At the risk of being repetitive, I’ve been arguing (and arguing, and arguing) that the United States should not turn its medium-sized welfare state into a European-style, large-sized welfare state.

Simply stated, that’s a route to economic anemia.

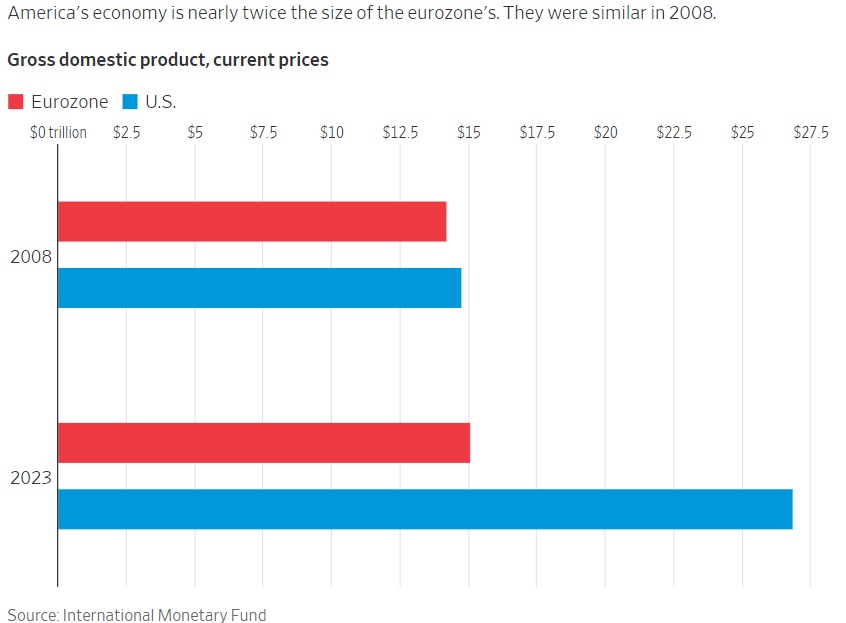

If you don’t believe me, look at this shocking chart, which compares European stagnation to American growth over the past 15 years.

The chart comes from a report in the Wall Street Journal. Here are some excerpts from that article.

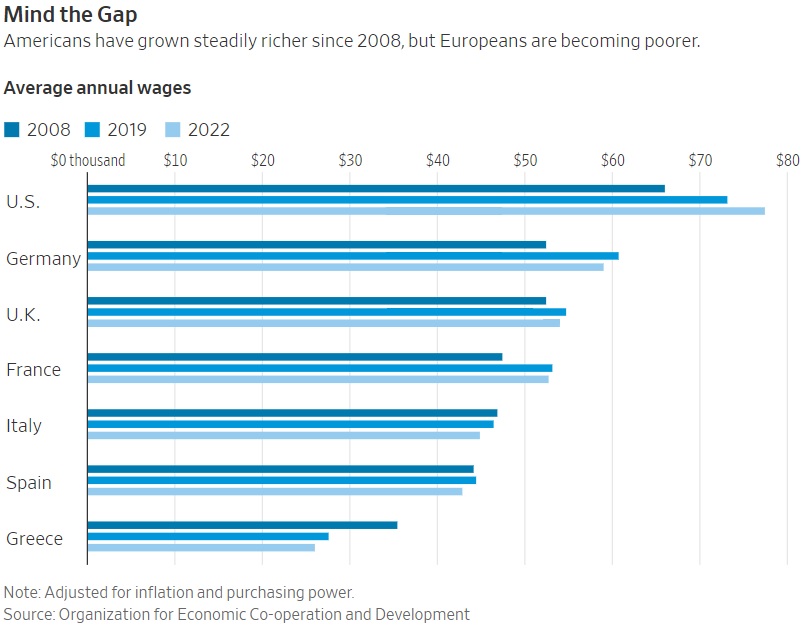

Europeans are facing a new economic reality… They are becoming poorer. …Private consumption has declined by about 1% in the 20-nation eurozone since the end of 2019 after adjusting for inflation… In the U.S., where households enjoy a strong labor market and rising incomes, it has increased by nearly 9%. …Adjusted for inflation and purchasing power, wages have declined by about 3% since 2019 in Germany, by 3.5% in Italy and Spain and by 6% in Greece. Real wages in the U.S. have increased by about 6% over the same period… The eurozone economy grew about 6% over the past 15 years, measured in dollars, compared with 82% for the U.S. …Weak growth and rising interest rates are straining Europe’s generous welfare states… given rising borrowing costs, economists expect taxes to increase, adding pressure on consumers. Taxes in Europe are already high relative to those in other wealthy countries, equivalent to around 40-45% of GDP compared with 27% in the U.S. American workers take home almost three-quarters of their paychecks, including income taxes and Social Security taxes, while French and German workers keep just half.

