December 17, 2024 by Dan Mitchell @ International Liberty

Some people say the Laffer Curve is the economic version of Goldilocks.

But instead of being a story about whether the porridge is too hot,

too cold, or just right, it’s a story about whether tax rates are too

high, too low, or just right.

But I’ve never liked that analogy because it implies the revenue-maximizing tax rate is “just right.”

At the risk of understatement, we don’t want to maximize revenue for politicians.

The goal should be to set tax rates at the growth-maximizing level (raising the small amount of revenue needed to finance the legitimate and proper functions of government).

That being said, it is very instructive to examine research on the topic because even our leftist friends hopefully don’t want tax rates set so high that the government loses revenue.

As such, if the goal is revenue maximization, there’s a fascinating new study that has been published by the Scandinavian Journal of Economics.

The authors, Marie-Noëlle Lefebvre, Etienne Lehmann, and Michaël Sicsic, wrote a summary of their study for VoxEU. Here’s the issue they addressed.

Capital income taxation has re-emerged as a pressing issue, particularly with rising income inequality. …However, capital income taxation also induces more behavioural responses than labour income taxation, thereby diminishing its efficiency. …In a recent paper…, we contribute to a deeper understanding of capital income taxation, both theoretically and empirically, by estimating the ‘Laffer rate’ on capital income tax for France. The Laffer rate is the tax rate above which increasing the rate further would compress tax bases enough to reduce government revenue. We express the Laffer tax rate on capital income using direct elasticity (capital income response) and cross-elasticity (labour income response) to the net-of-tax rate on capital income. …The Laffer rate on capital income depends not only on the direct elasticity of capital income to its net-of-tax rate but also on the cross-elasticity of labour income to the net-of-tax rate on capital income.

And here are their key findings.

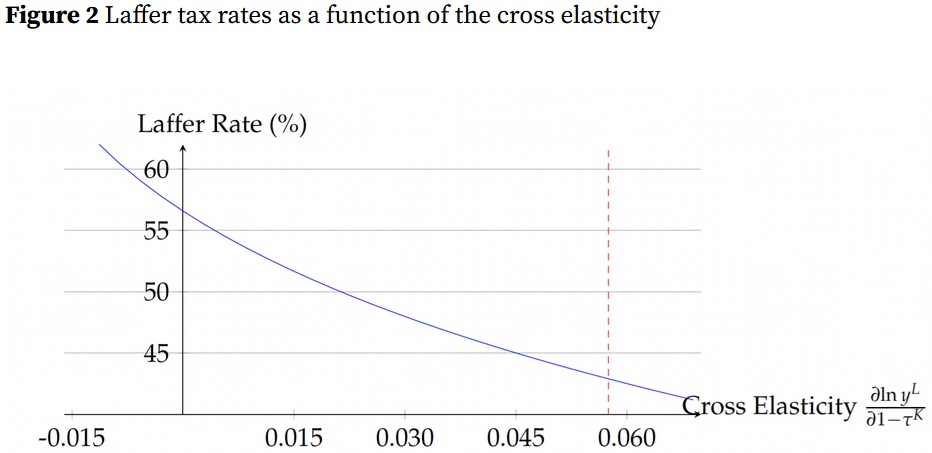

…the 2013 reform provides valuable insights… We therefore go further…by estimating elasticities of capital and labour income with respect to marginal net-of-tax rates (MNTRs) of both labour income and capital incomes. This allows us to estimate sufficient statistics to implement the Laffer formula. …Ignoring cross-response, this estimate leads to a Laffer rate on capital income of approximately 57%. …Moreover, we obtain statistically significant and slightly positive cross elasticities of labour income with respect to marginal net-of-tax rates on capital incomes. …These results suggest that the cross-elasticity is more likely explained by the impact of capital taxation on the incentive to work and save: an increase in the marginal tax rate on capital reduces the benefit of earning additional income from activity in order to save. Accounting for this cross-elasticity reduces the estimated Laffer rate significantly, to about 43%.

For non-wonky readers, what the authors basically found is that the revenue-maximizing tax rate on capital income is lower when you factor in the combined impact of changes in capital income and labor income.

How much lower? It depends on the degree to which taxpayers change their behavior, which is captured in Figure 2 from the VoxEU summary.

This is very interesting research.

I’ll add two points.

First, I’d be interested in how they define capital income. That’s not clear from the VoxEU summary and the actual study is behind an expensive paywall.

Second, I want to emphasize that it is pointlessly destructive to try to set tax rates at or near the revenue-maximizing level. This is because enormous amounts of private sector income are lost in exchange for very small amounts of additional tax revenue.

Regarding that second point, here are some excerpts from a study I summarized about a dozen years ago.

…labor taxes could be approximately doubled before getting to the downward-sloping portion of the curve. But notice that this means that tax revenues only increase by about 10 percent. …this study implies that the government would reduce private-sector taxable income by about $20 for every $1 of new tax revenue. …

What about capital taxation? According to the second chart, the government could increase the tax rate from about 40 percent to 70 percent before getting to the revenue-maximizing point. But that 75 percent increase in the tax rate wouldn’t generate much tax revenue, not even a 10 percent increase. So the question then becomes whether it’s good public policy to destroy a large amount of private output in exchange for a small increase in tax revenue.

Here’s an even better explanation of why higher tax rates are a net loser for society, this one involving higher tax rates on labor income.

I’ll close with the observation that U.S. tax rates on capital income already are very high when you measure the tax bias against income that is saved and invested.

P.S. I have a three-part series (here, here, and here) on the prudent case for the Laffer Curve.

No comments:

Post a Comment