October 26, 2022 by Dan Mitchell @ International Liberty

I discussed Italy’s looming fiscal crisis on Monday and then argued against a potential bailout on Tuesday.

Today, let’s focus on the rest of Europe.

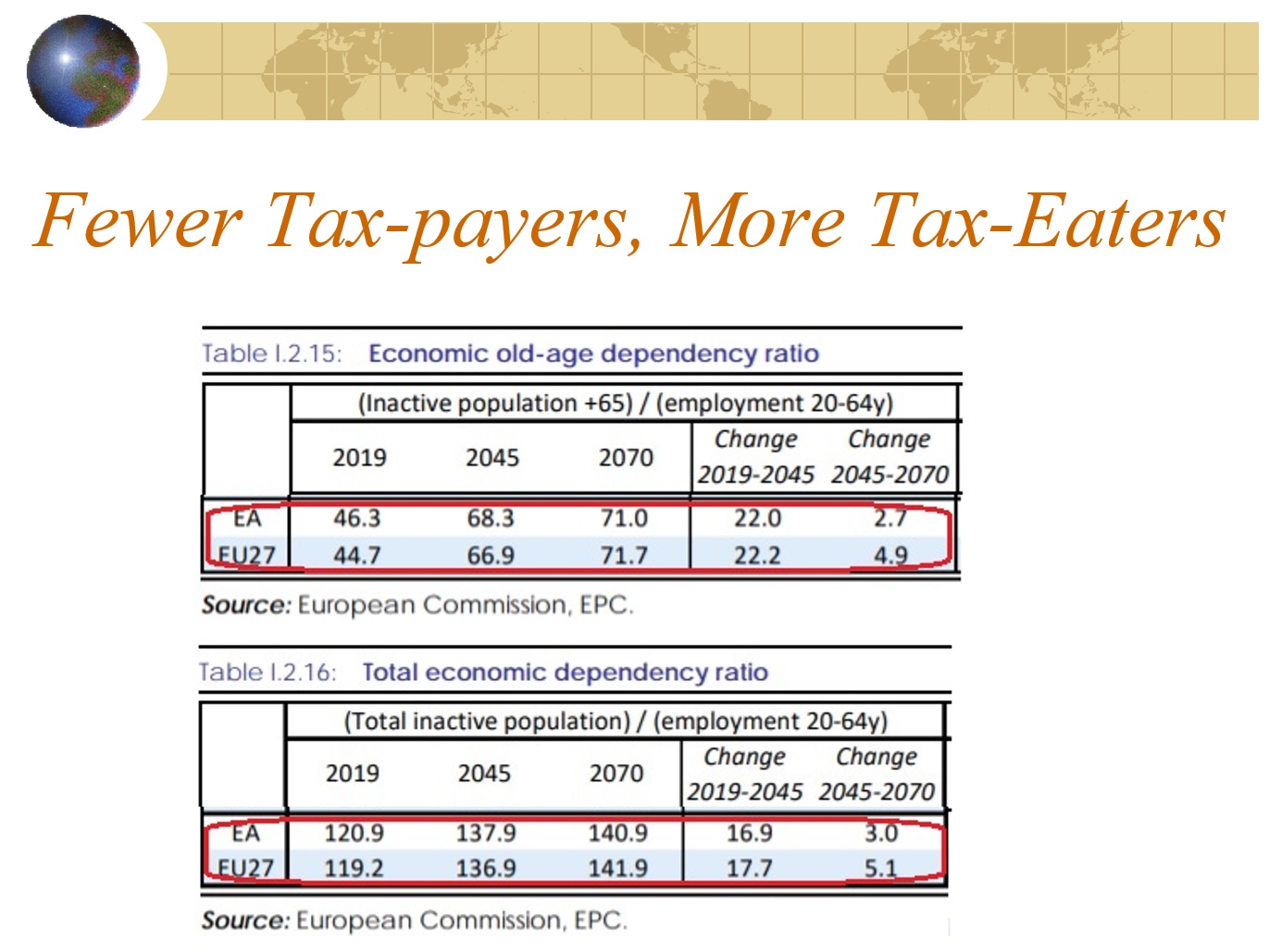

I gave a presentation yesterday in Brussels about “Public Finances in the Eurozone” and used the opportunity to explain that governments are too big in Europe and to warn that demographic changes were going to lead to an even-bigger burden of government in the future.

My assessment is very mainstream, at least with regards to what will happen to national budgets in European nations.

A study from the Organization for Economic Cooperation and Development, authored by Yvan Guillemette and David Turner, examines the long-run fiscal position of member nations.

It warns that government debt levels will increase dramatically if they don’t change current policies.