The last line in the above excerpt merits special attention.

Big government in Europe is very bad for workers, who earn less income. But, to make matters worse, taxes consume a bigger chunk of their smaller incomes.

And the income gap is growing every years, as illustrated by this chart from the article.

Note, by the way, that Greek wages have dropped by nearly $10,000 since 2008. That is partly a consequence of that nation’s fiscal crisis.

As I’ve warned, the same thing is about to happen to Italy.

P.S. And if we don’t reform entitlements in the United States, we’ll eventually suffer the same fate (though politicians will first spend a couple of decades raising taxes and repeating Greece’s mistakes).

Part II

July 19, 2023 by Dan Mitchell @ International Liberty

In Part I of this series, we learned from a report in the Wall Street Journal that the combined economies of the European Union have grown by only 6 percent over the past 15 years compared to 82 percent growth in the United States.

That is stunning evidence that big welfare states lead to economic stagnation.

For Part II, let’s look at a remarkable new study by the Brussels-based European Centre for International Political Economy.

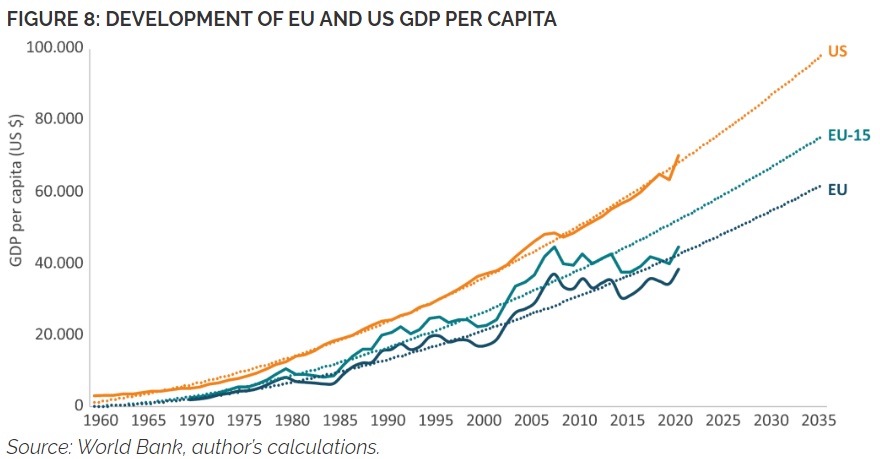

We’ll start with this chart, which shows that the U.S. is much richer. But what’s especially noteworthy is that the gap between the U.S. and E.U. keeps widening even though convergence theory says poorer nations should grow faster than richer nations.

Given the E.U.’s dismal performance over the past 15 years, it seems like the “anti-convergence” is becoming even more pronounced.

Here is some of the analysis from the report, authored by Fredrik Erixon, Oscar Guinea, and Oscar du Roy. They start by emphasizing the importance of long-run growth.

