I’m a fan of the no-tax increase pledge for the simple reason that our greatest economic threat is the rising burden of government spending.

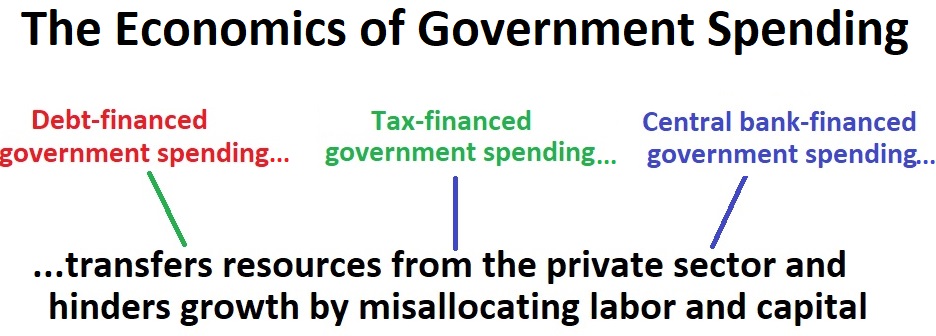

And since there are only three ways that politicians can finance spending (taxes, borrowing, and money-printing), I’m in favor of making those options more difficult.

Sadly, some GOP politicians don’t understand – or don’t care – about restraining the burden of government spending.

Using global warming as an excuse, they want a big tax on some imported goods.

The Wall Street Journal editorialized against the pro-tax wing of the Republican Party.

Too many Republicans these days have lost their economic bearings. Look no further than a GOP Senate bill that would enact a carbon tariff—i.e., a new tax. …The Foreign Pollution Fee Act, sponsored by Louisiana’s Bill Cassidy and South Carolina’s Lindsey Graham, could well have been written by the Sierra Club and AFL-CIO. …

The bill would expand the administrative state by creating a new bureaucracy with sweeping powers that would be hard for future Congresses to rein in. …the bill defines “pollution” as “greenhouse gas emissions.” This is a gift to Democrats who have been trying to codify the Supreme Court’s misconceived Massachusetts v. EPA (2007) ruling that let the Environmental Protection Agency regulate greenhouse gases as pollutants. This is the Administration’s legal justification for its back-door ban on gas-powered cars. …

The bill’s unstated purpose is to protect American businesses from foreign competition as they face rising energy costs at home owing to the government’s force-fed green-energy transition. Mr. Cassidy..’s right that rising energy prices could discourage U.S. manufacturing investment and undercut Washington’s industrial policy. But layering a carbon tax on top of sundry green-energy subsidies would raise U.S. manufacturers’ costs and create a Rube Goldberg contraption of economic distortions. …Senate Democrats last Congress introduced two carbon tariff bills, which have the added virtue for progressives of raising revenue they can spend.

Daren Bakst of the Competitive Enterprise Institute opined about this issue in a column for the Hill.

…new taxes, higher prices, punishing energy use, and giving foreign countries leverage over how the U.S. regulates. …a handful of Republicans are promoting a policy idea that will lead to those very outcomes. A carbon tariff is a tax on imported goods. It would result in American businesses and consumers paying higher prices. …

There are actually two taxes of concern with these bills: the tax on imports and a domestic carbon tax. Once an emissions measuring scheme for domestic and foreign products has been established to impose a carbon tariff, it will also put in place the structure necessary for domestic carbon tax advocates to impose this new tax on Americans.

It would be naïve to think otherwise. In fact, a domestic carbon tax would likely be required in order to impose a carbon tariff that complies with our international trade obligations. …a carbon tariff is a tax on the energy that makes modern life possible and keeps billions of people alive every winter.

Put more simply, it’s a tax on modern life. It would, among other things, make medical care, housing, communications, and transportation less affordable, especially for people who already struggle to pay their bills. …Policymakers, regardless of party, should reject anything connected to carbon tariffs. After all, higher taxes and higher prices are terrible policy and will undermine the economic wellbeing of all Americans.

I don’t like carbon taxes, but I don’t want to focus on that issue (you can read my thoughts here).

I don’t like carbon protectionism, but I don’t want to focus on that issue (you can read my thoughts here).

I don’t like any type of protectionism, but I don’t want to focus on that issue (you can read my thought here).

Instead, I want to stress a very simple point. The Republicans pushing this new tax could have made their plan fiscally legitimate – and perhaps even defensible – by including an offsetting tax cut.

In other words, if their proposed tax would generate X billion dollars, their legislation should also include provisions reducing other taxes by X billion dollars.

Depending on the size of their tax increase, it might generate enough revenue to get rid of the capital gains tax. Or the death tax.

There are many attractive and much-needed tax cuts. The fact that supporters did not propose offsetting tax cuts is a giant red flag.

P.S. Some supporters have tried to justify this tax increase by claiming that it’s just a way of punishing China.

But Daren Bakst debunked that claim in his column.

…if Cassidy is really concerned with China’s emissions, he should develop legislation that is specifically targeted at China, which doesn’t simultaneously torpedo America’s well-being. …There is something far more direct that Cassidy could do to address China’s emissions: propose that China no longer be considered a developing country in environmental agreements. China’s current designation as a developing country means that China doesn’t have the same emissions reduction obligations as the U.S.

P.P.S. Even though I said I wouldn’t address the issue of carbon taxes, I can’t resist making one final observation. Some of the supporters of carbon-based tariffs claim they are against carbon taxes. But this reminds me of the fight back in 2017 when some Republicans were pushing a “destination-based cash-flow tax” that would have set the stage for a value-added tax. The one big difference is that at least supporters of the DBCFT proposed offsetting tax cuts. So their hearts were in the right place. Too bad we can’t say the same for Republicans who are pushing for carbon protectionism today.

No comments:

Post a Comment