Thomas L. Hogan March 18, 2021 @ American Institute for Economic Research

Thomas L. Hogan March 18, 2021 @ American Institute for Economic Research

Last week, President Biden signed legislation that will increase fiscal spending by $1.9 trillion. While often referred to as a “stimulus” bill, it might be better described as “relief” (although in truth, most of the spending is neither for relief nor stimulus).

The prior week, a strong employment report showed that the US economy added 379,000 jobs in February, bringing the national unemployment rate down to 6.2 percent.

What does this news mean for the direction of the economy? What should we expect from the massive increase in federal government spending or further monetary expansion?

A closer look at unemployment

The labor market has mostly recovered from the major disruptions of a year ago. Unemployment has fallen to less than half of its 14.7 percent peak last April and is now very close to the US long-run average around 6 percent.

Unfortunately, the national average of 6.2 percent is not a good representation of the current state of the US economy due to an unusually wide dispersion in state-level unemployment.

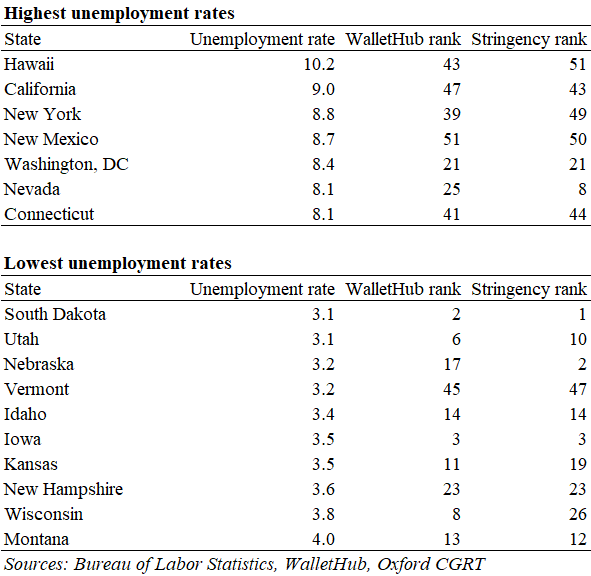

According to the most recent data available, as of January there were ten US states with very low unemployment rates of 4 percent or less. These rates are historically low. For example, only five times since the Great Depression has the US average reached as low as 4 percent.

At the same time, however, six states plus the District of Columbia have very high unemployment rates above 8 percent. These too are historic highs, only seen three times nationally since the Great Depression.

What is causing this unprecedented divergence between states? Government lockdowns and business restrictions.

Where employment is illegal

Many state and local governments have restricted business operations in a number of industries, making it difficult or even illegal to employ workers. New York City retail businesses are allowed to operate at 50 percent capacity, while restaurants remain at only 35 percent, increasing to 50 percent this weekend. In California, bars and concert venues are closed, dine-in restaurants are at 25 percent capacity, and nonessential workers are required to work from home. Theaters and other entertainment and hospitality businesses are beginning limited reopenings, but many employers are closed for good, leaving the former workers, and in many cases former small business owners, to the rolls of the unemployed.

The table below shows the six states and Washington, DC with high unemployment rates above 8 percent and the ten with low rates of 4 percent or less, along with the rankings of their restrictions as of early January according to two sources. The WalletHub rank is a weighted average of “across 14 key metrics […] from whether restaurants are open to whether the state has required face masks in public and workplace temperature screenings.” The stringency index is from the database of US state level Covid-19 Policy Responses from the Oxford COVID-19 Government Response Tracker (CGRT) based on “18 indicators such as school closures and travel restrictions.” In both measures, high numbers represent greater restrictions.

Of the seven with unemployment rates of 8 percent or higher, five are in the top half of coronavirus restrictions according to both WalletHub and the Oxford CGRT. Washington, DC ranks 21st on each index, although the official number likely understates the true stringency due to its dependence on the federal government. The other exception is Nevada, which ranks 25 out of 51 according to WalletHub but just eighth by the Oxford CGRT. Google mobility data for Nevada have been very low, suggesting that activity has declined more in Nevada than in other states. Considering that Nevada––and Las Vegas in particular––is a major tourist destination, the decline potentially has as much more to do with government rules in other states, which require quarantining upon return, as it does with individuals to restrict activity on their own.

Nine of the ten states with unemployment rates of 4 percent or less are in the bottom half of both indexes of coronavirus restrictions. Vermont is the one exception. Google mobility data show active movement across the state that would position it in the middle range among all US states. Vermont may be closed according to the law, but it seems to be open in practice.

While rates of unemployment have likely fallen since January, the state-level data reveal a consistent pattern. Unemployment rates are directly related to the strictness of coronavirus lockdowns and business restrictions. Closed states have high unemployment because it is illegal for businesses to employ people.

Fiscal spending

Given that unemployment is strongly related to economic restrictions, what should we expect from increased fiscal spending?

The goal of fiscal policy is to draw unemployed people and resources into the economy. The government hires workers who are unemployed, or it hires from businesses who then need to replace their lost workers and so on until (at least in theory) jobs are filled from the ranks of the unemployed. But this cannot happen in states with strong lockdowns and legal restrictions that prevent businesses from operating.

Fiscal spending is also not helpful in states with low restrictions. Unemployment is already low in these states, so there are few unemployed workers to draw upon. More government spending will encourage wasteful production, as businesses invest in and workers are bid into pursuits that are less efficient and may be ultimately unsustainable.

Monetary policy

In addition to fiscal spending, the Federal Reserve plans to continue its policies of monetary expansion. In recent congressional testimony, Fed Chair Jerome Powell downplayed the risks of inflation and said that further assistance is needed to support the recovery.

As with fiscal spending, more money is unlikely to improve economic conditions at present. It can do little to lower unemployment in states with lockdowns, where businesses are not allowed to operate. It will not reduce unemployment in states that have low unemployment already. In fact, the historic lows seen in those states may be caused in part by the Fed’s previous monetary expansion being directed to open states since in closed states, those funds were more difficult to use.

The only stimulus is ending lockdowns

The evidence is clear: Lockdowns and restrictions are causing high unemployment in many states. Such restrictions make it illegal to employ workers or to be employed. Neither fiscal spending nor monetary expansion can reduce unemployment where working is not allowed. Such policies are also not likely to improve states that are open and already experiencing strong economic growth.

What about states in the middle range with moderately restrictive policies? Luckily, several have recently announced they will be ending lockdowns soon. Americans in those states will soon be free to work, earn a living, and provide for themselves and their families. Much of the recent job growth has been in restaurants and hospitality, industries that were previously restricted but now allowed to thrive once again.

Regardless of what one believes about the health costs or benefits of lockdowns, preventing businesses from operating is clearly bad for the economy. Fiscal spending and monetary expansion cannot improve matters while these restrictions remain in place.

No comments:

Post a Comment