I was going to continue my Second-Edition-of-Trump series (see here, here, here, and here) by writing about what to expect with regards to trade (pessimistic) and then taxes (optimistic).

But I’m shifting gears today because the bureaucrats at the International Monetary Fund are once again peddling their nonsensical claim that higher taxes and bigger government are a recipe for faster growth in poor nations.

I’m not joking. Here’s the IMF’s hypothesis (which is also shared by the OECD and UN).

You may think I’m being sarcastic, but this is a completely accurate depiction of the IMF’s argument. The bureaucrats simply assert that bigger government will deliver more growth and that it is therefore good to raise taxes to enable more spending.

The latest example is an IMF report on property taxes. Here are some excerpts.

Property taxes are often under-exploited sources of local public revenues. A broad-based tax, raised at modest rates, can potentially generate significantly higher revenues in many countries…motivated by the resource mobilization needs of developing countries…design considerations are also pertinent for advanced and emerging market economies seeking to increase the revenue productivity of property taxes. …Significant scope exists for increasing revenues from property taxes, especially in developing countries. Total property taxes in Sub-Saharan Africa and Emerging Asia barely raised 0.1 percent of GDP in 2021… A reasonable target for property tax revenue-to-GDP is between 1 and 2 percent. …A well-designed and properly administered property tax can mobilize revenues.

By the way, the bulk of the report is a straightforward description and analysis of property taxes and how they operate in various countries.

But the authors (Martin Grote and Jean-François Wen) apparently couldn’t resist adding ideological – and wholly unsupported – comments such as “resource mobilization needs” and “increasing revenues” and “mobilize revenues.”

For what it’s worth, I would not have objected if the report mentioned higher property taxes in the context of revenue-neutral tax reform (to their credit, the authors did note that property taxes are “less distortive than taxes on labor because the relative immobility of real estate limits the behavioral responses to the tax”).

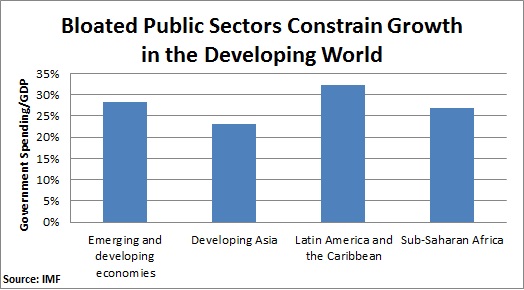

The bottom line is that developing countries do not need bigger government.

As I noted back in 2016, poor nations on average already have public sectors that are way above the growth-maximizing level. Especially when you consider that Western nations became rich in the 1800s and early 1900s when the burden of government spending only consumed about 10 percent of economic output.

P.S. In the grand scheme of things, the IMF report discussed today is only incidentally bad and therefore not nearly as bad as this nonsensical claim.

No comments:

Post a Comment