With regards to economic policy, Herbert Hoover and Franklin Roosevelt were two peas in a pod. They both responded to an economic downturn by dramatically expanding the size and scope of government. As a result of those mistakes, they turned a recession into the Great Depression.

But that statement doesn’t come close to capturing the terrible consequences of their statism. So I went to the Maddison database and created two charts that illustrate the utter failure of Hoover’s interventionism and FDR’s New Deal.

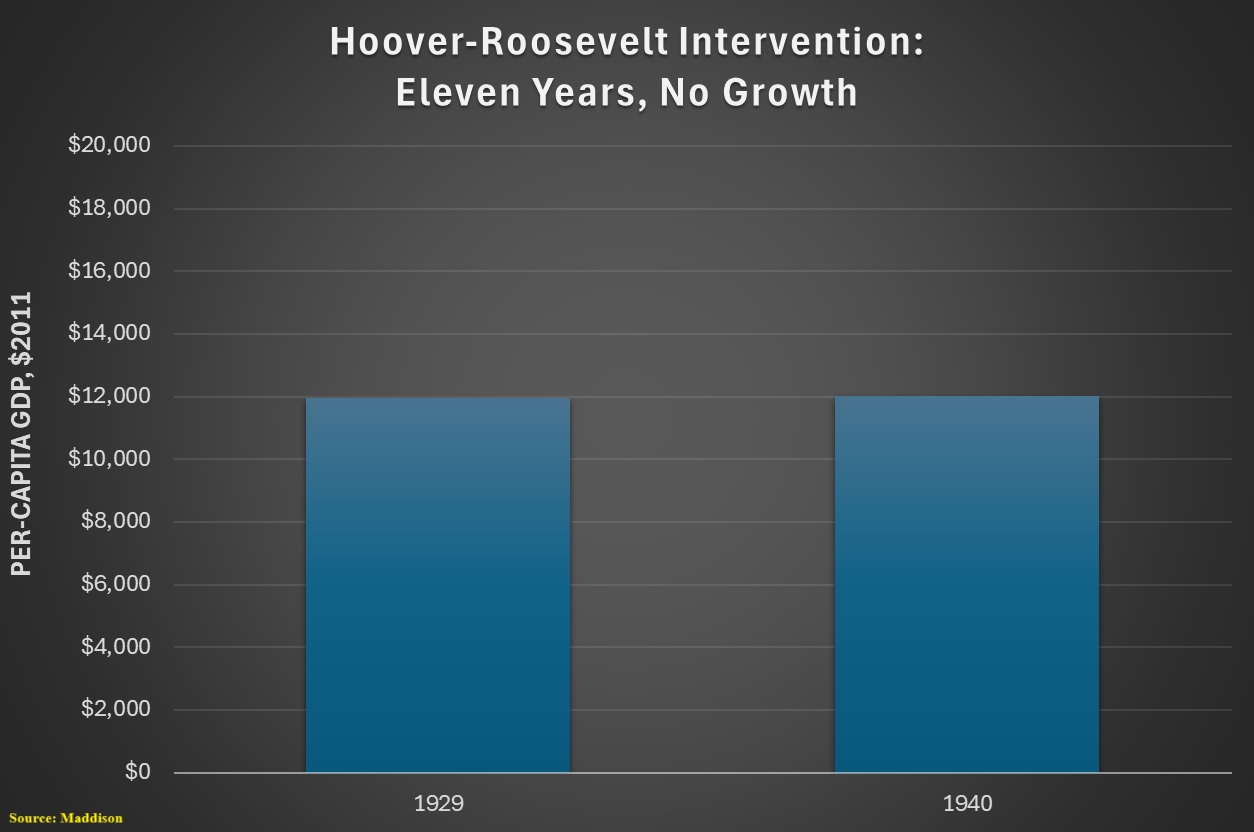

The first chart is very straightforward, showing that there was almost zero growth in per-capita GDP between 1929 and 1940.

