December 11, 2024 by Dan Mitchell @ International Liberty

Given the dirigiste mindset of the nation’s politicians, I’ve joked that France’s national sport is taxation. And I mocked a former French President for graciously and mercifully deciding that no residents should pay more than 80 percent of their income to government (at a time when it was not uncommon to have taxpayers with overall tax rates above 100 percent).

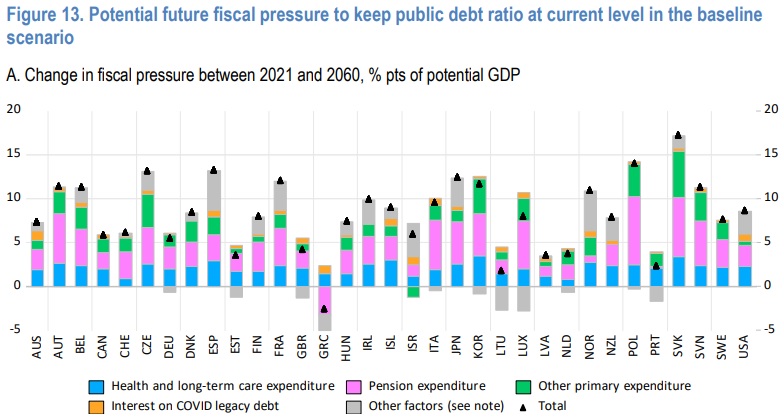

Those were examples from last decade. Now let’s look at some research from the past couple of years. In 2022, I shared a chart showing that the burden of government spending in France was projected to climb by about 12 percentage points of GDP over the next four decades. That sounds terrible, and it is terrible.

But it’s especially horrible news since France already has an excessive burden of spending. Indeed, I shared another chart in 2023 that revealed that France had the worst spending burden in Europe. So France starts in the very worst position and is among the worst when looking at future fiscal decay.

Sadly, very few French politicians have any interest in addressing the problem of excessive spending. The current President, Emmanuel Macron did tweak the age at with retirees could collect benefits. But this very modest reform caused an uproar. There’s been so much turmoil that France now is in the midst of a crisis, as reported by Chris Pope for the Manhattan Institute’s City Journal. Here are some excerpts.

Famously expensive, France’s welfare state imposes some of the world’s most punishing taxes on workers. …To rein in these costs, French president Emmanuel Macron recently pushed through a package of reforms increasing France’s full-retirement age from 62 to 64. …Now, mass protests have caused major disruptions in cities across the country. …

In 2021, government spending accounted for 59 percent of GDP in France, compared with 45 percent in the United States. Spending on public pensions accounts for much of that gap: it’s 15 percent of GDP in France, but only 7 percent in the U.S.

This greatly inflates associated payroll taxes, which alone took 28 percent of workers’ incomes in France, compared with just 11 percent in the U.S. …Whereas workers’ incomes in 1975 were 46 percent higher than those of retirees, by 2016 they were 2 percent lower. …The bulk of France’s public-pension spending goes to the middle class. Unlike in the United States, where Social Security’s benefit formula is designed to redistribute wealth to the poor, France’s pension system pays retirees a similar proportion of their prior earnings every month, regardless of income levels. …

Such an arrangement might have been more sustainable if the ratio of contributing workers to retired beneficiaries had stayed constant. But as life expectancy has risen and birth rates have fallen, the ratio of residents aged 20–64 to those 65 and over declined from 5.1–1 in 1950 to 3.7–1 in 2020, and it is projected to fall to 2.7–1 in 2050. …That burden could be avoided if individuals simply set aside savings for their own retirements, but French workers are trapped by the need also to provide for older generations who were not expected to do so.

I have two main reactions to Pope’s column.

First, he is right that it would be better to have personal retirement accounts (such as the ones that exist in nearby nations such as Switzerland and the Netherlands). But, just as is the case in the United States, that would involve a substantial “transition cost” because a new source of revenue would be needed to finance current benefits if younger workers are allowed to shift their payroll taxes to personal retirement accounts. That’s not impossible, but it’s also not easy.

Second, France needs more than pension reform. As I noted in 2019, France has the highest burden of social welfare spending among developed nation. But if you break down the numbers into various categories, the biggest problem is health spending. Fixing the pension system is a necessary but not sufficient reform to restore fiscal sanity.

Sadly, the political pressure in France is to make a bad situation even worse. Both the hard-left socialists and the right-wing populists are normally enemies, but they share a common desire for more freebies from the government.

