Since I just landed in London, it appropriate that today’s column will be based on an article in the U.K.-based Economist.

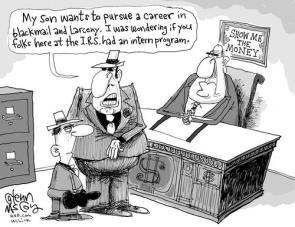

A recent issue of the magazine included an article lauding the Internal Revenue Service.

Why?

What could the bureaucrats have done to earn praise?

You’ll be amazed to learn that the Economist believes the IRS helped the economy by becoming a vehicle for income redistribution.

I’m not joking. Here are some excerpts from the article.

Despite its awful backlog, the irs has, from another perspective, had a very good pandemic. It has played a critical role in delivering support to Americans. And it has been surprisingly efficient at it. For each of the three rounds of stimulus payments, the irs was the conduit. Within two weeks of Mr Biden’s signing of the stimulus bill in March 2021, for instance, it sent out $325bn via 127m separate payments, mainly by direct bank deposit. Some people fell through the cracks and cheques took longer. But most got the money quickly. The irs operated at even greater frequency in making child-tax-credit payments every month. …It also expanded the earned-income tax credit, a subsidy given to low earners, one of America’s biggest anti-poverty programmes. Putting it together, a poor family with two young children could expect $20,000 from the irs last year, double what they would normally receive.

The Economist seems to think it’s wonderful that the IRS now plays a big role in distributing goodies.

In all, the agency paid out more than $600bn in pandemic-related support in 2021, equivalent to about two-thirds of Social Security spending in the federal government’s budget. “We have seen a substantial share of what used to be the social safety-net migrate from the public-expenditure side of the federal ledger to being run through the tax code,” points out Gordon Gray of the American Action Forum, a think-tank. …the irs…stands as one of the few federal agencies that would generate a large and nearly immediate return on investment were the government to spend more on it. The hope for the harried tax agents is that…irs performance during the pandemic will have earned it grudging support in Washington, demonstrating that it is both overstretched and indispensable.

Needless to say, “delivering support to Americans” should not be an “indispensable” function of the a bureaucracy that was created to collect tax revenue.

Even more problematic, giving out record amounts of money is not what “has kept the economy going.” This is a Keynesian view of the world.

In reality, the borrow-and-spend approach is akin to thinking you are richer after taking money out of the right pocket and putting it in the left pocket.

Sort of the economic version of a perpetual motion machine, all based on the broken-window theory of economics.

P.S. The article also cites the bogus estimate of a $1 trillion tax gap. If the Economist now is in the business of uncritically regurgitating make-believe numbers, I’m also willing to play that game. I encourage that magazine’s reporters to call me and I’ll blindly claim that all tax cuts pay for themselves and that we can have entitlement reform without transition costs.

Actually, I have ethics, so I won’t make those over-the-top claims.

P.P.S. Amazingly (but predictably), the Economist never mentioned past or present IRS scandals.

P.P.P.S. This isn’t the first time the Economist has engaged in anti-economics journalism. The magazine also has been guilty of dishonest journalism.

No comments:

Post a Comment