Keynesian economics is based on the misguided notion that consumption drives the economy.

In reality, high levels of consumption should be viewed an indicator of a strong economy.

The real drivers of economic strength are private investment and private production.

After all, we can’t consume unless we first produce.*

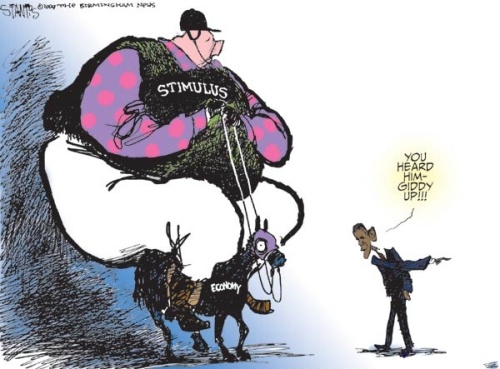

Not everyone agrees with these common-sense observations. The Biden Administration, for instance, claimed the economy would benefit if Congress approved a costly $1.9 trillion “stimulus” plan last year.

Yet we wound up with 4 million fewer jobs than the White House projected. We even wound up with fewer jobs than the Administration estimated if there was no so-called stimulus.

So what did we get for all that money?

Some say we got inflation. In a column for the Hill, Professor Carl Schramm from Syracuse is unimpressed by Biden’s plan. And he’s even less impressed by the left-leaning economists who claimed it is a good idea to increase the burden of government.

Nobel Laureate economist Joseph Stiglitz rounded up another 16 of the 36 living American Nobel Prize economists to declare, in an open letter, that…there was no threat of inflation. …The Nobelists’ letter showed that those signing had bought Team Biden’s novel argument that its enormous expansion of social welfare programs really was just a different form of infrastructure investment, just like roads and bridges. …The laureates seemed to have overlooked that previous COVID benefits had often exceeded what tens of millions of workers regularly earned and that recipients displaced by COVID were never required to look for other work. While the high priests of economic “science” were cheering on higher federal spending, larger deficits and increased taxes, employers were and are continuing to deal with inflation face-to-face. …The Nobelists assured that we would see a robust recovery because of President Biden’s “active government interventions.” Their presumed authority was used to give credence to the president’s continuously twisting storyline on inflation — that it was “transitory,” good for the economy, a “high-class problem,” Putin’s fault for invading Ukraine, and the greed of oil and food companies… Today’s fashionable goals seem to have displaced the no-nonsense pragmatism that has long characterized economics as a discipline. …Don’t expect a mea culpa from Stiglitz or his coauthors any time soon. …They can be wrong, really wrong, and never pay a price.

The New York Post editorialized about Biden’s economic missteps and reached similar conclusions.

President Joe Biden loves to blame our sky-high inflation on corporate greed and Vladimir Putin. But a new study from the San Francisco Fed shows it was Biden himself who put America on this grim trajectory. …other advanced economies…haven’t seen anything like the soaring prices now punishing workers across America. Which means that the spike is due to something US-specific, rather than global prevailing conditions. That policy, was, of course, Biden’s signature economic “achievement.” …The damage it did has been massive. …inflation…to 7%… Put in concrete terms, a recent Bloomberg calculation translates this to an added $433 per month in household expenses for 2022. And historic producer price inflation, a shocking 10%, guarantees even more pain ahead.

For what it’s worth, I don’t fully agree with Professor Schramm or the New York Post.

They are basically asserting that Biden’s wasteful spending is responsible for today’s grim inflation numbers.

I definitely don’t like Biden’s spending agenda, but I agree with Milton Friedman that it is more accurate to say that inflation is a monetary phenomenon.

In other words, the Federal Reserve deserves to be blamed.

The bottom line is that Keynesian monetary policy produces inflation and rising prices while Keynesian fiscal policy produces more wasteful spending and higher levels of debt.

I’ll close with a couple of caveats.

- First, Friedman also points out that there’s “a long and variable lag” in monetary policy. So it is not easy to predict how quickly (or how severely) Keynesian monetary policy will produce rising prices.

- Second, Keynesian deficit spending can lead to Keynesian monetary policy if a central bank feels pressure to help finance deficit spending by buying government bonds (think Argentina).

*Under specific circumstances, Keynesian policy can cause a short-term boost in consumption. For instance, a government can borrow lots of money from overseas lenders and use that money to finance more consumption of things made in places such as China. The net result of that policy, however, is that American indebtedness increases without any increase in national income.

P.S. You can read the letter from the pro-Keynesian economists by clicking here. And you can read a letter signed by sensible economists (including me) by clicking here.

P.P.S. Keynesianism is a myth with a history of failure in the real world.

- It didn’t work for Hoover.

- It didn’t work for Roosevelt.

- It didn’t work for Japan.

- It didn’t work for Europe.

- It didn’t work for Obama.

It’s also worth pointing out that Keynesians have been consistently wrong with predicting economic damage during periods of spending restraint.

- They were wrong about growth after World War II (and would have been wrong, if they were around at the time, about growth when Harding slashed spending in the early 1920s).

- They were wrong about Thatcher in the 1980s.

- They were wrong about Reagan in the 1980s.

- They were wrong about Canada in the 1990s.

- They were wrong after the sequester in 2013.

- They were wrong about unemployment benefits in 2020.

Call me crazy, but I sense a pattern. Maybe, just maybe, Keynesian economics is wrong.

No comments:

Post a Comment