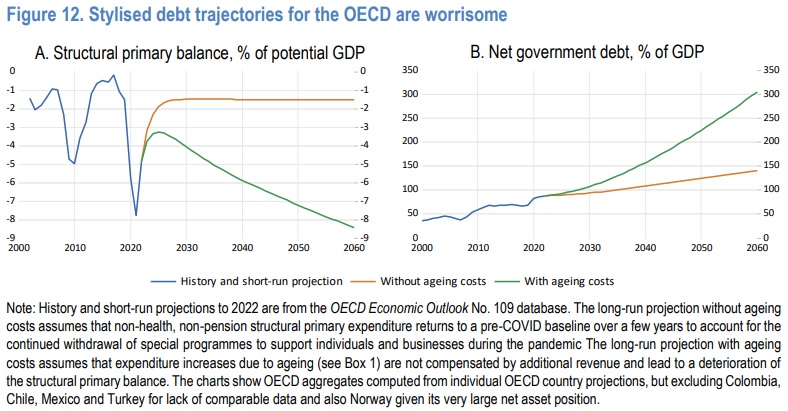

… secular trends such as population ageing and the rising relative price of services will keep adding pressure on government budgets. Without policy changes, maintaining current public service standards and benefits while keeping public debt ratios stable at current levels would increase fiscal pressure in the median OECD country by nearly 8 percentage points of GDP between 2021 and 2060, and much more in some countries. …governments will need to re-assess long-run fiscal sustainability in the context of higher initial government debt levels…when considering expenditure pressures associated with ageing…, the OECD structural primary balance would deteriorate rapidly and net government debt would more than double as a share of GDP by 2050 (Figure 12).

Here is the aforementioned Figure 12. As you can see, both deficits (left chart) and debt (right chart) are driven by the cost of age-related entitlement programs.

The report also explains that the increase in red ink is being caused by a bigger burden of government spending.

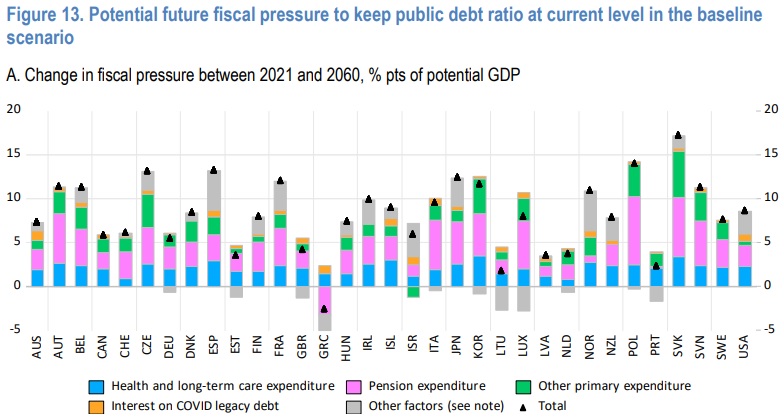

Under a ‘business-as-usual’ hypothesis, in which no major reforms to government programmes are undertaken, public expenditure is projected to rise substantially in most countries… Public health and long-term care expenditure is projected to increase by 2.2 percentage points of GDP in the median country between 2021 and 2060… Public pension expenditure is projected to increase by 2.8 percentage points of GDP in the median country between 2021 and 2060… Other primary expenditures are projected to rise by 1½ percentage points of GDP in the median country between 2021 and 2060 (Figure 13, Panel A). This projection excludes potential new sources of expenditure pressure, such as climate change adaptation.

Here’s Figure 13, mentioned above. Notice the projected increases in spending in most European nations.

So what’s the best response to this slow-motion fiscal disaster?

Since more government spending is the problem, you might think the OECD would recommend ways to restrain budgetary expansion.

But that would be a mistake. As is so often the case, OECD bureaucrats think giving politicians more money is the best approach.

The present study…uses an indicator of long-run fiscal pressure that is premised on the idea that governments would seek to stabilise public debt ratios at projected 2022 levels by adjusting structural primary revenue from 2023 onward. … all OECD governments would need to raise taxes in this scenario to prevent gross government debt ratios from rising over time… The median country would need to increase structural primary revenue by nearly 8 percentage points of GDP between 2021 and 2060, but the effort would exceed 10 percentage points in 11 countries.

To be fair, the authors acknowledge that there might be some complications.

Raising taxes…appears feasible in some countries…, in other countries it may present a substantial challenge. In Belgium, Denmark, Finland and France, for instance, structural primary revenue is already around 50% of GDP… Pushing mainstream taxes on incomes or consumption further up, even by only a few percentage points of GDP, may be politically difficult and fiscally counter-productive if it means reaching the downward-sloping segment of the Laffer curve… Lundberg…identifies five OECD countries where top effective marginal tax rates (accounting for income, payroll and consumption taxes) are already beyond revenue-maximizing levels (Austria, Belgium, Denmark, Finland and Sweden). Thus, if taxes are to rise, it might be necessary to look to other bases, such as housing, capital gains, inheritance or wealth. Recent international efforts to establish a minimum global corporate tax could also enable more revenue to be raised from corporate taxes.

I’m happy that the study acknowledges the Laffer Curve, though that is not much of a concession since even Paul Krugman agrees that it exists.

And even when OECD bureaucrats admit that it may be unwise to increase some taxes, their response is to suggest that other taxes can be increased.

Sigh.

Now you understand why I’ve argued that the OECD may be the world’s worst international bureaucracy. Especially since OECD bureaucrats get tax-free salaries while urging higher taxes on the rest of us.

No comments:

Post a Comment