That’s a miserable performance, and it is also is a massive historical anomaly.

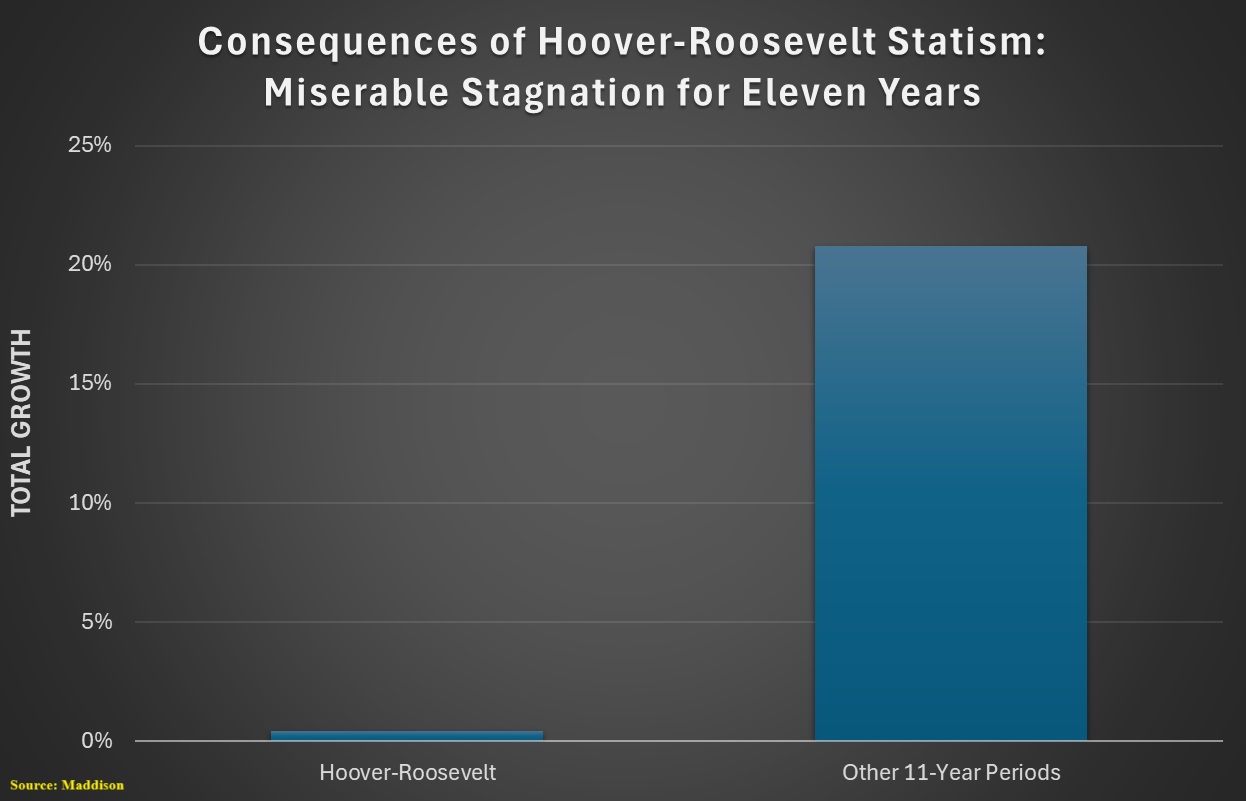

Here’s another chart comparing the 11-year change in per-capita GDP during the Hoover-Roosevelt era of statism with the average of every other 11-year period from the end of the Civil War until today.

The bottom line is that there have been plenty of recessions in American history, but they usually have not lasted very long and they’ve been more than offset by periods of growth.

It was only when Hoover and Roosevelt delivered 11 years of statism that America suffered 11 years of stagnation. Let’s now augment GDP data with some analysis. In a column for Law & Liberty, Amity Shlaes wrote about how the Hoover-Roosevelt policies were a failure that deepened and lengthened the Great Depression.

