February 5, 2022 by Dan Mitchell @ International Liberty

A key principle of economics is convergence, which is the notion that poorer nations generally grow faster than richer nations.

For instance, battle-damaged European nations grew faster than the United States in the first few decades after World War II.

But, starting in the 1980s, that convergence stopped. And not because Europe reached American levels of prosperity. Even the nations of Western Europe never came close to U.S. levels of per-capita economic output.

Moreover, European countries then began to lose ground for the rest of the 20th century.

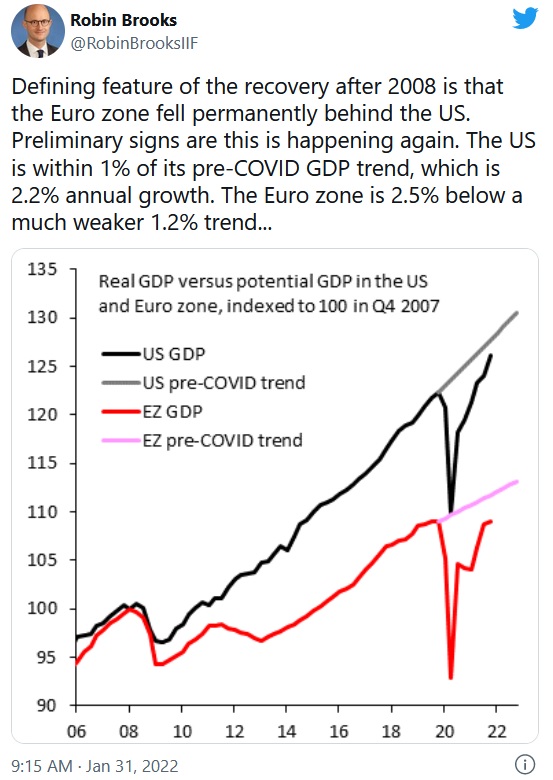

And that process is continuing. Here’s a recent tweet from Robin Brooks, the Chief Economist of the Institute of International Finance, which shows that the United States was growing faster than Europe before the pandemic and is now growing faster than Europe after the pandemic.

In other words, we’re seeing divergence.

Sven Larson addressed this same issue in a new article on this topic for European Conservative.

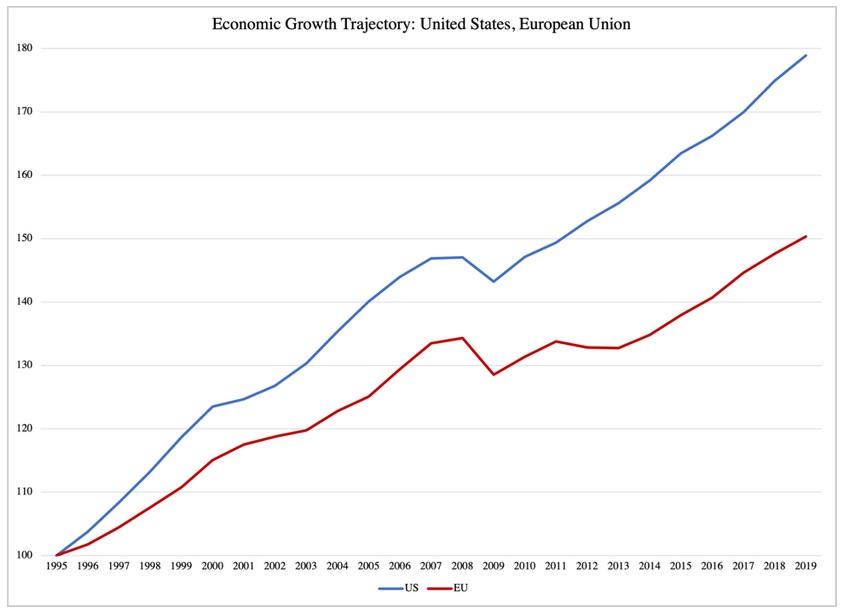

Over the 20 years from 2000 to 2019, the U.S. economy outgrew the 27-member European Union by a solid 19%, adjusted for inflation. These numbers…are quite impressive, especially considering that during President Obama’s eight years in office, annual growth in gross domestic product, GDP, never reached 3%. …From 2010 to 2019, U.S. unemployment averaged 6.3%, dropping below 3.7% in the last year before the pandemic. By contrast, the EU economy never dropped below 6.7% unemployment (in 2019) with an average of 9.5% for the entire decade. …These differences between America and Europe are significant, and should be the subject of debate in Europe: what is it that the Americans are doing that Europeans could do better? Over time, even small differences in economic growth compound into large differences in the standard of living.

Here’s his chart showing the divergence.

So why is Europe falling behind the United States when it should be growing faster because of lower living standards?

Sven has a very good explanation.

There are many candidates for explaining this difference, but there is one that stands out compared to all the others: the size of government. Between 2010 and 2019, government spending in the European Union was equal to 48.3% of GDP, on average, compared to 37.1% in the U.S. economy. …The most hard-hitting impact does not come through taxes, as conventional wisdom suggests, but through spending. …government operates under a form of central economic planning. Its outlays are not based on the mechanisms and prices of free markets: instead, its spending is governed by ideological preferences… While government spending inflicts the most damage on the economy, taxes are not insignificant. Here, again, the U.S. comes out more competitive than its European counterpart, and it is not a new problem. …For the past 20 years, European governments in general have taxed their economies 10-12 percentage points higher, as a share of GDP, than is the case in America.

Having crunched the data from Economic Freedom of the World, I think Sven is correct.

With regards to factors other than fiscal policy, European nations have just as much economic liberty (or, if you’re a glass-half-empty type, just as little economic liberty) as the United States. Heck, many of them rank above the United States when just considering factors such as trade, red tape, monetary policy, and rule of law.

Yet the United States nonetheless earns a better overall score.

Why? Because the United States does much better on fiscal policy (or, to be more accurate, doesn’t do as poorly).

P.S. Both Europe and the United States are moving in the wrong direction with regard to fiscal policy. Almost as if there’s a contest to see who can be the most profligate. Let’s call it the Keynesian Olympics. Whoever wins a gold medal is the first to suffer a fiscal crisis.

No comments:

Post a Comment