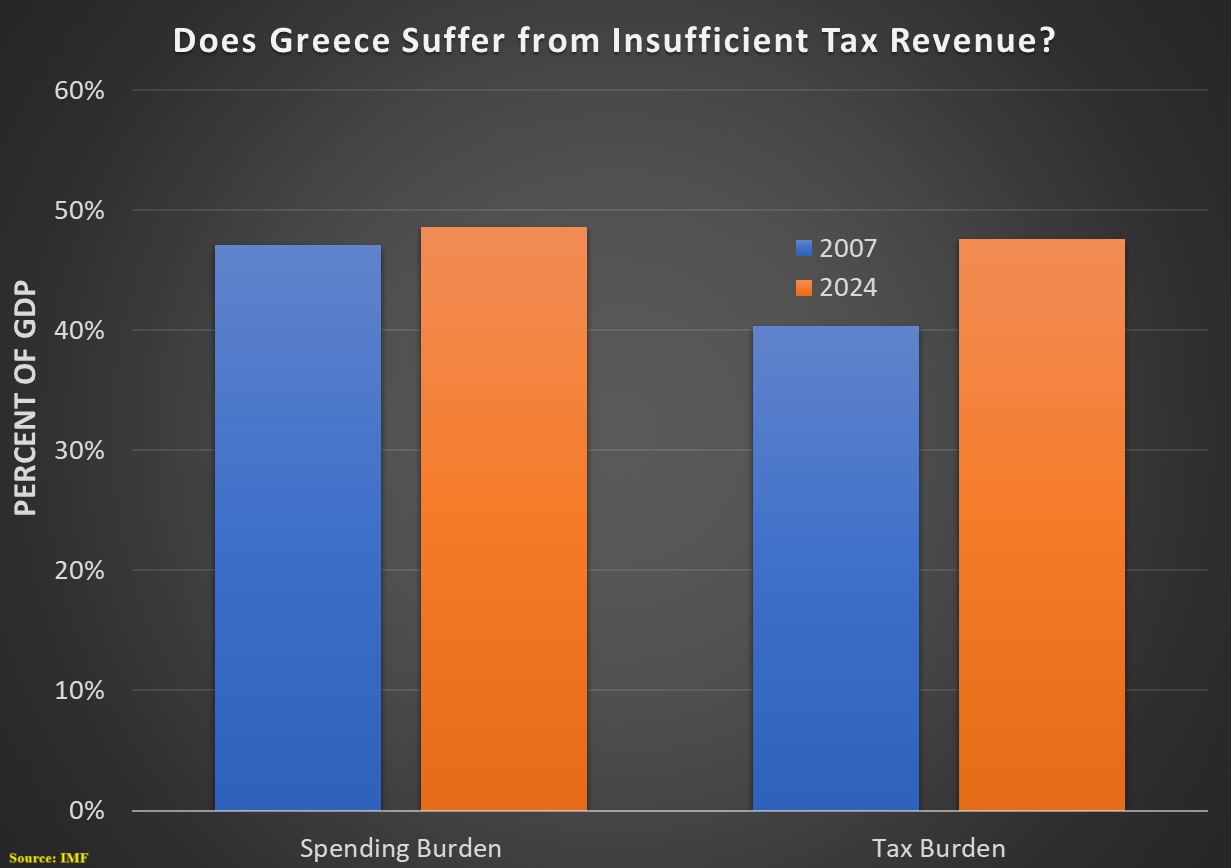

Here are the latest numbers for Greece’s spending burden and tax burden, courtesy of the IMF. Lo and behold, we find the same evidence of failure.

I could wrap up my column at this point by recycling my argument that bailouts are a bad idea.

And I certainly don’t mind writing I-told-you-so columns.

But I want to make a more-important point about the knee-jerk statism of the Paris-based Organization for Economic Cooperation and Development.

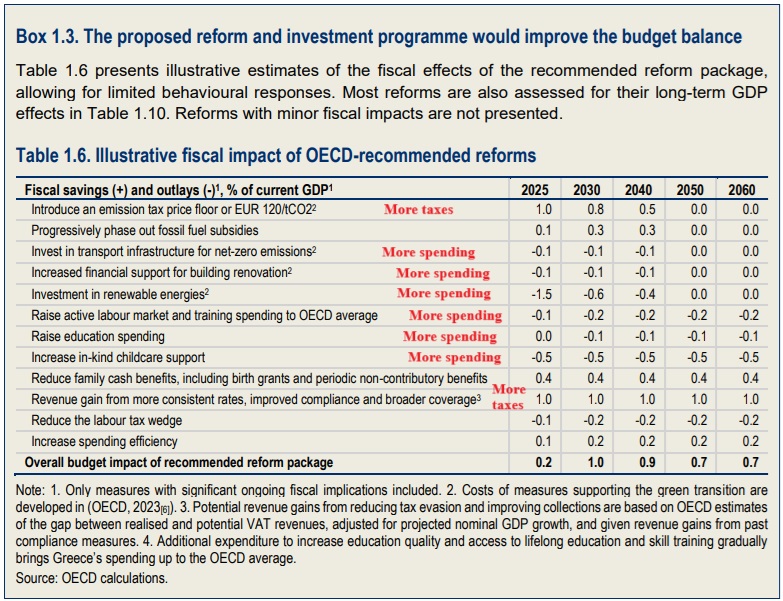

The OECD just released its Country Survey about Greece. Amazingly, the bureaucrats are suggesting even-higher taxes. I’m not joking. Here are some excerpts.