If you’re in a rush, these excerpts summarize her findings.

…many historians have been unwilling to probe the effect of Roosevelt’s multi-year recovery program, the New Deal. …Why did recovery not return after five years, or after seven? …It was the duration that made the Depression great. …These days, politicians routinely invoke the New Deal as a model of inspiration…even though the New Deal never…“put America back to work.” …other factors, well documented by the extensive studies of the early years, exacerbated the subsequent downturn: the young Fed’s missteps, an international crisis, the collapse of vulnerable small banks across the land. …

Historian Robert Higgs has developed a useful thesis to explain this lost decade: “regime uncertainty,” the notion that an erratic, aggressive government can terrify businesses into slowdown. …the downturn after 1929 would not have become the Great Depression had Presidents Hoover and Roosevelt replayed the restrained federal policy of the early 1920s: reduce uncertainty and allow the market to take the lead.

She documents some of Hoover’s failures.

Congress passed, and President Herbert Hoover went along with, a damaging tariff, Smoot-Hawley. …Hoover, unlike Harding or his successor Calvin Coolidge, was inclined to action. …Hoover therefore turned to measures his “do less” predecessors would have eschewed. …

Hoover loaded burdens on business with a large tax hike, raising the top income tax rate to 63% from 25%. Even Hoover’s smaller interventions today look perverse: At a time when transactions were difficult, Hoover threw sand in the gears by introducing a tax on checks. …Hoover likewise tried to manage prices in another new area: labor. …Under a then-novel theory, higher wages would prompt recovery because they would invigorate workers and enable workers to spend more, stimulating the economy.

Amity then explains that Roosevelt delivered more of the same.

Like Hoover before him, …Roosevelt promised..new interventions. …With his New Deal, the President claimed that license. In the famous 100 Days, his first legislative drive, Roosevelt established dozens of large programs to oversee or alter virtually every sector of the economy. The National Recovery Administration, tasked with managing the industry, became the centerpiece of the New Deal. …

Under statutes bearing visible traces of Benito Mussolini’s syndicalism, the NRA assigned large firms and industry leaders, to draft codes to promote efficiency in their markets. These codes spelled out in magnificent detail right down to what price a cleaner might charge to press pants, or which chicken a butcher must kill first — every aspect of daily business. …the NRA’s corollary agency in agriculture, the Agricultural Adjustment Administration both forced and paid farmers to destroy their crops, again on the principle that less product would drive up prices. …Though Hoover had raised taxes, Roosevelt boosted them yet again, specifically targeting those who were most likely to create jobs through investment: top earners.

Amen. Amity is right (and historians are wrong) about the destructive policies of the 1930s.

P.S. Amity also includes some discussion of what happened during the “Forgotten Depression” shortly after the end of World War I. Harding did the opposite of Hoover and Roosevelt and got infinitely better results.

In the early 1920s, …Washington and the young Fed addressed a severe downturn by halving federal spending and raising interest rates. These moves would today be considered counterintuitive, to put it politely. …a new president, Warren Harding, sent a signal: there was no need for grand reform from the government, despite the downturn. …

Assailing the heavy burden of taxes postwar, Harding, once elected, made it clear to the public that he intended to reduce taxes wherever and whenever he could. Fewer burdens would free the private sector to pull the country forward. It did. Indeed, the economy recovered so rapidly that the early 1920s downturn is today known as The Forgotten Depression. Stock prices rose dramatically, more than tripling over the decade. Jobs materialized, and most importantly, the standard of living increased. Productivity gains meant the old six-day work week could drop to five days. That gave America a gift we still enjoy: Saturday.

P.P.S. Fortunately, FDR was not able implement his “Second Bill of Rights” or his proposal for a 100 percent tax rate.

P.P.P.S. Some claim that World War II spending shows that Keynesian economics can work, but proponents of that view have never been able to explain why the economy didn’t fall back into depression when the war ended.

No comments:

Post a Comment