Part I of this series looked at unfunded pension debt of states and Part II examined the unfunded pension debt of cities.

In Part III, let’s look at the degree to which state taxpayers are exposed to big unfunded liabilities for “Other Post-Employment Benefits” such as health care and life insurance.

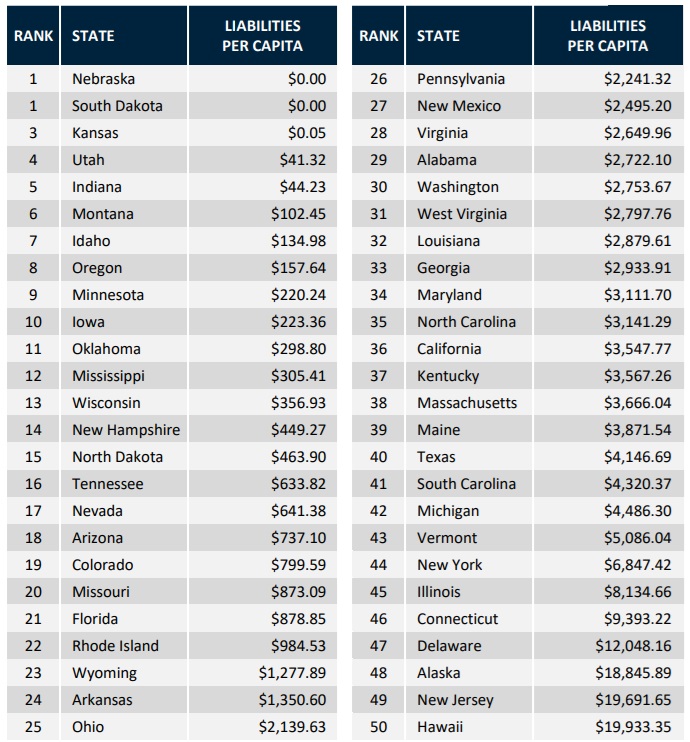

The American Legislative Exchange Council issued a report earlier this year that calculated the state-by-state burdens. Hawaii is the worst of the worst, followed by New Jersey and Alaska. South Dakota and Nebraska do the best job of protecting taxpayers, followed by Kansas.

But what does is mean to be the “worst of the worst”?

The ALEC report calculated that the burden for taxpayers in Hawaii, New Jersey, and Alaska is nearly $20,000 for every man, woman, and child in those states.

That compares to zero burden in Nebraska and South Dakota and almost zero in Kansas.

The nationwide burden of OPEB is now over $1 trillion according to the report.

Here are some highlights (lowlights would be a better term) from ALEC.

Other post-employment benefits (OPEB), also known as the “trillion-dollar acronym,” covers all the benefits a retired public employee is eligible to receive in retirement that are not a pension. These benefits include health insurance, life insurance, Medicare Supplement Insurance, and other benefits. …unfunded OPEB liabilities, now totaling over $1.14 trillion, just under $3,500 for every man, woman, and child in the United States. …

State OPEB plans face many of the same problems as public sector pension plans. Without real reforms, defined benefit OPEB plans will place a severe burden on taxpayers. By offering a range of defined contribution options as well as implicit subsidies by pooling retirees together with active employees, states can keep the promises made to both public employees and taxpayers.

The solution (both for pensions and OPEB) is for states to shift to systems based on “defined contribution” rather than “defined benefit.”

By definition, DC systems don’t have unfunded liabilities. Here’s a summary of the difference between the two approaches put together by the South Carolina-based Palmetto Promise.

The ALEC report notes that the two states with no unfunded liabilities use the DC approach.

Nebraska and South Dakota are the ideal models for state retiree health plans. Plan structures in both states now require current employees and retirees to purchase an HSA, where employees and retirees make tax-free contributions and the states match contributions up to a certain amount as well.

The report also praises Iowa, Indiana, and North Carolina for reforms moving in the right direction.

I’ll conclude by warning that columns about state and local unfunded liabilities may not be overly exciting, but there are big implications. At some point, reckless states such as Illinois and New Jersey are going to suffer a fiscal crisis and some politicians in Washington are going to want to provide bailouts.

That would be horrible policy, rewarding irresponsibility by profligate states.

No comments:

Post a Comment