…more domestic resources will be needed to maintain high rates of public investment. …Tax revenue has increased from 33.4% of GDP in 2000 to 41% in 2022, above the OECD average. …Previous Economic Surveys pointed to the need to simplify the tax system by reducing the use of tax expenditures including tax allowances, credits, exemptions and reduced tax rates. …Continuing the government’s efforts to make tax compliance easier can boost collection… The effectiveness of the value added tax (VAT) remains also hampered by a wide range of goods and services that are exempt or taxed at reduced rates. …Greece also has room to raise excise taxes… The introduction of ETS2 also provides an opportunity to revise fuel excise taxes and phase out fossil fuel subsidies to harmonise and raise effective carbon prices.

By the way, the Survey generally has sensible observations about the economic impact of various taxes.

The part that is troubling is that the OECD thinks the Greek government should be bigger and that is should have more money.

Here’s a table summarizing the recommendations and I’ve highlighted which ones raises tax burden and which ones raise the spending burden.

At the risk of over-simplifying, the OECD thinks Greece should move in the wrong direction, but in a way that minimizes economic damage.

I have a different view. Move in the right direction.

Instead of taking advice from the wrong type of people, maybe Greece should put Javier Milei in charge of fiscal policy?

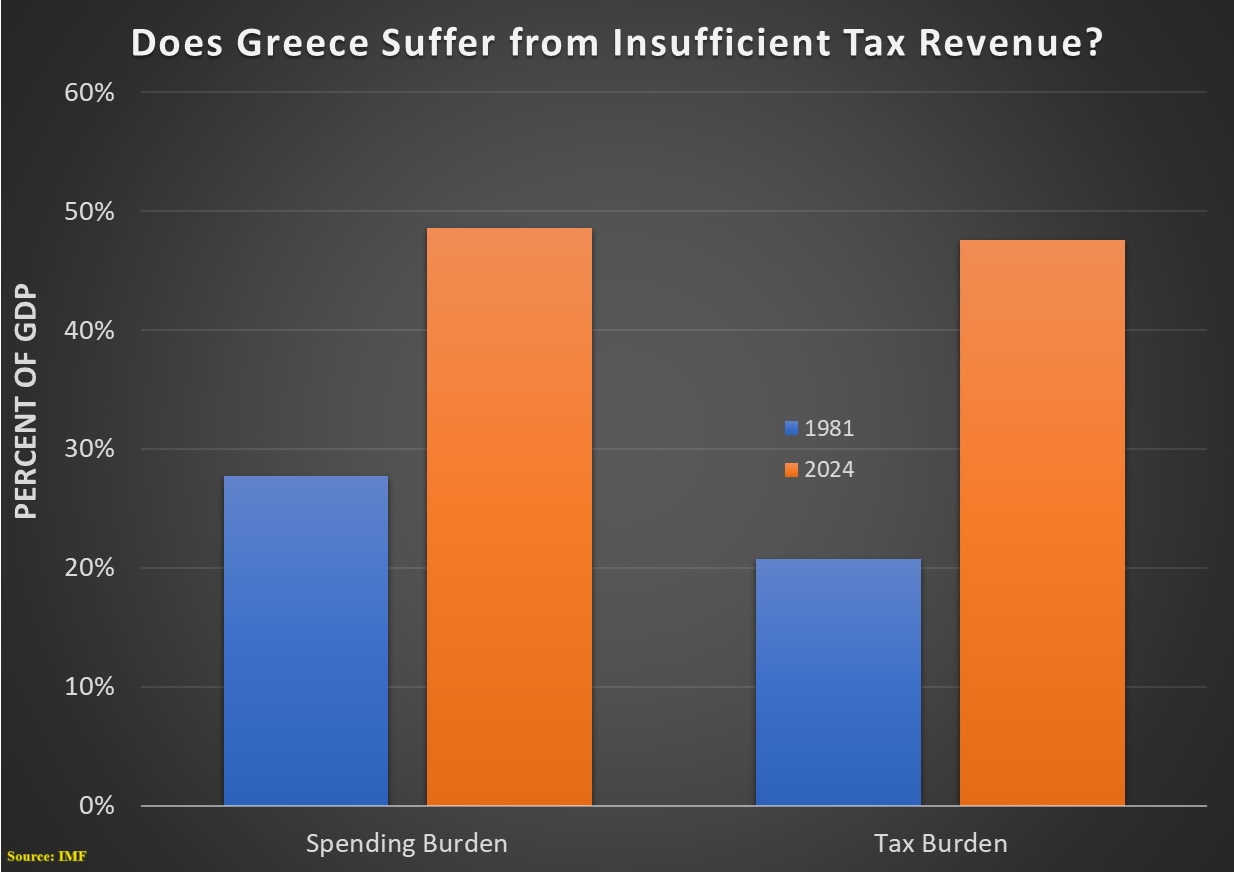

P.S. Just in case anyone thinks there is anything deceptive about the chart at the beginning of this column, here’s a look at the long-run data on taxes and spending in Greece.

The bottom line is that the tax burden and spending burden have increased in the past 15 years, but the numbers over the past 45 years are far more depressing.

Greece is way beyond the growth-maximizing size of government. And even OECD economists agree!

P.P.S. The political appointees are the reason why the OECD produces rubbish. But, to be fair, they don’t discriminate. The bureaucrats push for higher taxes and bigger government in every region of the world (China, Central America, Africa, Asia, Northern Europe, the United States, etc).

P.P.P.S. The Greek government has had interesting and unusual ways of moving in the wrong direction.

No comments:

Post a Comment