I wrote yesterday to speculate about a possible fiscal crisis in Italy.

Today, here are my thoughts on why there should not be a bailout if/when a crisis occurs.

I have moral objections to bailouts, but let’s focus in this column on the practical impact.

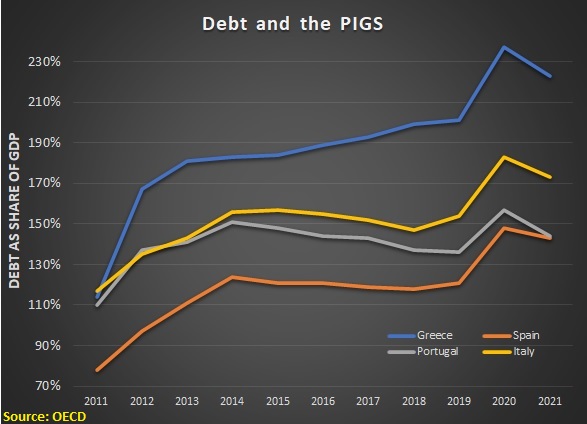

And let’s start with this chart, which shows debt levels in Portugal, Italy, Greece, and Spain (the so-called PIGS) ever since the misguided bailout of Greece about a dozen years ago.

As you can see, OECD data reveals that there’s been no change in these poorly governed nations. They have continued to over-spend and accumulate ever-higher levels of debt.

This certainly seems like evidence of failure, in part because of Greece’s continued bad policy.

But I’m equally concerned about how other Mediterranean nations did not change their behavior.

So why did those nations accumulate more debt, even though they had an up-close look at Greece’s fiscal collapse?

I suspect they figured they could get bailouts, just like Greece. In other words, the IMF and others created a system corrupted by moral hazard.

Defenders of bailouts assert that Greece was forced to engage in “austerity” as a condition of getting a bailout.

I have two problems with that argument.

- First, notice how Greece’s debt has continued to go up. If that’s a success, I would hate to see an example of failure.

- Second, the main effect of the so-called austerity is a much higher tax burden and a somewhat higher spending burden.

If there’s a bailout of Italy (or any other nation), I suspect we’ll see the same thing happen. Higher taxes, higher spending, and higher debt.

I’ll close by acknowledging that there are costs to my approach. If Italy is not given a bailout, the country may have a “disorderly default,” meaning the government simply stops honoring its commitments to pay bondholders.

That is bad for individual bondholders, but it also could hurt – or even bankrupt – financial institutions that foolishly decided to buy a lot of Italian government bonds.

But there should be consequences for imprudent choices. Especially if the alternative is bailouts that misallocate global capital and encourage further bad behavior.

The bottom line is that the long-run damage of bailouts is much great than the long-run damage of defaults.

P.S. Just like it’s a bad idea to provide bailouts to national governments, it’s also a bad idea to provide bailouts to state governments. Or banks. Or student loan recipients.

No comments:

Post a Comment