November 25, 2024 by Dan Mitchell @ International Liberty

I’m in Argentina this week, where I will be giving a speech about the flat tax on Wednesday. But I’m not going to use today’s column to regurgitate my thoughts about tax reform.

Instead, I want to dedicate today and the next few days to analyzing the track record of President Javier Milei, the world’s only libertarian leader.

Back in April, I shared some analysis about Milei reducing the burden of government spending by 4 percent of GDP. That seemed very impressive (akin to shaving about $1 trillion from the spending burden in Washington).

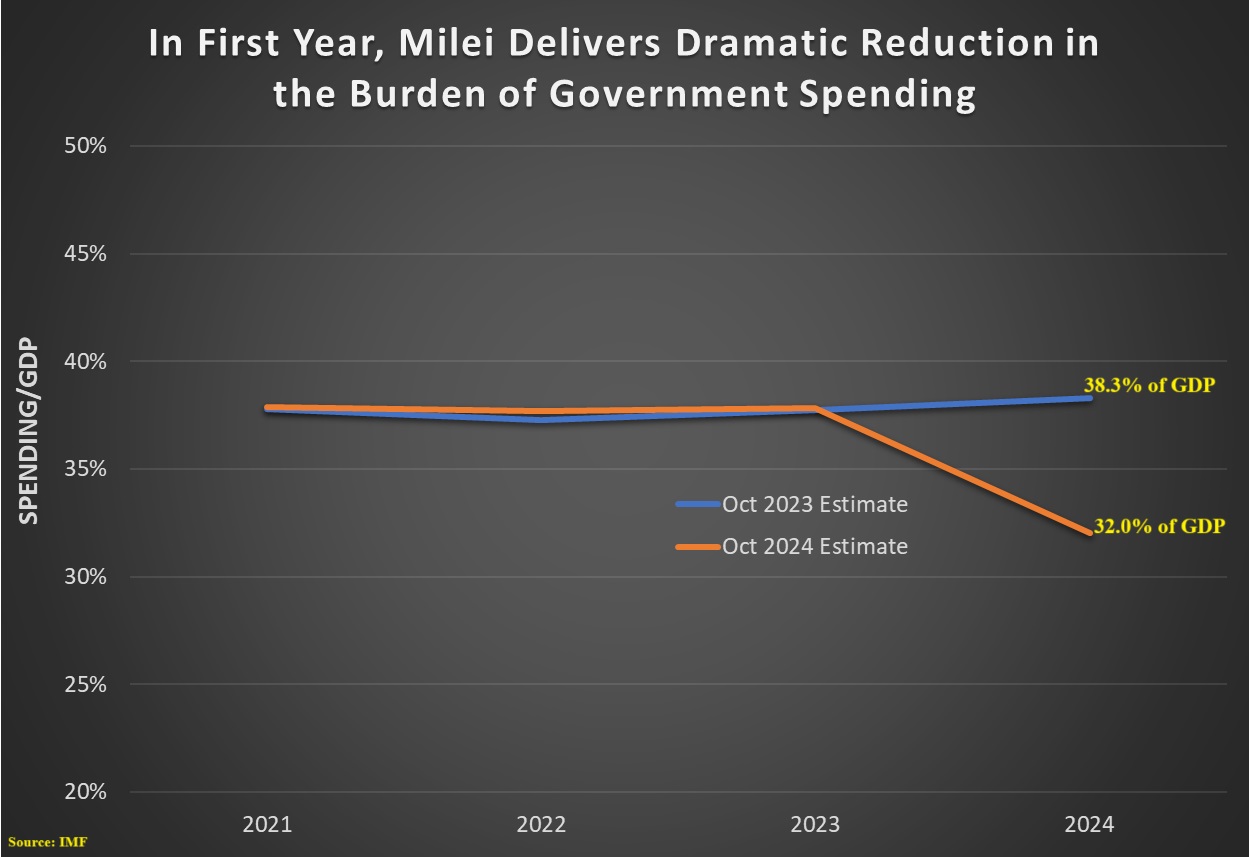

So I decided to investigate whether President Milei maintained that progress, and the best way to measure his impact is to compare the IMF’s estimates of annual spending burdens published in October 2023 and October 2024.

Since Milei was elected in November 2023, any change in the 2024 forecast presumably captures the effect of his reforms.

Here’s the data. Lo and behold, the burden of spending in 2024 is now projected to be 32.0 percent of GDP, more than six percentage points lower than the estimate (38.3 percent of GDP) from last year.

This is astounding progress.

By the way, the IMF numbers show the total burden of government spending, so Milei’s numbers don’t look good because of any budget games (such as shifting spending to local or provisional governments).

The bottom line is that the overall spending burden in Argentina has dramatically declined. On that basis, Milei’s first year has been a smashing success. Makes Ronald Reagan seem like a big spender by comparison.

P.S. Argentina is expected to have a small budget surplus this year, which is remarkable since last year’s deficit exceeded 5 percent of GDP. This is further confirmation that treating the disease of excessive spending is the only effective way of dealing with the symptom of red ink. I can say with near-100 percent certainty that tax increases would not have produced similarly positive results

No comments:

Post a Comment