October 31, 2024 by Dan Mitchell @ International Liberty

I realize the election is just a few days away and there are many bad ideas to analyze from both candidates, but I can’t resist sharing this preposterous soundbite from a woman at the (horribly misnamed) International Growth Centre at the London School of Economics.

I have the video set to begin at the start of the soundbite and the relevant part only lasts about 10 seconds. For those who don’t want to bother clicking on a video, she says, “The big issue is that developing countries don’t collect enough tax. For example, in Zambia, where I’m from, we only collect a third of the revenue that we need.”

Those are two of the most absurd sentences ever uttered.

Let’s start with her second sentence about Zambia only collecting “a third of the revenue that we need.”

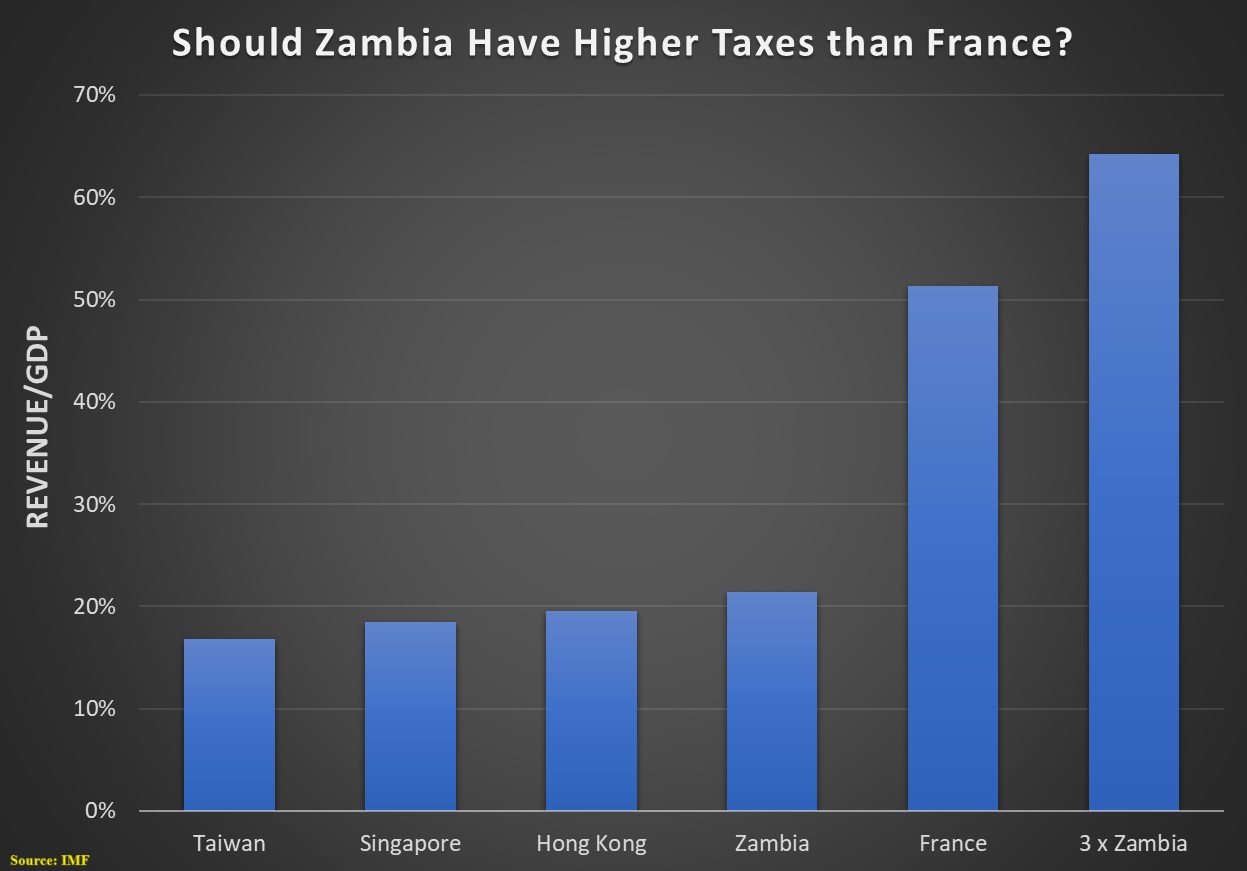

I went to the IMF’s World Economic Outlook database and found that government revenues are about 21.4 percent of GDP in Zambia. At which point three things came to mind.

- The tax burden is already far higher than it was when North American and Western European nations became rich in the 1800s and early 1900s (when fiscal burdens averaged about 10 percent of GDP).

- The very successful Asian Tigers of Taiwan, Singapore, and Hong Kong show that a government easily can finance things such as roads, education, and health care with revenues of less than 20 percent of GDP.

- If Zambia tripled its tax burden, as the woman favors, the tax burden would be the highest in the world, diverting nearly 65 percent of the economy into the hands of politicians. Which is worse even than France.

Here’s a chart showing the numbers.

I realize that most readers don’t spend any time thinking about Zambian fiscal policy, so now let’s shift to the more important issues, which is her assertion the first sentence that “developing countries don’t collect enough tax.”

|

Sadly, the woman is not alone. International bureaucracies such as the International Monetary Fund, United Nations, and Organization for Economic Cooperation and Development have also latched onto the bizarre theory that poor nations can grow faster if they raise taxes and increase the burden of government spending.

This isn’t April 1. I’m not joking.

To understand why this is nonsense, here’s a video from the Center for Freedom and Prosperity.

I highlighted two absurd sentences from the first video.

Here’s the sentence I want to highlight from the second video: “There’s no nation anywhere in the world that has become rich with big government.”

Indeed, when I debate folks on the left, I give them my “never-answered question.” I ask them to identify a country in recorded history that has successfully used higher taxes and more spending as a route to prosperity.

Not surprisingly, they never have a good response (they sometimes give bad responses because they misinterpret Wagner’s Law).

No comments:

Post a Comment