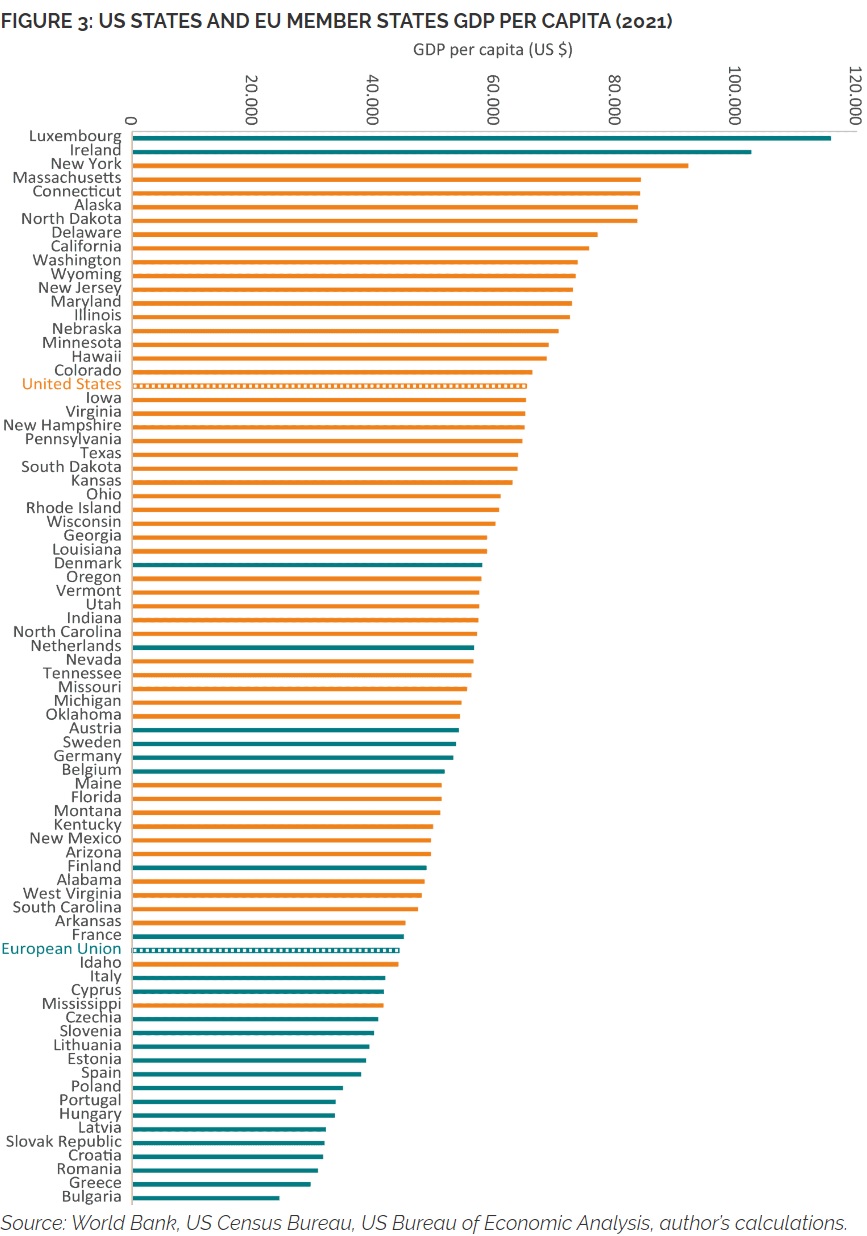

…it is the long-term trend that matters. An economy that grows at 3 percent per year will double in 24 years but an economy that grows at 1 percent per year will double only in 48 years. …If European countries were states in the United States, many of them would belong to the group of poorest… The result of this economic divergence between EU member states and US states is a growing wedge of GDP per capita between the EU and the US, which in 2021 was as large as 82 percent. If the trend continues, the prosperity gap between the average European and American in 2035 will be as big as between the average European and Indian today. …Economic growth in the Euro Area, a region that is comparable with the US, has been deeply disappointing: the region has been falling behind the US since the 1980s… At the current growth rates, it will take 20 years for output per person to double in the US, while in the EU it would take 43 years! …only two EU member states, Luxembourg and Ireland, have a GDP per capita higher than the US average.

One of the most interesting things about the report is the comparison of E.U. nations to American states.

As you can see, almost all American states rank about almost all European nations.

By the way, the above ranking is based on GDP per capita and the report notes that this approach overstates the prosperity of Luxembourg and Ireland.

…their GDP per capita overestimates their level of prosperity. In Ireland, GDP is boosted by large foreign pharmaceutical and IT multinationals based in the country which, while producing goods and services in Ireland, record a significant proportion of their global profits within Ireland. The Central Bank of Ireland estimated that Ireland should instead rank between the 8th and 12th position in the EU if the relevant parts of per capita income are considered. For Luxembourg the story is slightly different. High GDP per capita is mainly due to the cross-border flows of workers in total employment, as they contribute to overall GDP but are not residents of the country.

If you want a less-distorted view, I recommend the OECD’s data on per-capita “Actual Individual Consumption.” And the U.S. lead based on AIC data also has expanded over time.

Part III

July 20, 2023 by Dan Mitchell @ International Freedom

Part I of this series reviewed some data about the United States growing much faster than the welfare states of the European Union.

Part II of the series looked at some very depressing data about the European Union losing ground compared to the United States, even though convergence theory tells us that should not happen.

