No sensible person wants to copy the big-spending policies of failed welfare states such as Greece.

Unfortunately, many politicians lack common sense (or, more accurately, they are motivated by short-run political ambition rather than what’s in the long-run best interest of their nations).

So if they decide that they politically benefit by spending lots of other people’s money, they have to figure out how to finance that spending.

One option is to use the central bank. In other words, finance big government with the figurative printing press.

This is what’s know as Modern Monetary Theory.

From a theoretical perspective, it’s crazy. And if Sri Lanka is any indication, it’s also crazy based on real-world evidence.

In an article for The Print, based in India, Mihir Sharma looks at that government’s foolish monetary policy.

Cranks are considered cranks for a reason. That is the lesson from Sri Lanka… How did this tiny Indian Ocean nation end up in such straits? …the Rajapaksas turned Sri Lanka’s policymaking over to cranks… The central bank governor at the time, Weligamage Don Lakshman, informed the public during the pandemic that nobody need worry about debt sustainability…since “domestic currency debt

…in a country with sovereign powers of money printing, as the modern monetary theorists would argue, is not a huge problem.” Sri Lanka is the first country in the world to reference MMT officially as a justification for money printing. Lakshman began to run the printing presses day and night; his successor at the central bank, Ajith Nivard Cabraal, who also denied the link between printing money and inflation or currency depreciation, continued the policy. …Reality did not take long to set in. By the end of 2021, inflation hit record highs. And, naturally, the clever plan to “increase the proportion of domestic debt” turned out to be impossible… Proponents of MMT will likely say that this was not real MMT, or that Sri Lanka is not a sovereign country as long as it has any foreign debt, or something equally self-serving.

Professor Steve Hanke of Johns Hopkins University also discussed Sri Lanka’s crazy monetary policy in an article for National Review. And he also offered a way to reverse the MMT mistake.

This slow-motion train wreck first began in November 2019 when Gotabaya Rajapaksa won a decisive victory in the country’s presidential elections. …In total control, President Rajapaksa and his brother Mahinda, the prime minister, went on a spending spree

that was financed in part by Sri Lanka’s central bank. The results have been economic devastation. The rupee has lost 44 percent of its value since President Rajapaksa took the reins, and inflation, according to my measure, is running at a stunning 74.5 percent per year. …What can be done to end Sri Lanka’s economic crisis? It should adopt a currency board, like the one it had from 1884 to 1950… Most important, the board could not loan money to the fiscal authorities, imposing a hard budget on Ceylon’s fiscal system. The net effect was economic stability — and while stability might not be everything, everything is nothing without stability.

For readers who are not familiar with currency boards, it basically means creating a hard link with another nation’s currency – presumably another nation with a decent history of monetary restraint.

It’s what Hong Kong has with the United States (even though U.S. monetary policy over time has been less than perfect).

A currency board is not quite the same as “dollarization,” which is actually adopting another nation’s currency, but it’s a way of making sure local politicians have one less way of ruining an economy.

Let’s conclude with a story from the U.K.-based Financial Times, written by Tommy Stubbington and Benjamin Parkin. They provide some grim details about Sri Lanka’s plight.

Sri Lanka owes $15bn in bonds, mostly dollar-denominated, of a total $45bn long-term debt, according to the World Bank.

It needs to pay about $7bn this year in interest and debt repayments but its foreign reserves have dwindled to less than $3bn. …Sri Lanka has never defaulted and its successive governments have been known for a market-friendly approach. …Sri Lanka has previously entered 16 programmes with the IMF.

By the way, I can’t help but comment about a couple of points in the article.

The reporters claim that Sri Lanka has been “known for a market-friendly approach.”

To

be blunt, this is nonsense. I’ve been dealing with international

economic policy for decades and no supporter of free markets and limited

government has ever claimed the country was anywhere close to being a

role model for good policy.

To

be blunt, this is nonsense. I’ve been dealing with international

economic policy for decades and no supporter of free markets and limited

government has ever claimed the country was anywhere close to being a

role model for good policy.

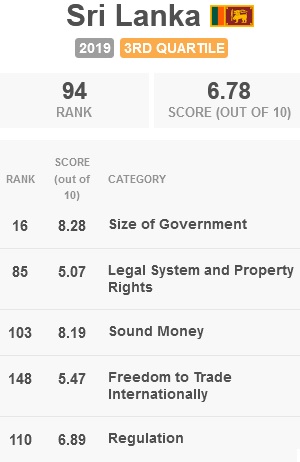

And if you peruse the latest edition of Economic Freedom of the World, you’ll see that Sri Lanka has very low scores, far below Greece and only slightly ahead of Russia.

And you can click here to see that it has always received dismal scores.

But maybe it’s “market-friendly” by the standards of left-leaning journalists.

I also can’t resist noting that Sri Lanka has already received 16 bailouts from the International Monetary Fund, according to the article.

This is further evidence that it’s not a market-oriented nation.

And it’s also evidence that IMF intervention does not make things better. In many cases, it’s akin to sending an arsonist to put out a fire.

P.S. The Mihir Sharma article also discusses the Sri Lankan government’s crazy approach to agriculture.

Last April, the government followed through on a campaign promise to transition Sri Lanka to organic farming by banning the import and use of synthetic fertilizers. More than two-thirds of Sri Lanka’s people are directly or indirectly dependent on agriculture; economists and agronomists warned that a transition to organic farming on that scale would destroy productivity and cause incomes to crash. …Unsurprisingly, the cranks were wrong. The production of rice — the basic component of Sri Lankans’ diet — and of tea — the country’s main export — sank precipitously.

Needless to say, it’s not a good idea for politicians to deliberately hurt a nation’s agriculture sector.

Just like it’s not a good idea for politicians in places like the United States to deliberately subsidize the sector. The right approach is to be like New Zealand and have no policy.

No comments:

Post a Comment