While there are plenty of reasons to be depressed about public policy (particularly the growing burden of government spending), there are a few reasons to feel optimistic.

- Argentina’s libertarian revolution.

- School choice revolution in the states.

- Tax cutting revolution in the states.

Today, let’s focus on the third item.

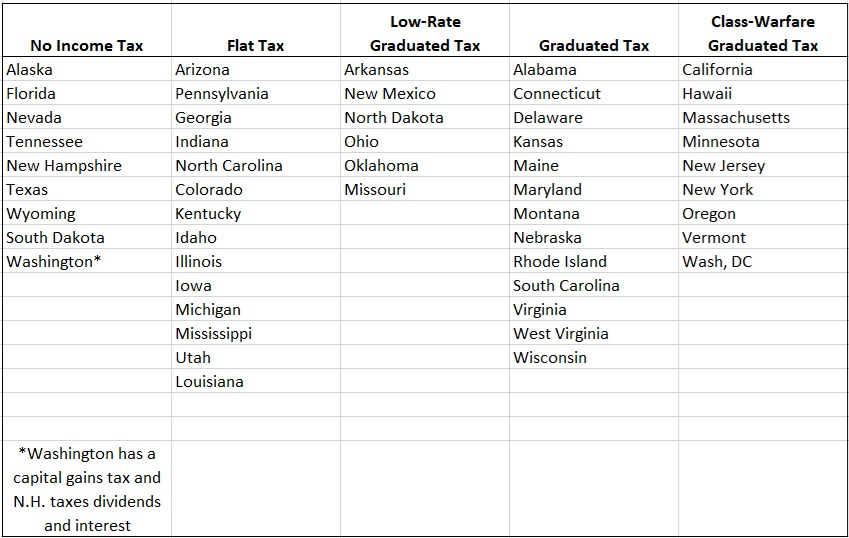

Back in 2018, I created a ranking of states based on tax policy, with the best having no income taxes and the worst having high-rate, class-warfare tax regimes.

Back then (just six years ago), about 60 percent of states were in the worst two categories.

Now it’s less than 50 percent.

And, thanks to Louisiana, there’s even more progress. The Pelican State has joined the flat tax club. Here are some excerpts from a report in the Louisiana Illuminator by

Gov. Jeff Landry scored one of the biggest victories of his political career Friday when he managed to push major corporate and personal income tax cuts through the Louisiana Legislature… A flat rate of 3% will replace all three personal income tax brackets that top out at a high rate of 4.25%. The current sales tax rate of 4.45% will move to 5% for five years, and then lower to 4.75% in 2030. A state corporate franchise tax has been eliminated, and the corporate income tax rate – which now tops out at 7.5% – has been moved to a flat rate of 5.5%. …“We’re more competitive now. We’ve lowered our rates to stay in line with our Southeastern neighboring states, and we’re just excited with hopefully bringing our people home and bringing more business to this state,” Rep. Julie Emerson, R-Carencro, who carried the bulk of the bills for Landry’s tax package.

To see the improvements, here’s an updated version of state tax rankings.

The big change is the number of flat tax jurisdictions. There are now a dozen flat tax states, a big jump from 2018 (and since the flat taxes in Kentucky, North Carolina, and Utah were enacted relatively recently, the 20-year shift is even more impressive).

P.S. In the long run, it’s impossible to have good tax policy without spending restraint. Colorado, Iowa, and North Carolina are role models in this regard. Sadly, Louisiana did not impose a spending cap to accompany tax reform.

P.P.S. While there has been progress in many states, Massachusetts voters made a terrible choice in 2022 and moved their state from the flat tax column to the class-warfare column.

No comments:

Post a Comment