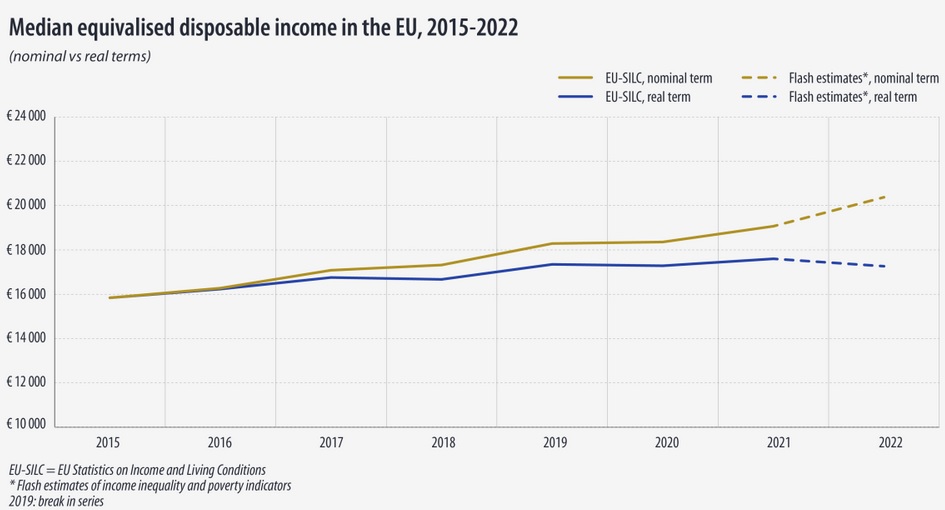

For today’s installment, let’s see what the European Union’s statistical body concluded in a new report about the region’s economic performance. We’ll start with this chart showing that inflation-adjusted disposable income (the blue line) declined last year.

To be sure, American households also suffered a decline in inflation-adjusted income, so this is not just a Europe-specific problem.

Here’s some of Eurostat’s analysis.

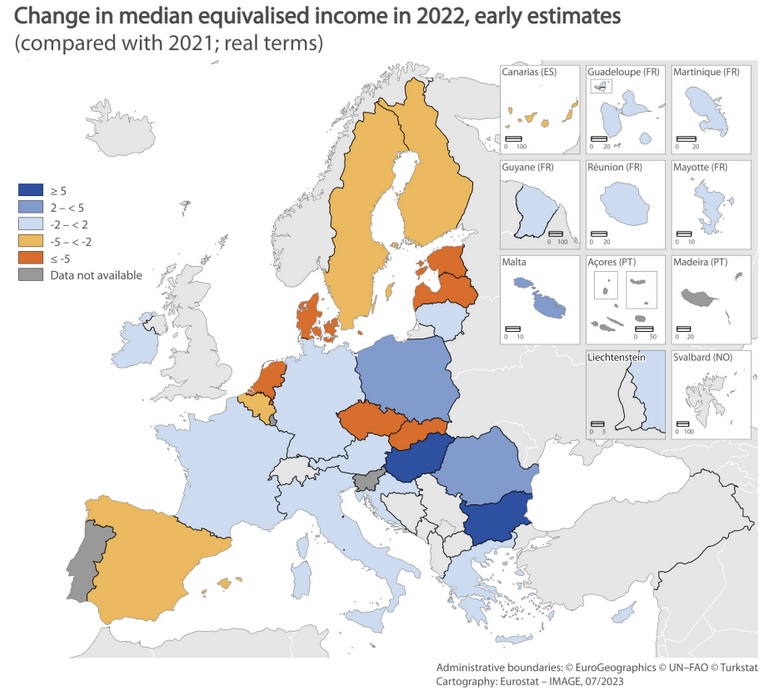

…the nowcasted median disposable income will decrease in real terms in most EU countries. Rising prices for essential items (goods and services), such as food, energy and transport were the main reason for the decrease of the real income. …It is estimated that inflation led to a 1.9 % decrease for EU median disposable income in real terms in 2022 (compared to 2021). The effect of inflation is likely stronger for low-income households, as essential items represent a higher share of their overall consumption, and they have little margin for adjusting their consumption. In this context, the at-risk-of-poverty rate anchored in 2021…is estimated to statistically significant increase for about half of the EU countries. …Figure 6 shows the change in median disposable income in real terms at country level. The largest decreases were estimated in Estonia, Latvia, the Netherlands, Denmark, Slovakia and Czechia. It increased most sharply in Hungary and Bulgaria.

Here’s the map showing which nations enjoyed more real income in 2022 (dark blue) and which ones suffered big losses (dark orange).

Though don’t assume that nations such as Hungary and Bulgaria had good policy.

Inflation-adjusted disposable income can go up for good reasons (faster growth, lower taxes), but it also can increase for not-so-good reasons (more handouts).

P.S. The data above does not include the United Kingdom, which wisely left the European Union, or Switzerland, which wisely never joined.

No comments:

Post a Comment