Unfortunately for them, France has reached the point Margaret Thatcher warned about. So it’s just a matter of time before really bad things happen (though Italy may hit that point first).

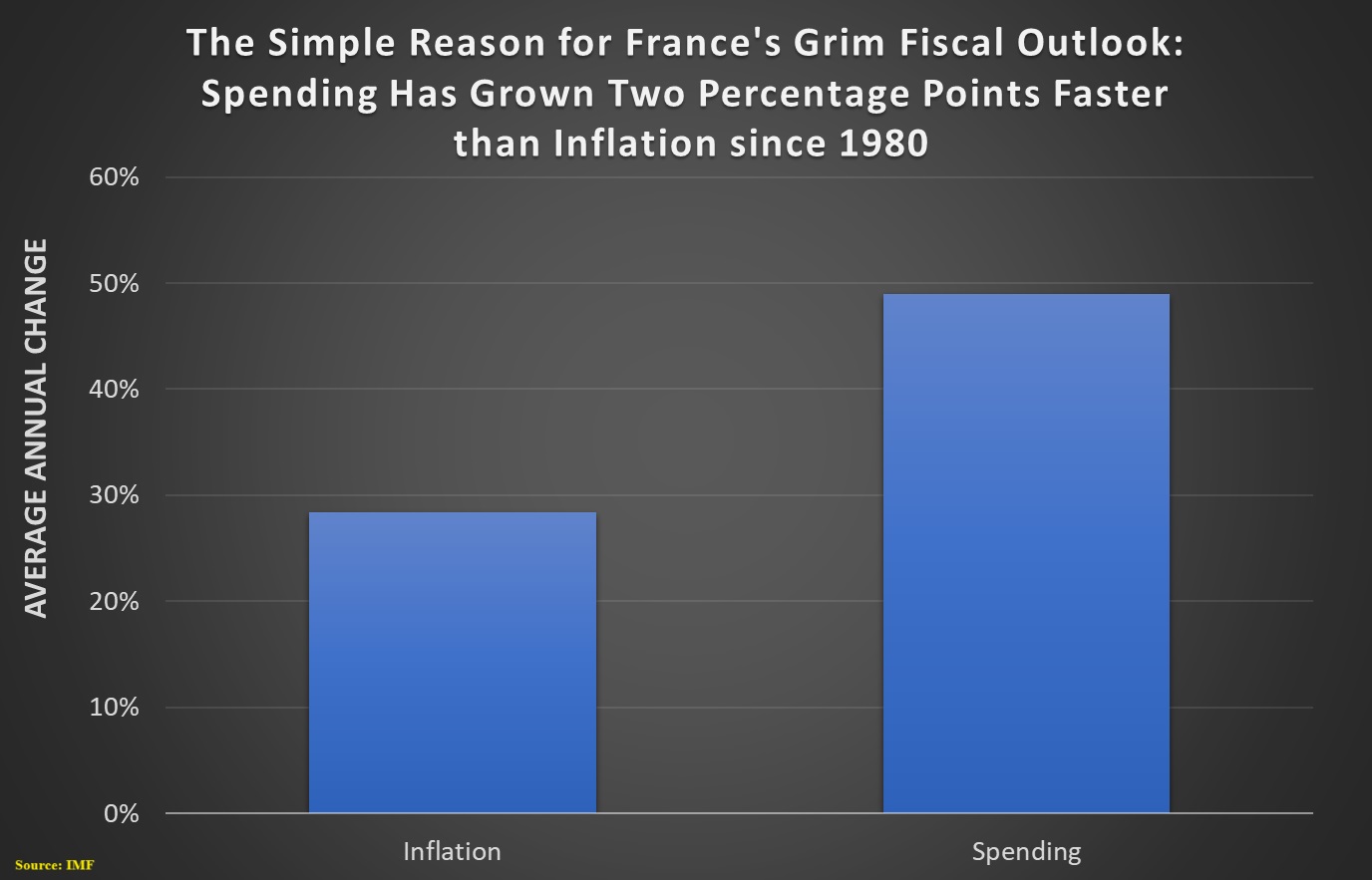

I’ll end with this chart showing why France is approaching a fiscal crisis. Simply stated, government has been growing far too fast.

Too bad France doesn’t have someone like Javier Milei.

Too bad France doesn’t have a spending cap like the one in Switzerland.

No comments:

Post a Comment