The capital gains tax is double taxation, and that’s a bad idea (assuming the goal is faster growth and higher wages).

Let’s consider how it discourages investment. People earn money, pay tax on that money, and then need to decide what to do with the remaining (after-tax) income.

If they save and invest, they can be hit with all sorts of additional taxes. Such as the capital gains tax.

If you want to be wonky, a capital gain occurs when an asset (like shares of stock) climbs in value between when it is purchased and when it is sold.

But stocks rise in value when the market expects a company will generate more income in the future.

Yet that income gets hit by both the corporate income tax and the personal income tax (the infamous double tax on dividends).

So a capital gains tax is a version of triple taxation.

Now that I’ve whined about capital gains taxation, let’s see what happens when a country moves in the right direction.

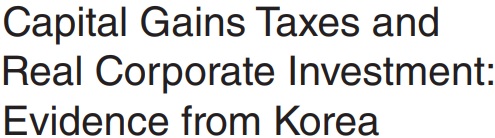

Professor Terry Moon, from the University of British Columbia, authored a study on the impact of a partial cut in South Korea’s capital gains tax. His abstract succinctly summarizes the results.

This paper assesses the effects of capital gains taxes on investment in the Republic of Korea (hereafter, Korea), where capital gains tax rates vary at the firm level by firm size. Following a reform in 2014, firms with a tax cut increased investment by 34 log points and issued more equity by 9 cents per dollar of lagged revenue, relative to unaffected firms. Additionally, the effects were larger for firms that appeared more cash constrained or went public after the reform. Taken together, these findings are consistent with the “traditional view” predicting that lower payout taxes spur equity-financed investment by increasing marginal returns on investment.

There are several interesting charts and graphs in the study.

But this one is particularly enlightening since we can see big positive results for the firms that were eligible for lower tax rates compared to the ones that still faced higher tax rates.

Richard Rahn wrote about capital gains taxation late last year.

Here are some excerpts from his column in the Washington Times.

Would you vote for a tax that frequently taxes people at an effective rate of 100% or more, misallocates investment, reduces economic growth and job creation, often becomes almost impossible to calculate, and in many cases reduces, rather than increases, revenue for the government? …So-called “capital gains” are price changes most often caused by inflation, which, of course, is caused by incompetent or corrupt governments. …Some countries explicitly allow for the indexing of a capital gain for inflation. Other countries have no capital gains tax at all because they recognize what a destructive tax it is. …The current maximum federal capital gains tax is 23.8%. …“Build Back Better” (BBB) bill would push the top rate to 31.8%…and…citizens of states with high state income tax rates like California, New York, and New Jersey would find themselves paying destructive rates from 43 to 45%.

Needless to say, it is a bad idea to impose a 43 percent-45 percent tax on any type of productive behavior.

But it is downright crazy to impose that type of tax on economic activity (investment) that also gets hit by other forms of tax.

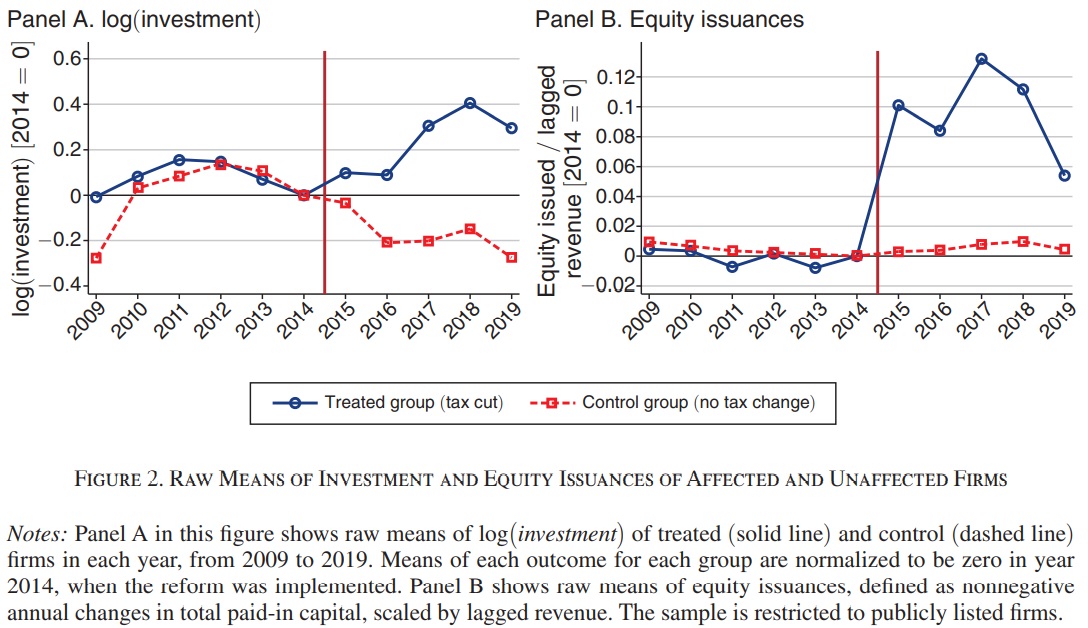

Let’s close with this map from the Tax Foundation. As you can see, some European nations have punitive rates, but countries such as Belgium, Slovakia, Luxembourg, the Czech Republic, and Switzerland wisely have chosen not to impose a capital gains tax..

P.S. For more information, I invite people to watch the video I narrated on the topic. And this editorial from the Wall Street Journal also is a good summary of the issue.

P.P.S. Biden wants America to have the world’s worst capital gains tax. To learn why that’s a bad idea, click here and here.

No comments:

Post a Comment